relevancy in our own time of transition to a

American system

freight shipments railroads felt compelled

globalized and digitized economy? Pursuing

toward competition to grant to industrial monopolies and other

these inquiries takes us first to the congres-

powerful customers. The law prohibited

sional debates and early court decisions

rather than behind-the- railroads from engaging in price discrimina-

interpreting the law, and then to the recent

scenes market

tion – from charging lower prices to powerful

Microsoft case more than a century later.

customers simply because they demanded

Although a great deal occurred between

manipulation by

them. Still, ferocious pressure continued.

these two chapters of economic history, both

powerful private

The railroads’ solution to the demands of

are set in periods of tempestuous industrial

their customers was to join together in price-

change in the United States and, thus, are

interests.

fixing cartels themselves. By the turn of the

particularly instructive episodes of antitrust

20th century, the flight from competition to

enforcement.

combination spread far beyond railroads. Gi-

ant cartels as well as corporate mergers between competi-

The Railway Problem

tors were reshaping and consolidating industries through-

out the economy – from oil refining and steel production

to wooden match and crèpe paper manufacture.

With few exceptions, everyday life in the latter half

of the 19th century lacked the telephone, the

electric light, and the automobile. Rather, it depended

on the horse-drawn wagon and carriage, the kerosene

lamp, as well as the new and rapidly expanding network

of railroads. Indeed, there was great celebration on the

day a “Golden Spike” was driven to complete the first

transcontinental railroad in 1869. The idea of a single

railroad stretching across the continental United States

sparked the imagination of citizens used to stage coach

travel and the mail service carried by relay teams of horse

riders known as the Pony Express.

Other national railroad lines followed and, together

with regional roads and feeder lines, they soon connected

32

The Rise of Standard Oil

increase of size ... cannot be arrested.” Even the pro-

gressive-minded journalist Lincoln Steffens remarked:

“Trusts are natural, inevitable growths out of our social

The most famous example involved an accountant

and economic conditions . ... You cannot stop them by

from northern Ohio named John D. Rockefeller. By

force, with laws.”

1859, oil had been discovered in Ontario, Canada, and in

Others saw it differently. They believed that only

western Pennsylvania. Most crude oil from both fields

legal reform could assure a modicum of free competition

was sent to refineries in northern Ohio for processing

and a fair distribution of wealth and power among larger

into useful forms like kerosene. In less than 15 years,

and smaller firms. As pressure for reform mounted, some

Rockefeller had become an enormously successful busi-

states took legal action against trusts, as they became

nessman because he controlled the Ohio oil refineries

universally known. But efforts by progressives to break

and, with them, the entire industry. He used this control

up trusts failed because, like Standard Oil at the time,

as leverage over the railroads, already financially weak-

they could simply move to less reform-minded states

ened by their own proliferation and intense competition.

with more permissive commercial laws.

Their condition allowed Rockefeller the leverage to

As it became clear that states could not or would

obtain not only lower

not curtail the

rates for transport-

growth of trusts

ing his Standard Oil

of all types,

Company products

Congress held

but also a portion of

hearings on how

every dollar his rivals

it might address

paid the railroads.

the issue. In

He extracted these

1888, Senator

payments by ap-

John Sherman of

proaching each rail-

Ohio introduced

road and threatening

his anti-trust

it with the loss of his

bill and

business, which was

declared:

quite substantial and,

The popular

thus, critical in an

mind is agi-

industry whose thin

tated

with

profit margin made it

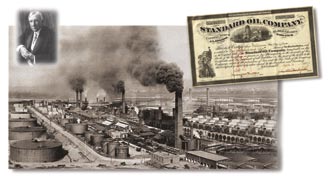

John D. Rockefeller, inset upper left, was the most famous businessman of his day, seen by foes as greedy problems that

dependent on traffic

and powerful. Rockefeller lived to see his Standard Oil Company broken up by federal decree. Upper may disturb

right: a stock certificate for Standard Oil. Center: Standard Oil refinery in California, 1911.

volume.

social order,

As a result, independent oil companies were crushed,

and among them all none is more threatening than

many of them selling out to Standard Oil. In 1892, the

... the concentration of capital into vast combinations.

Ohio attorney general won a court order to dissolve the

... Congress alone can deal with them and if we are

Standard Oil Company, but Rockefeller simply moved to

unwilling or unable there will soon be a trust for every

New Jersey, turning it into the first “trust”– a company

product and a master to fix the price for every necessity

controlling formerly independent competitors by holding

of life.

their stock certificates. The old trusts were different

Still, there were some in Congress who differed with

from today’s holding companies, whose stock portfolios

Senator Sherman. They sided with Carnegie and Stef-

are diversified across industries and, thus, do not raise

fens as well as Rockefeller, who would later testify be-

concerns about monopoly power in particular markets.

fore the United States Industrial Commission: “It is too

Although few companies actually adopted the form of

late to argue about the advantages of industrial combina-

a “trust,” the term rapidly became the catchword in pub-

tions. They are a necessity.”

lic debate over the government’s role in a time of such

In particular, the two men from Ohio – Sherman and

industrial concentration. Some saw increasing industrial

Rockefeller – disagreed sharply over the prospect and

concentration as natural and beneficial. Steel baron

the wisdom of turning the tide of increasing industrial

Andrew Carnegie said that “this overpowering irresist-

concentration. Rhetorically, they were both speaking in

ible tendency toward aggregation of capital and

favor of “free competition.” But free competition held

33

different meanings for them. For Senator Sherman, it

Anti-Trust Act more clearly, uniting to declare that all

signified competition free from domination by private

price-fixing cartels were illegal:

economic power. It meant that free markets require limits

... we can have no doubt that [cartels], however reason-

on monopolies, cartels, and similar economic restraints.

able the prices they fixed, however great the competition

Rockefeller believed in competition free from govern-

they had to encounter, and however great the necessity

ment regulation and called for an absolute freedom of

for curbing themselves by joint agreement from com-

contract.

mitting financial suicide by ill-advised competition,

Thus, in 1890, social concerns about massive industrial

[are prohibited] because they ... deprive the public of

transformation, economic concerns about the monopolies

the advantages which flow from free competition.

and cartels that threatened free markets, and political

With overt price-fixing cartels clearly illegal, the rail-

concerns about the fundamental “liberty of the citizen”

roads turned to mergers as the way to eliminate competi-

in a nation where trusts might become very powerful

tion between them. Thus, the second landmark case to

motivated Congress to pass the Sherman Anti-Trust Act.

test the statute was brought by the U.S. attorney general

In the American system, legislation typically serves as

to break up the Northern Securities Trust, the result of

the beginning of social change. Thereafter, laws are ap-

a merger engineered by the financier J. P. Morgan. His

plied and policies interpreted

group had come to control

by the courts, where the sharp

the faltering Northern Pacific

divide between the two sons

Railway, which competed

of Ohio, Sherman and Rock-

along 9,000 miles of parallel

efeller, continued to play out

track with the Union Pacific,

for decades.

amongst whose owners was

Rockefeller. To end the cut-

The Supreme

throat competition between

the two railroads, Morgan

Court Upholds

persuaded the two ownership

groups to merge by exchang-

the New Law

ing their railroad stock for

trust certificates. The federal

government brought suit to

dissolve the trust.

Two landmark antitrust

In 1904, a bare majority

cases involving railroads

of the Supreme Court ap-

soon reached the Supreme

proved the government

Court, the first in 1896. In

action to break up the rail-

United States v. Trans-Missouri

road trust. Four of the nine

Freight Association, the U.S.

justices dissented, insist-

attorney general sued a rail-

ing that the merger, like

road cartel whose 18 members

any commercial contract,

argued that they were merely

was simply a sale of prop-

setting reasonable prices to

erty. For them, free com-

avert ruinous competition.

petition meant the right

Although the railroads’ argu-

to sell or exchange one’s

ment persuaded the lower

business free from govern-

courts, a divided Supreme

19th-century political cartoonists had a field-day attacking Rockefeller, here ment intervention, regard-Court held the cartel illegal

caricatured as “King of the World,” sitting on a barrel of oil.

less of its actual impact on

and announced that only the competitive process could

the market. The Court majority, however, insisted that

set reasonable prices. The Court majority also observed

free competition calls for attention to the impact on the

that such “combinations of capital” threatened to “driv[e]

market. Crucially, it determined that the Anti-Trust Act

out of business the small dealers and worthy men whose

prohibited this particular merger because the resulting

lives have been spent therein.” A few years later, the

trust necessarily eliminated competition between the

Court factions reaffirmed the validity of the Sherman

railroads and created a monopoly. The Court declared:

34

structure on paper had come to resemble. Yet there were

The mere existence of such a combination and the pow-

others who pointed not to Rockefeller’s ruthlessness but

er acquired by the holding company as its trustee, con-

to his success in creating an efficient distribution network,

stitute a menace to, and a restraint upon, that freedom

and to the benefits to consumers of decreasing prices for

of commerce which Congress intended to recognize and

petroleum products in those years. But in the end it was

protect, and which the public is entitled to have protected.

a question of competition on the merits, not competitive

If such combination be not destroyed, all the advantages

success by any means. Indeed, Nobel Laureate Douglass

that would naturally come to the public under the oper-

C. North has recently written that the success of free mar-

ation of the general laws of competition ... will be lost.

ket economies depends on the belief that participants will

have a fair opportunity to succeed.

Even as the Sherman Act played out in the railroad

industry, Rockefeller’s Standard Oil Trust continued to

wage a relentless assault on the petroleum industry. His

Antitrust Law and the

vision of a unified and efficient network of petroleum

production and distribution entailed a methodical pro-

Modern Age

gram of intimidation that left his rivals with

no choice but to sell out for pennies on the

The

dollar.

success of

More recent critics of the Anti-Trust Act

But in1902, President Teddy Roosevelt

point to as many as five merger waves,

took action that would make his reputation

the first beginning in the late 19th century.

free market

as a “trust-buster”: On his instruction, the

For example, General Motors Corporation

U.S. attorney general filed suit to break up

and the now-defunct AT&T and U.S. Steel

economies

Standard Oil, whose predatory conduct had

corporations resulted from mergers that

come to symbolize the entire trust problem.

successfully consolidated the automobile,

depends on the

Court cases can take a long time, but in 1911,

telecommunications, and steel industries for

the Supreme Court finally held that Standard

belief that

the better part of the 20th century. In the

Oil had illegally monopolized the petroleum

critics’ view, the Anti-Trust Act, in spite of its

participants will

industry. Simply put, its success had not been

affirmation by the Court, did not reverse the

fairly won. The result was a decree to dis-

trend toward industrial concentration and,

have a fair

solve Standard Oil into 33 separate companies

with it, the increasing consolidation of eco-

known as “baby Standards.”

nomic and political power that had originally

opportunity

The Anti-Trust Act was a resounding suc-

moved Congress to act in 1890. Yet since

cess, or so it seemed. Price-fixing cartels

to succeed.

the1970s, in spite of the enormous authority

were stopped in their tracks and the notorious

and prestige of corporations in American life,

Northern Securities and Standard Oil

the Justice Department and the Federal Trade Commis-

trusts were no more. The Washington Post

sion in both Republican and Democratic administrations

would declare on May 18, 1911, that the

have accepted their statutory responsibility to review all

Supreme Court decision “dissolves the once sovereign

large mergers and often insisted on changes to reduce

Standard Oil Company as a criminal corporation. ...

their anti-competitive effects. Indeed, the AT&T

[H]onest men will find security from alarms and indict-

monopoly of telephone service was broken up during

ments, while dishonest men will see in it the certainty

Ronald Reagan’s first term.

of punishment. ... [I]t has given the country assurance of

Still, it is particularly hard to ignore the fact that even

justice and progress in its industry.”

after a century of trust-busting, legal mergers have con-

But in retrospect the success was not so clear. First, the

solidated the oil industry into a sector now dominated by

break up of Standard Oil permitted its shareholders to

a few large multinational corporations. Indeed, the argu-

retain ownership and control of the 33 baby Standards.

ment that concentration is good continues. Moreover,

Thus they were not independent companies, except in

times have changed, many argue: Global competition

name. Furthermore, in congressional hearings several

reduces the tension between the benefits of large-scale

years later, evidence showed that their profits had actu-

enterprise and the harms of industrial concentration.

ally increased, suggesting the break up had certainly

Others insist that tensions have not lessened but rather

not diminished their economic power, whatever their

shifted from the national to the international stage, as

35

evidenced by disputes adjudicated by the World Trade

innovation. But behind Gates’s public persona was a

Organization and similar groups.

corporate strategist whose tactics of competition some

Nonetheless, thanks to Senator Sherman, the commit-

have likened to those of John D. Rockefeller. Microsoft

ment to prohibit price-fixing has remained resolute: In

Windows is clearly the dominant operating system for

1999, for example, the federal government concluded

personal computers (PCs) just as Standard Oil was the

its case against an international vitamin cartel when its

dominant distribution system for the petroleum indus-

members agreed to fines approaching $1 billion and to

try. In the U.S. government case against Microsoft, the

imprisonment of the corporate managers involved. As a

United States District Court in Washington, D.C., found

general matter, there is an international consensus about

that Microsoft retained its dominance by intimidating

the economic evils of price-fixing cartels as unjustifiable

computer companies as powerful as Intel and IBM and as

restraints of competition. More than 100 countries have

frail as Apple Computer into withholding from consum-

enacted competition laws modeled on the Sherman Anti-

ers products that had the potential to challenge Microsoft

Trust Act – from the European Union and its member

Windows software.

states to Japan and Zambia.

Various tribunals ultimately found that Microsoft il-

In the United States, the Anti-Trust Act has both

legally monopolized the major market for PC operating

enunciated and strengthened an endur-

systems. Unlike Standard Oil, however,

ing commitment to opening markets to

Microsoft was not broken up. It was

new technologies and new groups. No

ordered to cease discriminatory pricing

longer do a few wealthy businessmen like

and product access policies, and to share

Rockefeller and Carnegie, Vanderbilt and

basic information about its Windows

Dupont, dominate commercial enterprise

PC operating system needed for rivals

and control economic opportunity. As

to compete more effectively and freely

the 20th century progressed, the inven-

with Microsoft in the market for applica-

tive energies bubbling at the core of the

tions software on the Windows platform.

American economy were unleashed to

In the European Union case, the

create new centers of innovation and

Commission imposed similar restrictions

entrepreneurial activity, whether in Hol-

as well as a fine of 497.2 million Euros.

lywood, on Madison Avenue, or across the

Microsoft settled numerous suits world-

Internet from California’s Silicon Valley to

wide, both public and private, at a cost

its counterparts in the environs of Austin

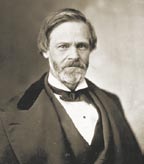

Senator John Sherman of Ohio, whose

of additional billions of dollars.

and Boston.

“Anti-Trust Act” of 1890 became the law of the

As a result, the ethos of the infor-

land. Since then, it has been used by the

mation technology industry changed.

U.S. government and by the courts to curb

The Microsoft Case

corporate monopolies.

Companies began to engage more freely

in research that competes fundamentally

with Microsoft technology. Indeed, Microsoft has re-

The dialectic of concentration versus competition

cently embarked on a new course of patent cross-licens-

continues, even as it mutates into new forms. It

ing that is a radical departure from its history of sharp

should come as no surprise that our own time of dramatic

competition. While it is too early to assess the ultimate

technological and economic transformation has given rise

impact of Microsoft’s shift toward cooperation, what is

to a second great monopolization case: Since 1990, Mi-

clear is that the Sherman Anti-Trust Act has retained its

crosoft Corporation, the software manufacturer, has been

legal relevance and has already had a substantial role to

investigated and sued by the U.S. federal government

play in regulating the commerce of the Information Age.

and 20 U.S. states, as well as by the European Union and

Has the Anti-Trust Act made a difference in the

numerous private plaintiffs. Notably, the Anti-Trust Act,

United States over the past century? The answer is

a 19th century statute, was still at the heart of the U.S.

clearly yes with respect to overt price-fixing cartels and

cases seeking to curb Microsoft’s allegedly anticompeti-

with respect to the most flagrant examples of predatory

tive conduct in high technology industries at the cusp of

commercial monopolies. But the effect on corporate <