Chapter 2

The 4 major currency pairs

The currency pairs are divided into three distinct categories; the majors, the minors or crosses and the exotics. Of these three, the major currency pairs which are often simply known as “the majors” are the most liquid and also the most widely traded in the market. There are 4 major currency pairs, each combination involving the USD, either as the base or the counter currency. Here is a look at the distinctive features of these pairs starting with their nicknames:

The “Euro”

EUR/USD: Since the Euro and the US dollar represent two of the largest economies and trading blocs, it is understandable why the EUR/USD would be the most popular currency pair and also the most commonly traded. Most traders who have just learnt to wade through the foreign exchange market can be found betting on this pair.

Also, multinational companies which have business operations in both countries will hold positions in the pair since they have the constant need to safeguard their earnings or expenditure by hedging their exposure to currency fluctuation risks. On a day to day basis, the average range of this pair stands at nearly 100 pips.

One of the distinctive advantages for investors who trade in EUR/USD is the low bid-ask spread. Moreover, given the popularity of the pair, constant liquidity is available for it, which makes it easier to buy or sell the pair. These features contribute heavily to the immense interest that speculators have in EUR/USD.

However, the one shortcoming here is that this pair offers very few arbitrage opportunities. Yet, there are many takers for it, given the fact that economic and financial data for the US and the EU is easily available. So, it is possible to formulate strategies and positions. Also, the constant activity equates to higher volatility and a greater opportunity to make profits.

The “Cable”

GBP/USD: Another widely traded pair, the Great Britain Pound vs. the US Dollar has greater volatility, so it is not suitable for newbie traders. The pair has an average daily pip range of 150 and it is one of the most liquid currency trading pairs given the economic clout of both countries.

Although arbitrage opportunities are rare, traders still prefer to put their money on GBP/USD given the high liquidity available for trading and the easy availability of instruments and trading data.

The “Swissey”

USD/CHF: In this pair, greenbacks are pitched against Swiss Francs (USD vs. CHF). This is a particularly good pair to observe if you want to gauge the strength of the US Dollar. The pip range of this pair on a day to day basis is 100 pips. Even though USD/CHF is less liquid than EUR/USD, the Swiss Franc is still a popular and easy currency to trade with, considering the economic and the political stability of the country along with its neutral geopolitical stance.

In fact, the Swiss economy is considered so safe that the CHF frequently acts as the safe haven along with USD for traders who are trying to escape the impact of political or economic turmoil. So, understandably, CHF does not hold as much allure for traders in times of economic and political stability. When the scenario is more stable, CHF shows a marked correlation with the euro, meaning that both these currencies will move in the same direction.

The “Ninja”

USD/JPY: This trading pair of US Dollar and the Japanese Yen has its own personality; nothing less could be expected from it since the currencies of the Eastern and Western economic powerhouses are being put against each other here. It is often found trending in the opposite direction of other dollar pairs, when traders are going for risk aversion transactions. Typically, the pair is perfect for new traders as well as more experienced investors since it is highly liquid and has a low bid/ask spread.

The distinctive benefit of dealing in USD/JPY is that trades can be carried out 24 hours on days when the markets are open. Also, US traders who find it more convenient to trade at night will find this pair particularly lucrative as it is heavily traded during business hours in Asia.

Who wears the currency crown?

In terms of popularity and liquidity, no other currency pair can hold a candle to EUR/USD. In fact, 70% of all forex trades are focused on these two currencies.

However, a significant number of retail investors (folks like you and me) prefer EUR/JPY, GBP/ USD and GBP/ JPY. Of these three, GBP/JPY gets the maximum attention given its sharp and strong trading signals and of course the greater movement scale. This allows investors to make greater profits, but the prospect of increased rewards comes with increased risks.

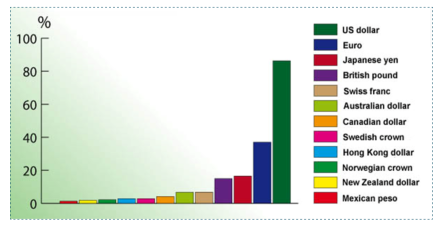

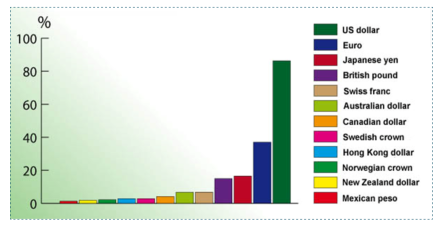

The EUR/JPY comes in a close second in terms of volatility and activity. Also, it should be noted that the EUR/ JPY and the GPB/JPY will typically have the same direction. Given below is a graph that shows the trading volume of the different currencies. Of course, it is no surprise that the USD is at the top of the stack.

Yes, there are minors involved in this game too!

Needless to say, the talk here is about minor currency pairs. These are not nearly as liquid as the majors; this means that they have wider spreads. From the trader’s perspective, this would equate to higher fees per transaction. Minor pairs will typically involve currencies from commodity and Scandinavian economies.

For example, commodity currencies, also known as com dollars are from nations that have rich natural resources, which impart an intrinsic value to their money. In other words, the value of their currency is linked to the price of the commodities that the country produces such as crude oil, gold, other metals, etc. Comm currencies include:

The AUD: The Australian Dollar is on the sixth spot in terms of trading volume. The country is the thirteenth largest economy in the world, measured on the basis of the GDP. So, it is no wonder that 6.5% of all currency trades involve the AUD.

The CAD: Nicknamed the Loonie, the Canadian Dollar accounts for 4.2% of the currency volume despite Canada being in the 10th position, ahead of Australia’s sixteenth, as far as the list of top global economies goes.

The NZD: About 2% of the global FX trades are conducted around the New Zealand Dollar. The country is the 52nd largest economy. This currency is exceptionally popular among speculators.

In addition to this, Scandinavian currencies are also traded in minors and these include the Danish Kroner (DKK), the Norwegian Kroner (NOK) and the Swedish Krona (SEK). Some examples of minor currency pairs are:

-

EUR/JPY called the euro yen

-

AUD/NZD known as aussie kiwi

-

EUR/NOK called euro nokkie

-

EUR/SEK known as euro stokkie

-

AUD/USD called the aussie dollar

-

USD/CAD known as the loonie

These currencies are not traded as heavily as the majors, so there can be a significant amount of fluctuation in their prices. Also, one of the most serious problems with trading in minor pairs is that it can be hard to get accurate prices, when the market is moving fast. This creates the risk of slippage, which is the difference between the price at which the trade gets executed and the expected price. Slippage is never seen when trading in majors or at least it is quite rare.

Of course, it is not all downhill when dealing in minors. In fact, if you have the funds to hold a position over the long terms, these currencies can be the perfect way to diversify your holdings and even create a hedge.

And, finally a word about the exotics!

Pairs such as the USD/SEK (US Dollar vs. Swedish Krona) or the USD pitched against the other Scandinavian currencies such as the NOK or the DKK are called exotics because of their pip value, which is considerably smaller than that of EUR/USD.