Smart Bond Investing

You’ve heard it before: Asset allocation is key to prudent, long-term investing. You’ve probably heard this before, too—depending on your age and tolerance for risk, your portfolio should contain a mixture of investments, including stocks, bonds and cash. This is sound advice. But do you understand the critical characteristics of bonds?

That’s where this guide comes in. We’ve written it to help those who already invest in bonds and mutual funds that primarily invest in bonds—and those who are considering investing—better understand this important component of a balanced portfolio.

Bonds and bond funds can be extremely helpful to anyone concerned about capital preservation and income generation. Bonds and bond funds also can help partially offset the risks that come with equity investing—regardless of prevailing market conditions. They can be used to accomplish a variety of investment objectives. Bonds and bond funds hold opportunity—but they also carry risk.

Bond Basics

What’s a Bond?

A bond is a loan that an investor makes to a corporation, government, federal agency, or other organization. Consequently, bonds are sometimes referred to as debt securities. Since bond issuers know you aren’t going to lend your hard-earned money without compensation, the issuer of the bond (the borrower) enters into a legal agreement to pay you (the bondholder) interest.

The bond issuer also agrees to repay you the original sum loaned at the bond’s maturity date, though certain conditions, such as a bond being called, may cause repayment to be made earlier. The vast majority of bonds have a set maturity date—a specific date when the bond must be paid back at its face value, called par value. Bonds are called fixed-income securities because many pay you interest based on a regular, predetermined interest rate—also called a coupon rate—that is set when the bond is issued.

Understanding bond basics is critical to making informed investment decisions about this investment category. The more you know now, the less likely you will be to make a decision you later regret.

Bond Maturity

A bond’s term, or years to maturity, is usually set when it is issued. Bond maturities can range from one day to 100 years, but the majority of bond maturities range from one to 30 years. Bonds are often referred to as being short-, medium-, or long-term. Generally, a bond that matures in one to three years is referred to as a short-term bond. Medium- or intermediate-term bonds are generally those that mature in four to 10 years, and long-term bonds are those with maturities greater than 10 years. The borrower fulfills its debt obligation typically when the bond reaches its maturity date, and the final interest payment and the original sum you loaned (the principal) are paid to you.

Callable Bonds

Not all bonds reach maturity, even if you want them to. Callable bonds are common. They allow the issuer to retire a bond before it matures. Call provisions are outlined in the bond’s prospectus (or offering statement or circular) and the indenture—both are documents that explain a bond’s terms and conditions. While firms are not formally required to document all call provision terms on the customer’s confirmation statement, many do so. (When you buy municipal securities, firms are required to provide more call information on the customer confirmation than you will see for other types of debt securities.)

You usually receive some call protection for a period of the bond’s life (for example, the first three years after the bond is issued). This means that the bond cannot be called before a specified date. After that, the bond’s issuer can redeem that bond on the predetermined call date, or a bond may be continuously callable, meaning the issuer may redeem the bond at the specified price at any time during the call period. Before you buy a bond, always check to see if the bond has a call provision, and consider how that might impact your portfolio investment strategy.

Bond Coupons

A bond’s coupon is the annual interest rate paid on the issuer’s borrowed money, generally paid out semiannually. The coupon is always tied to a bond’s face or par value, and is quoted as a percentage of par. For instance, a bond with a par value of $1,000 and an annual interest rate of 4.5 percent has a coupon rate of 4.5 percent ($45).

Coupon Choices

Say you invest $5,000 in a six-year bond paying 5 percent per year, semiannually. Assuming you hold the bond to maturity, you will receive 12 interest payments of $125 each, or a total of $1,500. This coupon payment is simple interest.

You can do two things with that simple interest—spend it or reinvest it. Many bond investors rely on a bond’s coupon payments as a source of income, spending the simple interest they receive.

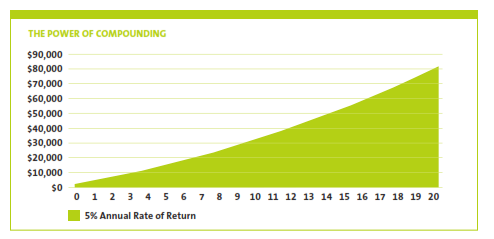

When you reinvest a coupon, however, you allow the interest to earn interest. The precise term is “interest-on-interest,” though we know it by another word: compounding. Assuming you reinvest the interest at the same 5 percent rate and add this to the $1,500 you made, you would earn a cumulative total of $1,724, or an extra $224. Of course, if the interest rate at which you reinvest your coupons is higher or lower, your total return will be more or less. Also be aware that taxes can reduce your total return.

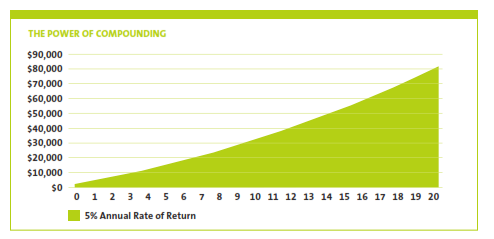

The Power of Compounding

Regardless of the type of investment you select, saving regularly and reinvesting your interest income can turn even modest amounts of money into sizable investments through the remarkable power of compounding. If you save $200 a month and receive a 5 percent annual rate of return, you will have more than $82,000 in 20 years’ time.

Smart Bond Investing

Accrued Interest

Accrued interest is the interest that adds up (accrues) each day between coupon payments. If you sell a bond before it matures or buy a bond in the secondary market, you most likely will catch the bond between coupon payment dates. If you’re selling, you’re entitled to the price of the bond, plus the accrued interest that the bond has earned up to the sale date. The buyer compensates you for this portion of the coupon interest, which is generally handled by adding the amount to the contract price of the bond.

Accrued Interest Calculator

Interest on a bond accrues between regularly scheduled payments. To find out how much interest is owed on a given bond, use FINRA’s calculator.

-

Accrued Interest Calculator: www.finra.org/interestcalculator

Zero-Coupon Bonds

Bonds that don’t make regular interest payments are called zero-coupon bonds—zeros for short. As the name suggests, these are bonds that pay no coupon or interest payment. Instead of getting an interest payment, you buy the bond at a discount from the face value of the bond, and you are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

Federal agencies, municipalities, financial institutions, and corporations issue zeros. One of the most popular zeros goes by the name of STRIPS (Separate Trading of Registered Interest and Principal Securities). A financial institution, government securities broker, or government securities dealer can convert an eligible Treasury security into a STRIP bond. As the name implies, the interest is stripped from the bond. A nice feature of STRIPS is that they are non-callable, meaning they can’t be called to be redeemed should interest rates fall. This feature offers protection from the risk that you will have to settle for a lower rate of return if your bond is called, you receive cash, and you need to reinvest it, also known as reinvestment risk.

Caution—Interest Is NOT Invisible to the IRS

The difference between the discounted amount you pay for a zero-coupon bond and the face amount you later receive is the imputed interest. This is interest that the IRS considers to have been paid, even if you haven’t actually received it. While interest on zeros is paid out all at once, the IRS demands that you pay tax on this “phantom” income each year, just as you would pay tax on interest you received from a coupon bond. Some investors avoid paying the imputed tax by buying municipal zero-coupon bonds (if they live in the state where the bond was issued) or purchasing the few corporate zero-coupon bonds that have tax-exempt status.

Floating-Rate Bonds

While the majority of bonds are fixed-rate bonds, a category of bonds called floating-rate bonds (floaters) have a coupon rate that is adjusted periodically, or “floats,” using an external value or measure, such as a bond index or foreign exchange rate.

Floaters offer protection against interest rate risk, because the fluctuating interest coupon tends to help the bond maintain its current market value as interest rates change. However, their coupon rate is usually lower than that of fixed-rate bonds. Because a floating bond’s rate increases as interest rates go up, they tend to find favor with investors during periods when economic forces are causing interest rates to rise. Most floater coupon rates are generally reset more than once a year at predetermined intervals (for example, quarterly or semiannually). Floaters are slightly different from so-called variable rate or adjustable rate bonds, which tend to reset their coupon rate less frequently. (Note: Floating and adjustable-rate bonds may have restrictions on the maximum and minimum coupon reset rates.)

Bond Prices

Bonds are generally issued in multiples of $1,000, also known as a bond’s face or par value. But a bond’s price is subject to market forces and often fluctuates above or below par. If you sell a bond before it matures, you may not receive the full principal amount of the bond and will not receive any remaining interest payments. This is because a bond’s price is not based on the par value of the bond. Instead, the bond’s price is established in the secondary market and fluctuates. As a result, the price may be more or less than the amount of principal and the remaining interest the issuer would be required to pay you if you held the bond to maturity.

The price of a bond can be above or below its par value for many reasons, including interest rate adjustments, whether a bond credit rating has changed, supply and demand, a change in the creditworthiness of a bond’s issuer, whether the bond has been called or is likely to be (or not to be) called, a change in the prevailing market interest rates, and a host of other factors. If a bond trades above par, it is said to trade at a premium. If a bond trades below par, it is said to trade at a discount. For example, if the bond you desire to purchase has a fixed interest rate of 8 percent, and similar-quality new bonds available for sale have a fixed interest rate of 5 percent, you will likely pay more than the par amount of the bond that you intend to purchase, because you will receive more interest income than the current interest rate (5 percent) being attached to similar bonds.

Bond Yield

Yield is a general term that relates to the return on the capital you invest in the bond.

You hear the word “yield” a lot with respect to bond investing. There are, in fact, a number of types of yield. The terms are important to understand because they are used to compare one bond with another to find out which is the better investment.

There are several definitions that are important to understand: coupon yield, current yield, yield-to-maturity, yield-to-call and yield-to-worst. Let’s start with the basic yield concepts.

-

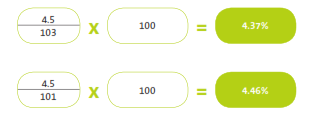

Coupon yield is the annual interest rate established when the bond is issued. It’s the same as the coupon rate and is the amount of income you collect on a bond, expressed as a percentage of your original investment. If you buy a bond for $1,000 and receive $45 in annual interest payments, your coupon yield is 4.5 percent. This amount is figured as a percentage of the bond’s par value and will not change during the lifespan of the bond.

-

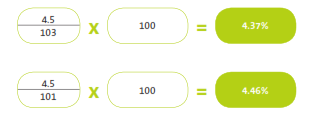

Current yield is the bond’s coupon yield divided by its market price. Here’s the math on a bond with a coupon yield of 4.5 percent trading at 103 ($1,030).

If you buy a new bond at par and hold it to maturity, your current yield when the bond matures will be the same as the coupon yield.

Yields That Matter More

Coupon and current yield only take you so far down the path of estimating the return your bond will deliver. For one, they don’t measure the value of reinvested interest. They also aren’t much help if your bond is called early—or if you want to evaluate the lowest yield you can receive from your bond. In these cases, you need to do some more advanced yield calculations. Fortunately, there is a spate of financial calculators available—some that even estimate yield on a before- and after-tax basis. The following yields are worth knowing, and should be at your broker’s fingertips:

-

Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it is the discount rate at which the sum of all future cash flows (from coupons and principal repayment) equals the price of the bond. YTM is often quoted in terms of an annual rate and may differ from the bond’s coupon rate. It assumes that coupon and principal payments are made on time. It does not require dividends to be reinvested.

-

Further, it does not consider taxes paid by the investor or brokerage costs associated with the purchase.

-

Yield-to-Call (YTC) is figured the same way as YTM, except instead of plugging in the number of months until a bond matures, you use a call date and the bond’s call price. This calculation takes into account the impact on a bond’s yield if it is called prior to maturity and should be performed using the first date on which the issuer could call the bond.

-

Yield-to-Worst (YTW) is whichever of a bond’s YTM and YTC is lower. If you want to know the most conservative potential return a bond can give you—and you should know it for every callable security—then perform this comparison.

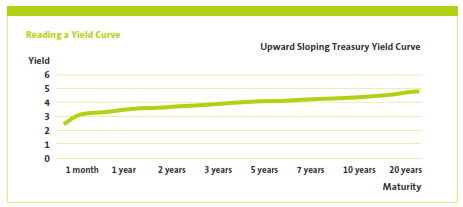

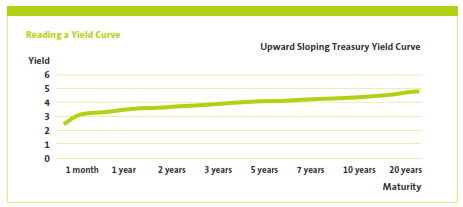

Reading a Yield Curve

You’ve probably seen financial commentators talk about the Treasury Yield Curve when discussing bonds and interest rates. It’s a handy tool because it provides, in one simple graph, the key Treasury bond data points for a given trading day, with interest rates running up the vertical axis and maturity running along the horizontal axis.

A typical yield curve is upward sloping, meaning that securities with longer holding periods carry higher yield.

In the yield curve above, interest rates (and also the yield) increase as the maturity or holding period increases—yield on a 30-day T-bill is 2.55 percent, compared to 4.80 percent for a 20-year Treasury bond—but not by much. When an upward-sloping yield curve is relatively flat, it means the difference between an investor’s return from a short-term bond and the return from a long-term bond is minimal. Investors would want to weigh the risk of holding a bond for a long period (see Interest Rate Risk on page 15) versus the only moderately higher interest rate increase they would receive compared to a shorter-term bond.

Indeed, yield curves can be flatter or steeper depending on economic conditions and what the Federal Reserve Board is doing, or what investors expect the Fed to do, with the money supply. A flattened positive yield curve means there’s little difference between short-term and long-term interest rates. Sometimes economic conditions and expectations create a yield curve with different characteristics. For instance, an inverted yield curve slopes downward instead of up. When this happens, short-term bonds pay more than long-term bonds. Yield curve watchers generally read this as a sign that interest rates may decline.

The Department of Treasury provides daily Treasury Yield Curve rates, which can be used to plot the yield curve for that day.

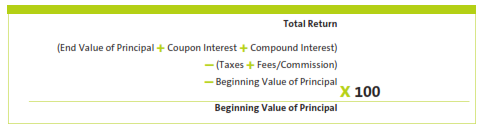

Figuring Return

If you’ve held a bond over a long period of time, you might want to calculate its annual percent return, or the percent return divided by the number of years you’ve held the investment. For instance, a $1,000 bond held over three years with a $145 return has a 14.5 percent return, but a 4.83 percent annual return.

When you calculate your return, you should account for annual inflation. Calculating your real rate of return will give you an idea of the buying power your earnings will have in a given year. You can determine real return by subtracting the inflation rate from your percent return. As an example, an investment with 10 percent return during a year of 3 percent inflation is usually said to have a real return of 7 percent.

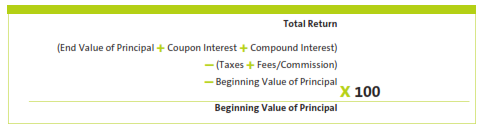

To figure total return, start with the value of the bond at maturity (or when you sold it) and add all of your coupon earnings and compounded interest. Subtract from this figure any taxes and any fees or commissions. Then subtract from this amount your original investment amount. This will give you the total amount of your total gain or loss on your bond investment. To figure the return as a percent, divide by the beginning value of your investment and multiply by 100:

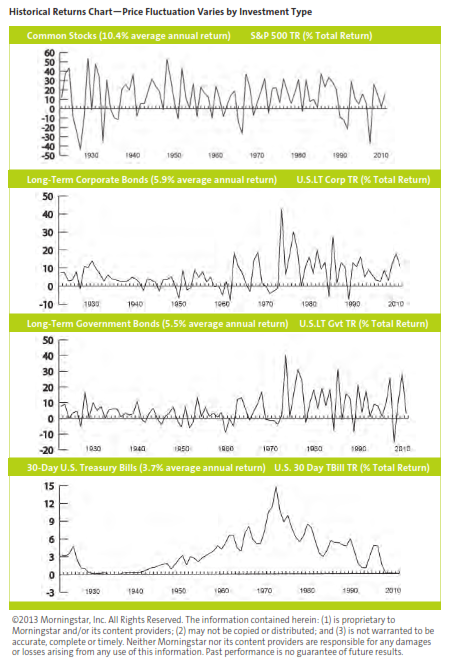

Historical Returns

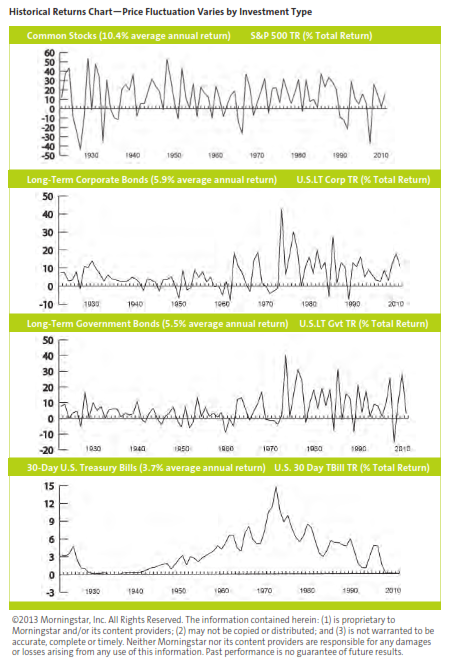

Like virtually all investment products, bonds generate returns that fluctuate from year to year. Longer-term stocks have enjoyed a performance edge, outperforming bonds by a margin of almost 2 to 1 since 1926. But there is a trade-off: Stocks’ performance edge has come with more uncertainty and bumps in the road. But bonds—even U.S. Treasury bills—can have their ups and downs, too.

Bonds and Interest Rates

Three Cardinal Rules

1. When interest rates rise—bond prices fall.

2. When interest rates fall—bond prices rise.

3. Every bond carries interest rate risk.

Interest rate changes are among the most significant factors affecting bond return.

To find out why, we need to start with the bond’s coupon. This is the interest the bond pays out. How does that original coupon rate get established? One of the key determinants is the federal funds rate, which is the prevailing interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. The Federal Reserve (or “the Fed”) sets a target for the federal funds rate and maintains that target interest rate by buying and selling U.S. Treasury securities.

When the Fed buys securities, bank reserves rise, and the federal funds rate tends to fall. When the Fed sells securities, bank reserves fall, and the federal funds rate tends to rise. While the Fed doesn’t directly control this rate, it effectively controls it through the buying and selling of securities. The federal funds rate, in turn, influences interest rates throughout the country, including bond coupon rates.

Another rate that heavily influences a bond’s coupon is the Federal Reserve Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. The Federal Reserve Board directly controls this rate. Say the Federal Reserve Board raises the discount rate by one-half of a percent. The next time the U.S. Treasury holds an auction for new Treasury bonds, it will quite likely price its securities to reflect the higher interest rate.

What happens to the Treasury bonds you bought a couple of months ago at the lower interest rate? They’re not as attractive. If you want to sell them, you’ll need to discount their price to a level that equals the coupon of all the new bonds just issued at the higher rate. In short, you’d have to sell your bonds at a discount.

It works the other way, too. Say you bought a $1,000 bond with a 6 percent coupon a few years ago and decided to sell it three years later to pay for a trip to visit your ailing grandfather, except now, interest rates are at 4 percent. This bond is now quite attractive compared to other bonds out there, and you would be able to sell it at a premium.

Basis Point Basics

You often hear the term basis points—bps for short—in connection with bonds and interest rates. A basis point is one one-hundredth of a percentage point (.01). One percent = 100 basis points. One half of 1 percent = 50 basis points. Bond traders and brokers regularly use basis points to state concise differences in bond yields. The Federal Reserve Board likes to use bps when referring to changes in the federal funds rate.

Where to Find Economic Indicators

Smart bond investors pay close attention to key or “leading” economic indicators, primarily watching for any potential impact they may have on inflation and, because there is a close correlation, interest rates. Various branches of the federal government keep tabs on many, but not all, of these leading indicators. Here are a few useful online resources:

-

U.S. Census Bureau’s Economic Briefing Room and Economic Calendar: www.census.gov/cgi-bin/briefroom/BriefRm

-

U.S. Department of Labor, Bureau of Labor Statistics: www.bls.gov

-

The Conference Board’s Economic Indicators: www.conference-board.org/economics

-

The Federal Reserve Board’s calendar of Federal Open Market Committee (FOMC) meetings. The FOMC sets certain interest rates that are used by others in the bond market to determine all other interest rates: www.federalreserve.gov/monetarypolicy/FOMC.htm