Understanding Risk

Interest Rate Risk

Remember the cardinal rule of bonds: When interest rates fall, bond prices rise, and when interest rates rise, bond prices fall. Interest rate risk is the risk that changes in interest rates in the U.S. or the world may reduce (or increase) the market value of a bond you hold. Interest rate risk—also referred to as market risk—increases the longer you hold a bond.

Let’s look at the risks inherent in rising interest rates.

If you bought a 10-year, $1,000 bond today at a coupon rate of 4 percent, and interest rates rise to 6 percent, two things can happen.

Say you need to sell your 4 percent bond prior to maturity. In doing so, you must compete with newer bonds carrying higher coupon rates. These higher coupon rate bonds decrease the appetite for older bonds that pay lower interest. This decreased demand depresses the price of older bonds in the secondary market, which would translate into you receiving a lower price for your bond if you need to sell it. In fact, you may have to sell your bond for less than you paid for it. For this reason, interest rate risk is also referred to as market risk.

Rising interest rates also make new bonds more attractive (because they earn a higher coupon rate). This results in what’s known as opportunity risk—the risk that a better opportunity will come around that you may be unable to act upon. The longer the term of your bond, the greater the chance that a more attractive investment opportunity will become available, or that any number of other factors may occur that negatively impact your investment. This also is referred to as holding period risk—the risk that not only a better opportunity might be missed, but that something may happen during the time you hold a bond to negatively affect your investment.

Bond fund managers face the same risks as individual bondholders. When interest rates rise—especially when they go up sharply in a short period of time—the value of the fund’s existing bonds drops, which can put a drag on overall fund performance.

Since bond prices go up when interest rates go down, you might ask what risk, if any, do you face when rates fall? The answer is call risk.

Duration Risk

If you own bonds or have money in a bond fund, there is a number you should know. It is called duration. Although stated in years, duration is not simply a measure of time. Instead, duration signals how much the price of your bond investment is likely to fluctuate when there is an up or down movement in interest rates.

The higher the duration number, the more sensitive your bond investment will be to changes in interest rates.

Duration risk is the name economists give to the risk associated with the sensitivity of a bond’s price to a one percent change in interest rates.

For more information, see FINRA’s alert, Duration—What an Interest Rate Hike Could Do to Your Bond Portfolio.

Call Risk

Similar to when a homeowner seeks to refinance a mortgage at a lower rate to save money when loan rates decline, a bond issuer often calls a bond when interest rates drop, allowing the issuer to sell new bonds paying lower interest rates—thus saving the issuer money. For this reason, a bond is often called following interest rate declines. The bond’s principal is repaid early, but the investor is left unable to find a similar bond with as attractive a yield. This is known as call risk.

With a callable bond, you might not receive the bond’s original coupon rate for the entire term of the bond, and it might be difficult or impossible to find an equivalent investment paying rates as high as the original rate. This is known as reinvestment risk. Additionally, once the call date has been reached, the stream of a callable bond’s interest payments is uncertain, and any appreciation in the market value of the bond may not rise above the call price.

Refunding Risk and Sinking Funds Provisions

A sinking fund provision, which often is a feature included in bonds issued by industrial and utility companies, requires a bond issuer to retire a certain number of bonds periodically. This can be accomplished in a variety of ways, including through purchases in the secondary market or forced purchases directly from bondholders at a predetermined price, referred to as refunding risk.

Holders of bonds subject to sinking funds should understand that they risk having their bonds retired prior to maturity, which raises reinvestment risk. Unlike other bonds subject to call provisions, depending upon the sinking fund provision, there may be a relatively high likelihood that the bondholders will be forced to redeem their bonds prior to maturity, even if market-wide interest rates remain unchanged.

It is important to understand that there is no guarantee that an issuer of these bonds will be able to comply strictly with any redemption requirements. In certain cases, an issuer may need to borrow funds or issue additional debt to refinance an outstanding bond issue subject to a sinking fund provision when it matures.

Default and Credit Risk

If you have ever loaned money to someone, chances are you gave some thought to the likelihood of being repaid. Some loans are riskier than others. The same is true when you invest in bonds. You are taking a risk that the issuer’s promise to repay principal and pay interest on the agreed upon dates and terms will be upheld. U.S. Treasury securities (for example, a Treasury bond, bill or note) and other bonds backed by the

“full faith and credit of the U.S. government,” are generally deemed to be risk-free. However, most bonds face a possibility of default. This means that the bond obligor will either be late paying creditors (including you, as a bondholder), pay a negotiated reduced amount or, in worst-case scenarios, be unable to pay at all.

Ratings Agencies

Ratings are a way of assessing default and credit risk. The Securities and Exchange Commission (SEC) has designated 10 rating agencies as Nationally Recognized Statistical Rating Organizations (NRSROs). They are: A.M. Best Company, Inc.; DBRS, Inc.; Egan-Jones Ratings Co.; Fitch, Inc.; HR Ratings de México, S.A. de C.V.; Japan Credit Rating Agency, Ltd.; Kroll Bond Rating Agency, Inc.; Moody’s Investors Service, Inc.; Morningstar Credit Ratings, LLC; and Standard & Poor’s Ratings Services. These organizations review information about selected issuers, especially financial information, such as the issuer’s financial statements, and assign a rating to an issuer’s bonds—from AAA (or Aaa) to D (or no rating).

Each NRSRO uses its own ratings definitions and employs its own criteria for rating a given security. It is entirely possible for the same bond to receive a rating that differs, sometimes substantially, from one ratings agency to the next. While it is a good idea to compare a bond’s rating across the various NRSROs, not all bonds are rated by every agency, and some bonds are not rated at all.

Slow Down When You See “High Yield”

Junk Bonds

Generally, bonds are lumped into two broad categories—investment grade and non-investment grade. Bonds that are rated BBB, bbb, Baa or higher are generally considered investment grade. Bonds that are rated BB, bb, Ba or lower are non-investment grade. Non-investment grade bonds are also referred to as high yield or junk bonds. Junk bonds are considered riskier investments because the issuer’s general financial condition is less sound. This means the entity issuing the bond—a corporation, for instance— may not be able to pay the interest and principal to bondholders when they are due.

Junk bonds typically offer a higher yield than investment-grade bonds, but the higher yield comes with increased risk—specifically, the risk that the bond’s issuer may default

Many investors heavily weigh the rating of a particular bond in determining if it is an appropriate and suitable investment. Although credit ratings are an important indicator of creditworthiness, you should also consider that the value of the bond might change depending upon changes in the company’s business and profitability. Some credit rating agencies issue outlooks and other statements to warn you if they are considering upgrading or downgrading a credit rating. In the worst scenario, holders of bonds could suffer significant losses, including the loss of their entire investment. Finally, some bonds are not rated. In such cases, you may find it difficult to assess the overall creditworthiness of the issuer of the bond.

Distressed Debt

Believe it or not, there is a market for distressed and even defaulted debt. This is a playing field for sophisticated bond investors who are seeking—often through painstaking research, or with the intent to assume increased investment risk—to find a few diamonds in this very rough environment characterized by bankruptcies and steep debt downgrades.

Inflation and Liquidity Risk

Inflation Risk

This is the risk that the yield on a bond will not keep pace with purchasing power (in fact, another name for inflation risk is purchasing power risk). For instance, if you buy a five-year bond in which you can realize a coupon rate of 5 percent, but the rate of inflation is 8 percent, the purchasing power of your bond interest has declined. All bonds but those that adjust for inflation, such as TIPS, expose you to some degree of inflation risk.

Liquidity Risk

Some bonds, like U.S. Treasury securities, are quite easy to sell because there are many people interested in buying and selling such securities at any given time. These securities are liquid. Others trade much less frequently. Some even turn out to be “no bid” bonds, with no buying interest at all. These securities are illiquid.

Liquidity risk is the risk that you will not be easily able to find a buyer for a bond you need to sell. A sign of liquidity, or lack of it, is the general level of trading activity: A bond that is traded frequently in a given trading day is considerably more liquid than one which only shows trading activity a few times a week. Investors can check corporate bond trading activity—and thus liquidity—by using FINRA’s Market Data Center. For insight into municipal bond liquidity, investors can use trade data found on the Municipal Securities Rulemaking Board’s website.

If you think you might need to sell the bonds you are purchasing prior to their maturity, you should carefully consider liquidity risk, and what steps your broker will take to assist you when liquidating your investment at a fair price that is reasonably related to then-current market prices. It is possible that you may be able to re-sell a bond only at a heavy discount to the price you paid (loss of some principal) or not at all.

Event Risk

In the 1980s, buyouts, takeovers and corporate restructurings became prevalent. With such upheavals often came swift, and very often negative, changes to a company’s credit rating. To this day, mergers, acquisitions, leveraged buyouts, and major corporate restructurings are all events that put corporate bonds at risk, thus the name event risk.

Other events can also trigger changes in a company’s financial health and prospects, which may trigger a change in a bond’s rating. These include a federal investigation of possible wrongdoing, the sudden death of a company’s chief executive officer or other key manager, or a product recall. Energy prices, foreign investor demand and world events also are triggers for event risk. Event risk is extremely hard to anticipate and may have a dramatic and negative impact on bondholders.

Types of Bonds

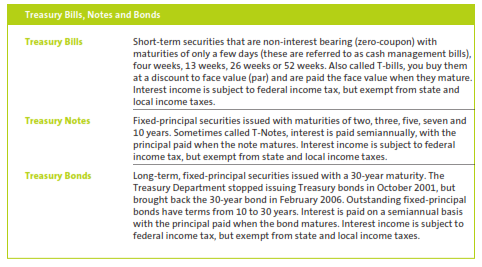

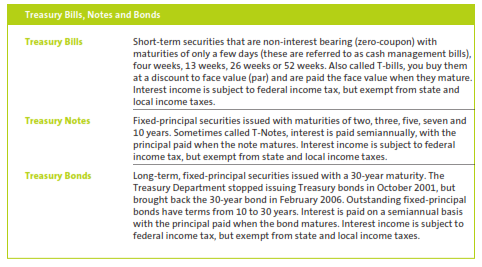

U.S. Treasury Securities

Once you’ve decided to invest in bonds, the next question is—which type of bond? Bonds tend to be broadly categorized according to who is issuing them.

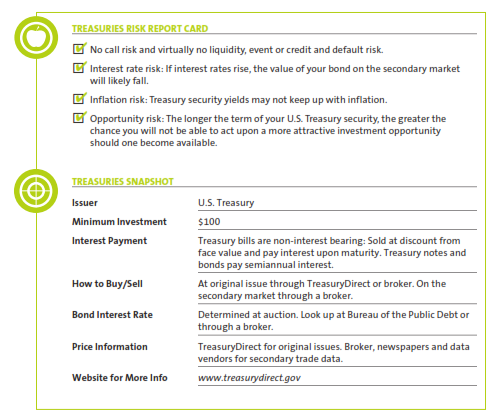

U.S. Treasury securities (“Treasuries”) are issued by the federal government and are considered to be among the safest investments you can make, because all Treasury securities are backed by the “full faith and credit” of the U.S. government. This means that come what may—recession, inflation, war—the U.S. government is going to take care of its bondholders.

Treasuries are also liquid. A group of more than 20 primary dealers are required to buy large quantities of Treasuries every time there is an auction and stand ready to trade them in the secondary market.

There are other features of Treasuries that are appealing to the individual investor. They can be bought in denominations of $100, making them affordable, and the buying process is quite convenient. You can either buy Treasuries through brokerage firms and banks, or you can simply follow the instructions on the TreasuryDirect website. For more information, see the Buying and Selling Treasuries and Savings Bonds section.

As an added bonus, while you must pay federal income taxes on the interest paid to you from Treasuries held outside of a tax-deferred retirement account, you won’t have to pay state income taxes on the interest you received.

You can learn more about Treasuries on the TreasuryDirect website.

As safe as an investment in legitimate Treasury securities is, even the Treasury bond market has its share of scams. The Bureau of the Public Debt alerts investors to fraudulent schemes through a website called Frauds, Phonies, and Scams.

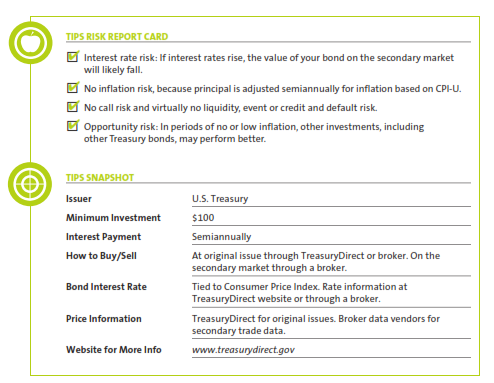

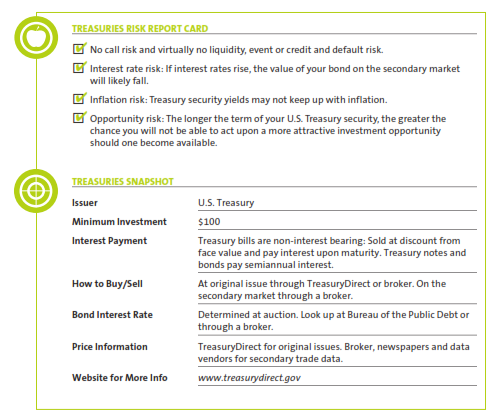

TIPS

If you are concerned about inflation, the U.S. Treasury Department has some bonds that might interest you. They’re called Treasury Inflation Protected Securities, or TIPS. Issued with maturities of five, 10 and 30 years, TIPS shelter you from inflation risk because their principal is adjusted semiannually for inflation based on changes in the Consumer Price Index-Urban Consumers (CPI-U), a widely used measure of inflation. Interest payments are calculated on the inflated principal. So, if inflation occurs throughout the life of the bond, interest payments will increase. At maturity, if the adjusted principal is greater than the face or par value, you will receive the greater value.

Because they are U.S. Treasury securities, TIPS are backed by the “full faith and credit” of the U.S. government and, therefore, carry virtually no credit or default risk. Remember the trade-off between risk and reward? It holds for TIPS as well. While the TIPS investor is sheltered from inflation risk and, in fact, benefits during periods of inflation, the trade-off is that the base interest rate on TIPS is usually lower than that of other Treasuries with similar maturities. In periods of deflation, low inflation or no inflation, a conventional Treasury bond can be the better-performing investment.

You might ask, “What happens if deflation (a negative inflation rate) occurs? Would my TIP investment be worth less than what I paid for it?” No, unless you paid more than the face value of the bond. Upon maturity, the Treasury Department agrees to pay the initial face value of the bond or the inflation-adjusted face value, whichever is greater.

For more information on TIPS, see TreasuryDirect’s Treasury TIPS web page.

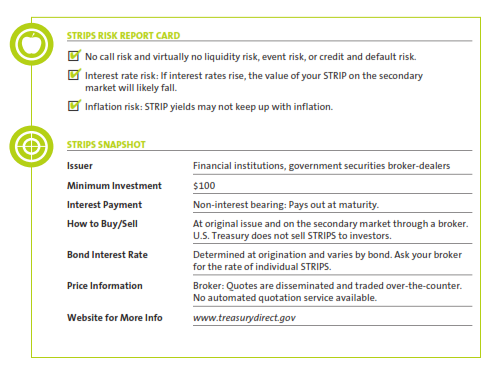

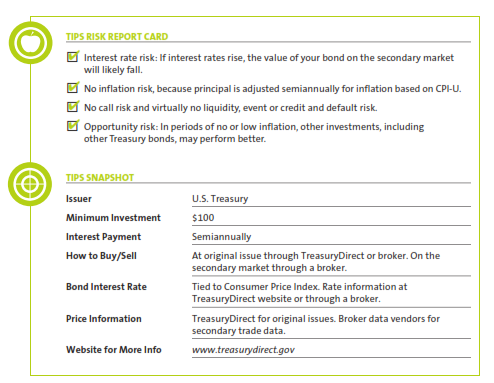

STRIPS

The U.S. Treasury STRIPS program was introduced in the mid-1980s. STRIPS is the acronym for Separate Trading of Registered Interest and Principal of Securities. The STRIPS program lets investors hold and trade the individual interest and principal components of eligible Treasury notes and bonds as separate securities. While “stripping” also happens to non-U.S. Treasury securities, this discussion applies to stripped U.S. Treasury securities.

When a U.S. Treasury fixed-principal note or bond or a Treasury inflation-protected security (TIPS) is stripped, each interest payment and the principal payment becomes a separate zero-coupon security. Each component has its own identifying number and can be held or traded separately. For example, a 10-year Treasury note consists of 20 interest payments—one every six months for 10 years—and a principal payment payable at maturity. When this security is “stripped,” each of the 20 interest payments and the principal payment become separate STRIPS, and can be held and transferred separately. STRIPS can only be bought and sold through a financial institution or brokerage firm (not through TreasuryDirect), and held in the commercial book-entry system.

Like all zero-coupon bonds, STRIPS sell at a discount because there are no interest payments. Your income on a STRIP that is held to maturity is the difference between the purchase price and the amount received at maturity. When you buy a STRIP, the only time you receive an interest payment is when your STRIP matures.

Risk-adverse investors who want to receive a known interest payment at some specific date in the future favor STRIPS. State lotteries and pension funds regularly invest in STRIPS to be assured they will be able to meet annual payout obligations to prizewinners or pensioners.

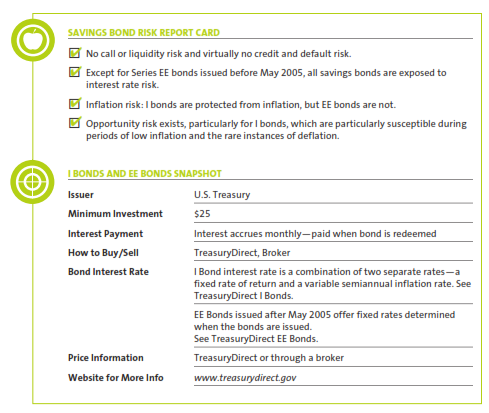

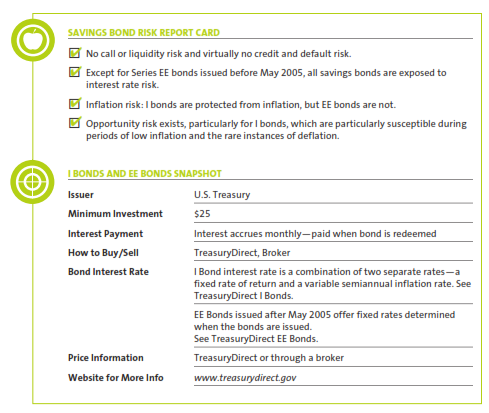

U.S. Savings Bonds

Savings bonds are also issued by the federal government and backed by the “full faith and credit” guarantee. But unlike Treasuries, savings bonds may be purchased for an investment as low as $25. Like Treasuries, the interest earned on your savings bonds is subject to federal income tax, but not state or local income taxes.

Savings bonds can be purchased from the U.S. Treasury, at banks and credit unions, and are often offered by employers through payroll deduction. But unlike most other Treasuries, savings bonds cannot be bought and sold in the secondary market. In fact, only the person or persons who have registered a savings bond can receive payment for it.

Say Goodbye to Paper Saving Bonds

As of January 1, 2012, paper savings bonds are no longer sold at financial institutions. Electronic savings bonds in Series EE and I will remain available through purchase in TreasuryDirect®, a secure, web-based system operated by the Bureau of the Public Debt.

Types of Savings Bonds

The two most common types of savings bonds are I Bonds and Series EE Savings Bonds. Both are accrual securities, meaning the interest you earn accrues monthly at a variable rate and the interest is compounded semiannually. You receive your interest income when you redeem the bonds.

The I Bond tracks inflation to prevent your earnings from being eroded by a rising cost of living. Series EE Savings Bonds issued after May 2005 earn a fixed rate of interest. Both types of bonds are exempt from all state and local income taxes.

Purchasing Savings Bonds

You can purchase savings bonds electronically through the TreasuryDirect Website. No physical certificate will exist. TreasuryDirect allows you to buy, track, change registration and redeem your bond—all electronically via a secure online account. A program called SmartExchangeSM allows TreasuryDirect account owners to convert their paper savings bonds to electronic securities in a special Conversion Linked Account in their online account.

Taking Savings Bonds at Face Value

Whether you buy savings bonds electronically or in paper form, most savings bonds are sold at face value in amounts from $25 to $30,000. This means that if you buy a $100 bond, it costs you $100, on which you earn interest.

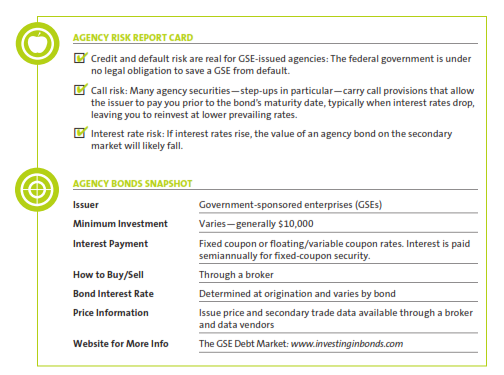

Agency Securities

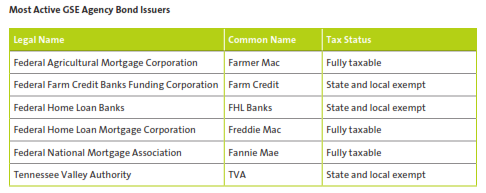

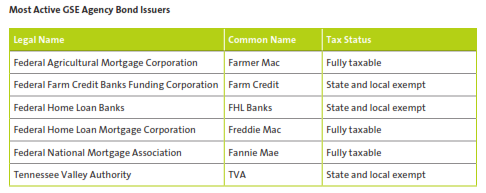

“Agencies” is a term used to describe two types of bonds: (1) bonds issued or guaranteed by U.S. federal government agencies; and (2) bonds issued by government-sponsored enterprises (GSEs)—corporations created by Congress to foster a public purpose, such as affordable housing.

Bonds issued or guaranteed by federal agencies such as the Government National Mortgage Association (Ginnie Mae) are backed by the “full faith and credit of the U.S. government,” just like Treasuries. This is an unconditional commitment to pay interest payments, and to return the principal investment in full to you when a debt security reaches maturity.

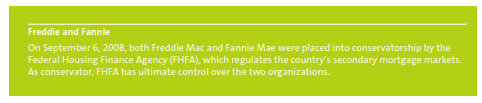

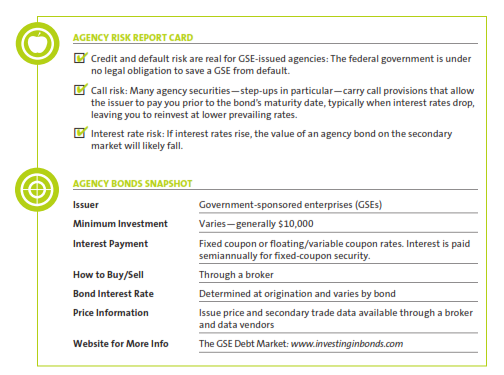

Bonds issued by GSEs such as the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage (Freddie Mac) and the Federal Agricultural Mortgage Corporation (Farmer Mac) are not backed by the same guarantee as federal government agencies. Bonds issued by GSEs carry credit risk.

It is also important to gather information about the enterprise that is issuing the agency bond, particularly if it is issued by a GSE. Players in the agency bond market such as—Fannie Mae, Freddie Mac and Farmer Mac—are publicly traded companies who register their stock with the SEC and provide disclosures that are publicly available including annual reports, quarterly reports, and reports of current events that stand to impact the company. These documents can give you insight into the economic health of the company, the challenges and opportunities it faces, and short- and long-term corporate goals. These company filings are available online on the SEC’s website. It is important to learn about the issuing agency because it will affect the strength of any guarantee provided on the agency bond. Evaluating an agency’s credit rating before you invest should be standard procedure.

It takes $10,000 to invest in most agency bonds (Ginnie Maes are an exception, requiring a minimum investment of $25,000), with the majority of agency bonds paying a semiannual fixed coupon. There is a relatively active (liquid) secondary trading market for agencies, though it is important for investors to understand that many agencies are tailored to the needs of a particular investor or class of investors—with the expectation that they will be held until maturity. This is especially true of structured agency securities (agencies with special features, which are often not suitable for individual investors).

Most agency bonds pay a semiannual fixed coupon and are sold in a variety of increments, though the minimum investment level is generally $10,000 for the first increment, and $5,000 increments thereafter. The tax status of agency bonds varies. Interest from bonds issued by Freddie Mac and Fannie Mae is fully taxable, while those issued by some other GSEs offer state and local tax exemptions. Capital gains and losses on the sale of agency bonds are taxed at the same short- and long-term rates (for bonds held for one year or less or for more than one year) as for stocks.

Types of Agencies

Agency bonds can be structured to meet a specific need of an investor, issuer or both.

For instance, in addition to the traditional coupon-paying agency bond, some organizations issue no-coupon discount notes—called “discos”—generally to help them meet short-term financing demands.

This explains why disco maturities are usually quite short, ranging from a single day to a year. Discos resemble STRIPS in that they are zero-coupon securities that are issued at a discount to par. As with all bonds that trade at such a discount, if you sell the bond before it matures, you may lose money.

Another type of structured agency security is a step-up note, or “step-up.” These securities are callable with a coupon rate that “steps up” over time according to a pre-set schedule. The goal of a step-up is to minimize the impact of interest rate risk. Provided the security is not called, the step-up will keep providing the bondholder with an increased coupon rate, cushioning the investor from interest rate risk. Step-ups are not problem-free, however, as they often offer limited call protection.

Yet another type of agency is a floating-rate security, or “floater.” Floaters pay a coupon rate that changes according to an underlying benchmark, such as the six-month T-bill rate.

Keep in mind that such structured notes, and other esoteric products such as index floaters and range bonds, can be quite complicated and may be unsuitable for individual investors.

Mortgage-Backed Securities

Mortgage-backed securities, called MBSs, are bonds secured by home and other real estate loans. They are created when a number of these loans, usually with similar characteristics, are pooled together. For instance, a bank offering home mortgages might round up $10 million worth of such mortgages. That pool is then sold to a federal government agency like Ginnie Mae or a government sponsored-enterprise (GSE) such as Fannie Mae or Freddie Mac, or to a securities firm to be used as the collateral for the new MBS.

The majority of MBSs are issued or guaranteed by an agency of the U.S. government such as Ginnie Mae, or by government-sponsored enterprises (GSEs), including Fannie Mae and Freddie Mac. Mortgage-backed securities carry the guarantee of the issuing organization to pay interest and principal payments on their mortgage-backed securities. While Ginnie Mae’s guarantee is backed by the “full faith and credit” of the U.S. government, those issued by GSEs are not.

A third group of MBSs is issued by private firms. These “private label” mortgage-backed securities are issued by subsidiaries of investment banks, financial institutions, and homebuilders whose credit-worthiness and rating may be much lower than that of government agencies and GSEs.

The minimum investment amount is generally $1,000 (although it’s $25,000 for Ginnie Maes). Secondary trading of mortgage-backed bonds is relatively liquid in normal economic conditions and done over the counter, between dealers. Investors work with brokers, preferably those with specialized expertise in the mortgage bond arena, to buy and sell these bonds.

Because of the general complexity of mortgage-backed securities, and the difficulty that can accompany assessing the creditworthiness of an issuer, use caution when investing. They may not be suitable for many individual investors.

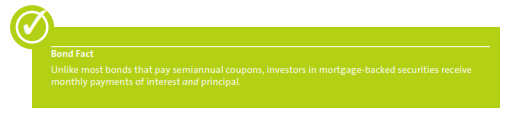

Varied Monthly Interest Payments

Unlike a traditional fixed-income bond, most MBS bondholders receive monthly—not semiannual—interest payments. There’s a good reason for this. Homeowners (whose mortgages make up the underlying collateral for the MBS) pay their mortgages monthly, not twice a year. These mortgage payments are what ultimately find their way to MBS investors.

There’s another difference between the proceeds investors get from mortgage-backed bonds and, say, a Treasury bond. The Treasury bond pays you interest only—and at the end of the bond’s maturity, you get a lump-sum principal amount, say $1,000. But a mortgage-backed bond pays you interest and principal. Your cash flow from the mortgage-backed security at the beginning is mostly from interest, but gradually more and more of your proceeds come from principal. Since you are receiving payments of both interest and principal, you don’t get