Chapter 1

Introduction to the Forex Market

What Is Forex?

Currencies from most countries across the world are traded in the Foreign Exchange Market. Local money cannot be used for inter country trade and business, which calls for the need to exchange currencies. Let us consider the example of a US consumer who wants to buy cheese produced in France. Although the buyer may not have to pay for the cheese in Euros, the retailer from whom he is purchasing the product must have bought the product by paying for it in the local currency.

To get their hands on the Euros, the US retailer would have to exchange an equivalent number of US Dollars to make up the amount to be paid. Similarly, a French tourist, who is travelling to the US, will not be able to use Euros to pay his hotel bills or buy food in the US. For this, he would need US Dollars. To get these dollars, he would go to his bank in France and ask them to change the Euros he has into dollars at the current exchange rate. This is the amount of USD that he would get for 1 Euro.

The need to exchange currencies for personal reasons such as travel, medical treatment as well as for commercial purposes has led to the creation of the largest and the most liquid financial market in the world. Currencies are not traded on a physical exchange like stocks. The trading takes place OTC (Over-The Counter), meaning that all transactions take place over computer networks. So, traders from all over the world can participate in the Foreign Exchange Market. Forex trades can be conducted round the clock for five and a half days each week at the major currency trading centers such as New York, London, Zurich, Frankfurt, Paris, Hong Kong, Singapore, Sydney and Tokyo. The operational times of these markets, which are divided into 3 zones, often overlap for a few hours.

Also, by the time the US financial centers are winding down, the London exchange comes online, which means that transactions continue to occur, regardless of the local time. So, the currency market is extremely active throughout the 24 hours in a day, with prices showing constant movement.

How are Currencies Bought and Sold?

Because a physical commodity is not bought or sold in FX trading, most people get confused at the idea of currency transactions. To put it simply, by purchasing the currency of a particular country, you are essentially placing a bet on the economic strength and performance of that nation. The price of the currency is a result of the current and future health of the economy of a country.

At this time, 180 de facto currencies are being used around the globe. While not all of these are traded actively in the FX markets, the value of each currency continually changes in comparison to that of others. When currencies are bought, the payment for the purchase is made in the form of the currency of another country.

The exchange rate is an indication of how well the economy of one country is performing in comparison to that of the other.

Forex trading is done in pairs; for instance, EUR/USD. In this case, the first currency which is EUR is known as the base currency, while the USD is the quote or counter currency. When you buy a EUR/USD, you are buying the Euro and paying for it in US Dollar. The quote is for one unit of the currencies.

So, if you are given a price of EUR/USD 1.2500, it means that it would take $1.25 to buy €1. It also means that if you were to sell €1, you would get paid $1.25 in return. Currency pairs will have two prices: BID and ASK, and there is a small difference in these two prices. This is known as the spread.

For example, the bid/ask rate of the EUR/USD would be 1.2500/1.2600. As you can see, there is a difference of 1 cent in the price, which is the spread. So, when the market maker or broker buys from a trader, he pays $1.25 USD per EUR. However, when he sells to a trader, he makes $1.26 USD per EUR.

This can also be seen from the trader’s perspective, so when you buy EUR/USD, you will be paying a higher price of $1.26 per Euro but when selling, you will get a slightly lower sum of $1.25 per Euro. The spread represents the earnings of the market maker in the trade, discounting any membership fees that you may have paid to register with the broking house. Since with forex transaction, you are not being charged a commission per trade, like with equities, this is how the market makers earn their profits.

Getting ready to place your first order!

You can buy and sell currencies anytime the market is open. In fact, most trading platforms will allow you to place a buy or sell order in 2 clicks, one to choose the position and the next to confirm it. When you buy a currency pair, you are taking a long position on it, while a trader who sells a pair is said to be going short.

Investors who are buying a pair are relying on the value of the currency to increase while those who are selling it are doing so in the anticipation that the prices will tumble and they will have made a profit on the sale before that happens.

In Forex trades, it is possible to not only sell the currencies that you own, but also those that you don’t hold. This is known as shorting the pair and you can exit the short position by simply placing a buy order for the pair in the future. Currencies are traded in lots; this is a trading unit. So, you could trade in micro, mini or standard lots.

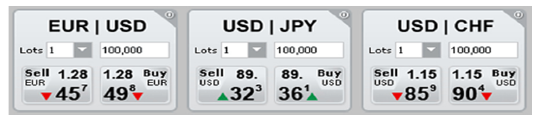

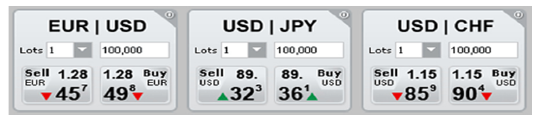

In essence, a €1 million can be opened with 10 standard lots or 100 mini lots. Once a trader knows how much to trade and the position to take, it is time to determine how to execute the transaction. The simplest and fastest way is to buy/sell at the current market. This is the type of trade used when you want to get into a position right away. The image below is what a typical trading platform looks like.

You simply have to click on the buy/sell to take a position. However, if you do not want to trade at the current market rates, there are other types of orders which are available to you.

An order is an instruction that specifies the price at which the trader would like to enter or exit the market. The directive will also have details on how long the trade ought to be kept active. Although some orders are placed to limit losses, they also have another crucial function. They allow the trader to step away from his computer terminal without missing out on moneymaking entry and exits.

The type of order you choose will typically depend on the price at which you want to buy or sell a currency. Based on this, you could place one of the three orders listed below:

Market orders: This is nothing but another term for buying/selling at the current market rate. These orders are immediately executed at the rate being displayed on your screen, as soon as you click your mouse.

Limit orders: As its name suggests, this type of order limits the price at which the trade can be executed. The trader specifies the rate and the trade will be carried out when selling, if the market price reaches above the specified rate, and when buying, if the market price reaches below the specified rate.

To understand this concept better, let us take the example of a USD/CAD trade where the trader believes that the market value of the pair will go up, but it will take a slight dip before doing so. Now, understandably he wants to buy at the lowest rate possible and he would like to sell when the pair is at its peak.

Without access to limit orders, the trader would have to continuously watch the screen. However, by putting this order in place, he can automate the entire process. There is a drawback though; limit orders are executed at an exact price and not even one pip away from it

Stop orders: This is specifically used to limit losses and typically a move that is made to exit a position, when the market rate changes against the position and the expectation of the trader. In this type of order, the currency will be bought above the present market price and sold below the current price.

Contingent orders: These are complex orders that involve one or more simultaneous or back to back trades which are reliant on each other.

Orders are issued directly from the trading platform. As soon as you click on the buy/sell button, you will see a small popup form in which you will be asked to specify the order type.

Leverage and Margins

In order to trade currencies, you will need to maintain funds in your account with the brokerage house. This money is kept in a segregated trust as regulated by the authorities. The minimum account balance requirement is set by the brokerage firm. The amount of money committed to a trade is known as the margin. This is usually a percentage of the trade value. The ratio of the margin to the trade value is known as the leverage.

The currency markets are famous for high leverage ratios such as 100:1 and even more, which are unheard of in the equity markets. A ratio of 10:1 would mean that the trader must reserve 10% of the total trade value as the margin. For instance, if you are purchasing one micro lot of USD/JPY valued at $1000 and the brokerage is offering a leverage of 50:1, you will have to set aside 2% of the total value that is $20.

To put it simply, as long as you have $20, you can open a trade worth $1000. So, if the price increases, the trader gets to keep the profit on the entire amount of $1000 minus interest. However, this is a two sided sword. If the trade loses even temporarily, your margin will get depleted rapidly and you will have to add more funds to your account. If the losses on the trade exceed the available balance in your account, the position will be exited automatically.

Prices and pips!

The minimum account requirement for the majority of brokerage houses is $100. However, it is recommended that you start with at least $500, to get more out of your trading. A pip is defined as the increase or decrease in the price of the currency. The market moves in pips and the value of 1 pip is defined as the fourth decimal place movement.

So, if you were to consider the EUR/USD pair priced at 1.3025. A unit’s movement in the fourth decimal place would be one pip. Take the instance where the price of EUR/USD moves to 1.3125; that would be a move of 100 pips. When USD is the quote currency, the value of the pip is fixed based on the lot size. So, a pip would be worth $0.10 for micro lots, $1 for mini lots and $10 for standard lots.