Buying and Selling Bonds

The Bond Market

Bonds are issued to raise money for cities, states, the federal government and corporations. The primary and secondary bond markets are an essential part of the capital-raising process. The public and private sectors use the vast sums of money raised to do all sorts of things—build roads, improve schools, open new factories and buy the latest technology.

Bonds are bought and sold in huge quantities in the U.S. and around the world. Some bonds are easier to buy and sell than others—but that doesn’t stop investors from trading all kinds of bonds virtually every second of every trading day. To understand the process of buying and selling, it is first helpful to understand the size and scope of the bond market, why bonds are issued in the first place, and who regulates this vast financial arena.

Bonds are big players on the global financial stage. U.S. bond market debt (generally referred to as “the bond market”) exceeds $35 trillion—making it by far the largest securities marketplace in the world. The term “bond market” is a bit misleading, because each type of bond has its own market and trading systems.

Bond Regulation

FINRA is among a number of organizations that oversee bond issuers’ and dealers’ activities. Here is a breakdown of regulators and their responsibilities:

-

FINRA licenses brokers and brokerage firms that sell stocks, bonds and other securities; writes rules to govern their conduct; conducts regulatory reviews of brokerage firm business activities; and disciplines violators. If you believe you have been the subject of unfair or improper business conduct by a brokerage firm or broker, you may file a complaint online at the www.finra.org/complaint.

-

The SEC registers and regulates stocks, bonds, and other securities and companies that issue securities. The SEC also regulates mutual fund products and companies, and financial advisers.

If you believe that you were defrauded or encountered problems with the issuer of a bond, a mutual fund company or a financial adviser, you may file a complaint at the SEC Complaint Center: www.sec.gov/complaint.shtml.

-

The Municipal Securities Rulemaking Board (MSRB) develops rules regulating securities firms and banks involved in underwriting, trading and selling municipal bonds. Responsibility for examination and enforcement of MSRB rules is delegated to FINRA for all securities firms, and to the Federal Deposit Insurance Corporation, the Federal Reserve Board and the Comptroller of the Currency for banks.

-

State securities agencies enact and enforce state rules and regulations, and register and regulate securities sellers and securities sold in their states.

Buying and Selling Treasuries and Savings Bonds

Treasury and savings bonds may be bought and sold through an account at a brokerage firm, or by dealing directly with the U.S. government. New issues of Treasury bills, notes and bonds—including TIPS—can be bought through a brokerage firm, or directly from the government through auctions at the U.S. Treasury Department’s TreasuryDirect website. You can also hold these in a TreasuryDirect account set up at the same website, and sell them for a fee on the secondary market.

Savings bonds can also be purchased from the government, or through banks, brokerages and many workplace payroll deduction programs. When it comes time to cash in your bond, most full-service banks and other financial institutions are “paying agents” for U.S. savings bonds. Want to know the current value of your savings bonds? You can download TreasuryDirect’s Savings Bond Wizard.

Buying and Selling Corporate and Municipal Bonds

Like other types of bonds, corporate and municipal bonds may be purchased, like stock, through a broker. Investors may either buy the bond at issue or in the secondary market. You buy a bond at issue through full-service, discount or online brokers, as well as through investment and commercial banks. Once new-issue bonds have been priced and sold, they begin trading on the secondary market, where buying and selling is also handled by a broker. You will generally pay brokerage fees when buying or selling corporates and munis through a brokerage firm.

When secondary trading begins, most corporate and municipal bonds sell on the over-the-counter (OTC) market. Some bonds are traded in smaller quantities on the facilities of the New York Stock Exchange (NYSE) and the American Stock Exchange (AMEX), and a few trade on The Nasdaq Stock Market.

FINRA’s TRACE system provides price and trade data for corporate and agency bonds, and the MSRB’s Electronic Municipal Market Access website provides trade data for municipals.

Buying and Selling Bond Funds

Bond funds may be can be bought and sold through a broker or other investment professional, or through the fund directly. Keep in mind that if you work with a broker, the choice of bond funds is limited to those the brokerage firm allows its professionals to sell.

As with other mutual funds, when you buy shares of a bond fund, you pay the fund’s current net asset value (NAV) per share plus any fee the fund or broker assesses at the time of purchase. This may include a sales load or other type of purchase fee. When you sell your shares, the fund will pay you the NAV minus any fee the fund or investment professional charges at the time of sale, such as a back-end sales load or redemption fee. Most funds have a toll-free number or website that can provide information about the fund and the net asset value (NAV) of a funds shares, as well as the ability to request or download a prospectus.

Buying and Selling Bonds through a Broker

You can buy virtually any type of bond through a brokerage firm. Some firms specialize in buying and selling a specific type of bond, such as municipal bonds or junk bonds. Buying anything but Treasuries and savings bonds typically requires using a broker.

You should understand that your brokerage firm is being compensated for performing services for you. If the firm acts as agent, meaning it acts on your behalf to buy or sell a bond, you may be charged a commission.

In most bond transactions, the firm acts as principal. For example, it sells you a bond that the firm already owns. When a firm sells you a bond in a principal capacity, it may increase or mark up the price you pay over the price the firm paid to acquire the bond. The mark-up is the firm’s compensation. Similarly, if you sell a bond, the firm, when acting as a principal, may offer you a price that includes a mark-down from the price that it believes it can sell the bond to another dealer or another buyer. You should understand that the firm very likely has charged you a fee for its transaction services.

If the firm acts as agent, the fee will be transparent to you. The firm must disclose the amount of the commission you were charged in the confirmation of the transaction. However, if the firm acts as principal, it is not required to disclose to you on the confirmation how much of the total price you paid to buy the security was the firm’s mark-up; it is only required to disclose the price at which it sold the bond to you and the yield. Similarly, if you sell a security to a firm and it acts as principal, the firm is not required to tell you how much of a mark-down the firm incorporated in determining the price the firm would pay you.

Buying and Selling Bond Funds

Bond funds may be can be bought and sold through a broker or other investment professional, or through the fund directly. Keep in mind that if you work with a broker, the choice of bond funds is limited to those the brokerage firm allows its professionals to sell.

As with other mutual funds, when you buy shares of a bond fund, you pay the fund’s current net asset value (NAV) per share plus any fee the fund or broker assesses at the time of purchase. This may include a sales load or other type of purchase fee. When you sell your shares, the fund will pay you the NAV minus any fee the fund or investment professional charges at the time of sale, such as a back-end sales load or redemption fee. Most funds have a toll-free number or website that can provide information about the fund and the net asset value (NAV) of a funds shares, as well as the ability to request or download a prospectus.

Choosing a Broker

Most bond transactions for individual investors are handled through a broker. The vast majority of brokers are honest, competent professionals, and there are organizations like FINRA to help make sure that the few who are not are identified and disciplined—sometimes even barred from the industry. But there is more to finding a broker than knowing which ones might not be trustworthy. The key is finding the broker and brokerage firm that make you feel comfortable and best meet your personal financial needs.

There are many different types of brokerage firms, and the costs for their services vary according to how much or how little they do for you. If you are a more experienced investor and have made up your own mind about the securities you want to buy or sell, you might consider a discount brokerage firm that charges a minimal fee for simply executing the transactions that you have selected. Online investing services are the latest trend in discount brokering—you do your own research, select your investment, and then trade online for a minimal fee. A full-service brokerage firm, on the other hand, charges a little more, but typically provides you with information, support, recommendations and investment advice, in addition to executing your transactions.

Whether you select a brokerage firm first and then choose a broker from among its associates, or find an individual broker and accept the firm at which he or she is employed, it is strictly up to you. Either way, when selecting a broker, you will want to take your time and do your homework.

You should also take time to understand how the broker is paid; ask for a copy of the firm’s commission schedule. Firms generally pay brokers based on the amount of money you invest and the number of completed transactions in your account. More compensation may be paid if a broker is selling his or her firm’s own investment products. Ask what the fees or charges are for opening, maintaining, and closing an account.

At the initial interview, obtain a copy of the account agreement, fee structure and any other documents you would be asked to sign if you were to open an account with that broker. That way, you can take the paperwork home to read carefully at your own pace, and make comparisons if you are considering brokers at several firms. If the prospective broker pushes you too hard to open an account on the spot, this might be an indication that he or she will be overly aggressive in pushing you toward certain investment decisions in the future. In addition to the documents that you would need to sign, some brokerage firms have brochures or other informative material that would be helpful to you.

It’s also a good idea to check the background of the broker and brokerage firm before you make a selection. Investors may obtain information on the disciplinary record, professional background, and registration and license statuses of any FINRA-registered broker or brokerage firm by using FINRA BrokerCheck®. FINRA makes BrokerCheck available at no charge to the public. Investors can access this service by linking directly to BrokerCheck at www.finra.org/brokercheck, or by calling (800) 289-9999.

FINRA Market Data

An array of bond information is available in the Market Data section of the FINRA website. The section provides data on equities, options, mutual funds and a wide range of bonds—corporate, municipal, Treasury, agency bonds and securitized products. Market Data Center is the sole source for real-time bond pricing information and trade data. Furthermore, it offers a full profile for every exchange-listed company, including company description, recent news stories and Securities and Exchange Commission filings, and an interactive list of domestic securities the company issues. In addition, the site includes U.S. Treasury Benchmark yields, market news, an economic calendar and other information indicating current market conditions. You can find all of this information at www.finra.org/marketdata.

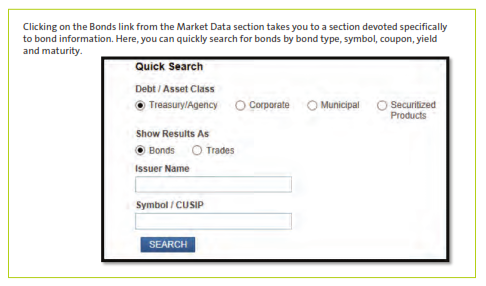

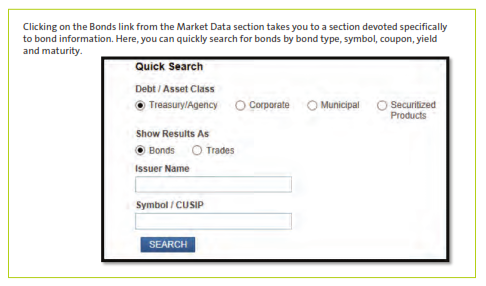

Using FINRA’s Bond Market Data

The Bonds section of FINRA’s Market Data brings individual investors visible real-time pricing on corporate and other bond market transactions by providing investors with a means to obtain market information. Bond Market Data includes the price and other information from executed transactions in investment grade, non-investment grade and convertible corporate bonds as reported to TRACE, as well as data for municipal, Treasury, agency bonds and securitized products. In addition, descriptive information and credit ratings on individual bonds are available.

Five Good Reasons to Use FINRA’s Bond Market Data:

1. You get the most comprehensive real-time bond pricing and trade data on the Web. 2. You can search and screen a bond by criteria you select—such as maturity date, rating, most recent trades, CUSIP and industry category.

3. You can compare the pricing and bond information you find here with information you receive from your broker.

4. You can create and track a bond portfolio to evaluate performance.

5. You can familiarize yourself with bond pricing and terminology so that you are better prepared to talk about bonds with a securities industry professional.

FINRA-Bloomberg Corporate Bond Indices

The Bonds area also features two valuable corporate bond indices—the FINRA-Bloomberg Active Investment Grade US Corporate Bond Index and the FINRA-Bloomberg Active High Yield US Corporate Bond Index. These are powerful tools that investors can use on a daily basis to gauge overall market direction and to measure the performance of their corporate bond holdings against the broader market. The indices’ underlying transaction information is derived from data submitted to FINRA’s Trade Reporting and Compliance Engine (TRACE). As such, it is comprised of 100 percent of over-the-counter transaction activity in the index components.

Bonds and Taxes

As with buying and selling stocks, there are tax consequences associated with buying and selling bonds.

Interest Income

Whether or not you will need to pay taxes on a bond’s interest income (coupons) or a bond fund’s dividends depends on the entity that issued the bond.

-

Corporate and Mortgaged-Backed Bonds—The interest you get from corporate and mortgage backed bonds typically is subject to federal and state income tax.

-

Treasuries and Other Federal Government Bonds—The interest you earn on Treasuries and agency bonds backed by the “full faith and credit” of the U.S. government is subject to federal income tax, but not state income tax. This does not include bonds in which the U.S. government only provides a guarantee such as with Ginnie Maes.

-

Municipal Bonds—Municipal bonds are generally exempt from federal income tax. If the municipal bond was issued by your state or local government, the interest on the bond is usually exempt from state and local taxes, as well. However, if the bond was issued by a state or local government outside of the state in which you reside, the interest from the bond is usually subject to state income tax. Bonds issued by a U.S. Territory, such as Puerto Rico or Guam, however, are exempt from federal, state and local taxes in all 50 states.

Gains

When you purchase an individual bond at face value and hold it to maturity, there is no capital gain to be taxed. Of course, if you sell the bond for a profit before it matures, you’ll likely generate a taxable gain, even if it’s a tax-exempt bond. If you owned the bond for more than a year, your gain is taxed at the long-term capital gain rate. If you owned the bond for one year or less, you are taxed at the short-term rate.

With a bond fund, you are unlikely to sell at the exact share price at which you bought, which means you incur a capital gain or loss. In addition, mutual fund managers buy and sell securities all year long, incurring capital gains and losses. If the gains are more than the losses, shareholders will receive a capital gain disbursement at the end of the year.

Remember—the tax rules that apply to bonds are complicated. Before investing, you may want to check with your tax advisor about the tax consequences of investing in individual bonds or bond funds.