Introduction

Thank you for downloading the latest e-book from B2B CFO®. We have tried to compile a collection of insightful business tips for the small business owner. These articles are written by

B2B CFO® partners and are the result of over 5,000 years of col ective experience in the

business world.

We have organized these articles by author rather than topic since there are so many different

categories that are addressed. Please review the table of contents in order to find the articles

that can help you the most with your business.

Copyright © 2012 B2B CFO® 6

The Ultimate Small Business Playbook

Articles By Mark Gandy

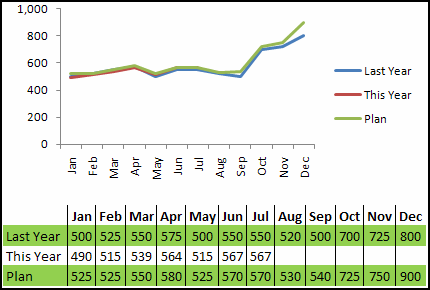

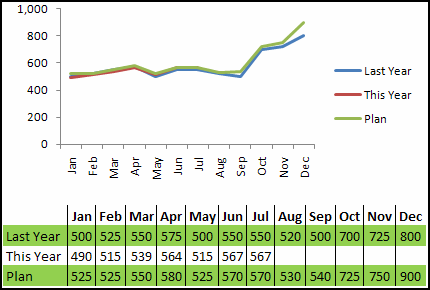

What Forecasting is Not

Forecasting is not about predicting the future. And while everyone knows that, the CEO’s and

CFO’s in the war room continue to forecast like they are predicting what will likely happen. At least that’s what I experience regularly through listening to corporate leaders.

Instead, let this smal -town CFO offer his take on forecasting (it can be cash, production levels,

sales, or how many games the Cubs will lose this year):

1. Forecasting is about trying to make better business decisions based on what we know today.

Accordingly, forecasting is not a prediction. Bottom line, the forecast is only as good as your assumptions. Poor forecasts? Then the result is poor assumptions.

2. You wil get better at this over time. Accordingly, forecasting is not an ongoing practice of futility.

Let’s say you start a forecasting process as part of a new management system you start (one

that forecasts sales, production levels, and inventory). I promise you the first 3 or 4 months will

be fair to poor. But in time, you wil get better and better. One way to show improvement in

this process is to use a waterfall chart – I give them to clients who are only serious about excellence and want to take their B game to an A game in all areas of their business. Stay the

course; you’l get better at this.

3. Forecasting starts at the macro level, not the micro/detailed levels. That’s why I initially don’t like accountants involved in forecasting. Many like to start with the details and look at history.

Instead, the view should start high (where’s the market heading, what are the current trends,

what’s happing in the economy). Ignore the macro level and you are flirting with disaster.

Case in point, I was visiting with a banker (one of the sharpest banking minds I’ve ever

encountered in 20 years). We were talking about case goods for wine product. He stated some

wineries like to push growth to the extent they case too many gal ons, then they get stuck with

al those case goods. The end result is that they have to dump the goods through huge

discounts. I countered that would never happen in an environment where there is a formal

forecasting and planning process in place. He agreed.

Parting Comments

Finally, eventually dump the term forecast and exchange it for the term plan, because that’s

exactly what we’re doing–planning the future based on what we know today. The planning

Copyright © 2012 B2B CFO® 7

The Ultimate Small Business Playbook

process should be adaptive, agile, and collaborative. Adaptive and agile are self-explanatory.

Collaborative means getting the key team involved (the sales VP, the OPs manager, the CFO).

And while we said forecasting is about trying to make better decisions, specifical y, it’s about

matching demand with supply. So if you are a products-based business, understanding the

future demand helps you to plan production and inventory levels accordingly. The same

applies to service-based businesses. There’s an art to planning excess capacity human

resources when future demand looks weak. Bottom line, the goal is to get demand to

approximate your supply-side products or service levels.

Weekly Financials

One of my favorite topics– weekly financial statements.

My third controller/CFO client in 2001 actually taught me something. While I was big on the

one-day close or same-day close already, I never knew about weekly financials in non-banking

situations (as a KPMG Peat Marwick accountant, my bank clients had those ugly green bar

reports showing their financials from the day before–so I knew about daily financials already,

albeit in the banking arena).

Copyright © 2012 B2B CFO® 8

The Ultimate Small Business Playbook

Ten years later, the weekly financial report is one of the most important flash reports you need

to look at every Friday or Monday. And below are just a few recommendations to pull these

off:

1. Keep them simple. Quickly, you want to know what happened last week and if changes are

needed. You should only need to study this flash reporting in just a couple minutes, so detail is

not required. Certainly, if you want drill-down capability, the make that supplemental detail,

but keep the primary reporting stupidly simple.

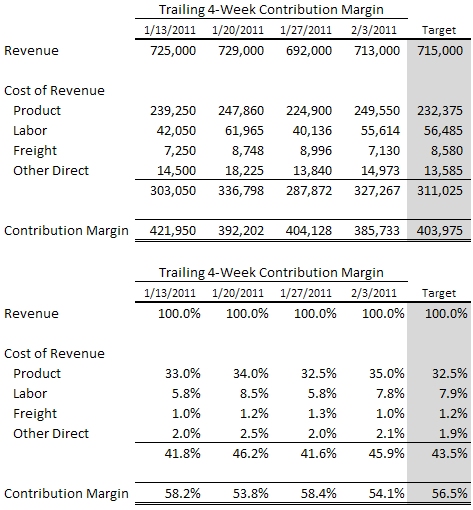

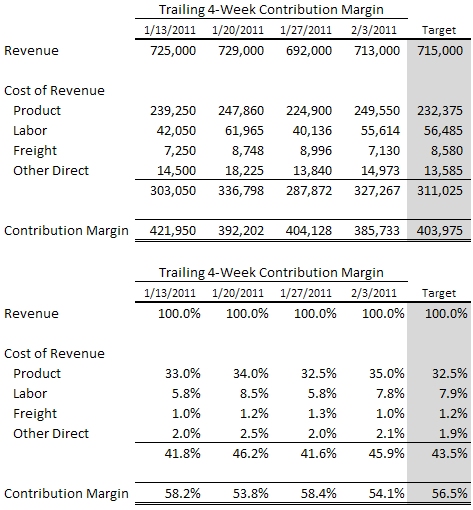

2. Forget the monthly/period expenses. Just focus on direct costs. Only do payroll every two

weeks? No big deal. In this case, you need two pieces of information–hours worked and

average hourly pay rate. Those can be used to calculate direct labor. I have a sample

contribution margin report below showing the numbers that count.

3. Consider a trailing 4 or 8 week analysis with a target column. I like 4 weeks because I’m

concerned about last week and I already know what I want my target to be. If I want to do

trend analysis, that’s fine and there’s great software to do that. I want this darn thing to be

simple and a quick-read. Four weeks works for me. It should for you.

4. Tailor to your situation. In the example below, the format and process works great for retail,

distribution, and hospitality. How about service firms with longer-term projects? Then

customize. For example, columns could include each project showing current revenues with

direct costs and then expected revenues and costs to complete. Remember, there are no rules

for format and what’s included or left out–you make the rules. Bottom line; find a weekly

reporting format that works in your situation.

DO THIS. There is no excuse not to include these in your weekly flash reporting. Ignorance,

laziness, and apathy are not reasons to punt on these. Want to be better? Implement this

stupidly simple tool. The time and expense to develop and implement this process will be very

low.

Copyright © 2012 B2B CFO® 9

The Ultimate Small Business Playbook

Copyright © 2012 B2B CFO® 10

The Ultimate Small Business Playbook

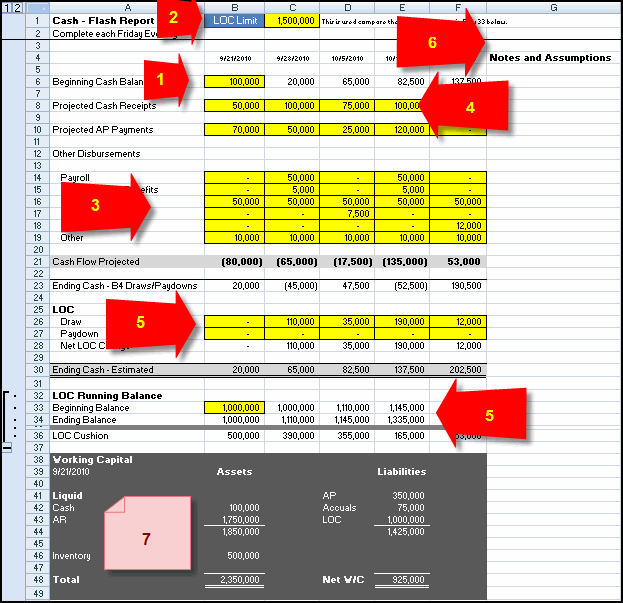

Cash Projection Basics

Too bad I don’t have a dollar for every cash projection model I’ve built over the years. Most are

stupidly simple, but all have this in common. They work.

A few days ago, an awesome CFO asked for some examples of my cash projections tools. If he

asked, a CFO, maybe non-CFO’s need to know what they look like. So here goes.

First, simplicity and big picture. Can I make payroll at the end of the month, or not? Can I even

buy inventory this week? Do I need to extend my line of credit? The projection tool should

answer these questions quickly.

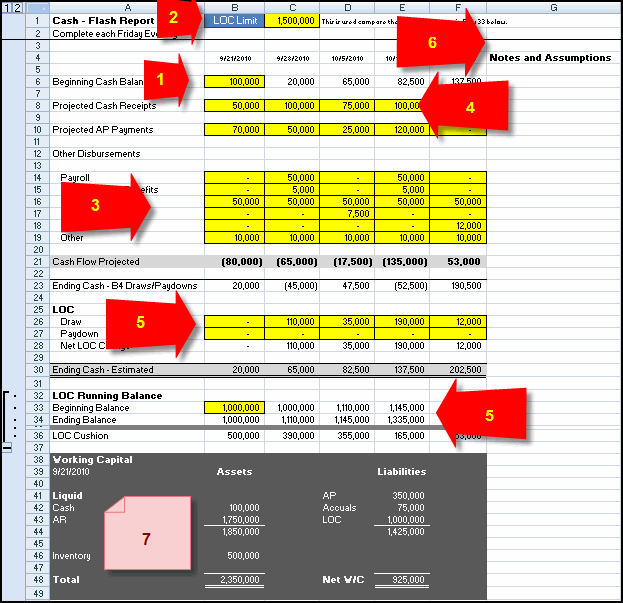

The Basic Elements of a Cash Projection Model

1. Start with a clean beginning cash number. Reconcile cash daily, no exceptions. Then start

with that clean number.

2. Enter your LOC limit which is required in the analysis deeper in the model (see image below).

I love the financial term called cushion. As we project cash, we want plenty of cushion between

the projected LOC balance and your LOC limit.

3. Enter your projected cash outlays–the big guys. Forget the little stuff. Your big numbers are inventory purchases, payroll, rent, and other regular ongoing payments.

4. Enter cash receipts–this can be harder if your receipts are irregular. Guess, and be

conservative. Do this weekly, and you’ll get better at it.

5. Now start entering projected draws and pay downs based on your projected cash flow. I

used to make this a calculated number, but I quit doing it for strategic reasons. I wanted

owners and their accountants to real y think through the process by doing the LOC math

manually. Then, look at the LOC results which fol ow.

6. I’m big on documentation. Ask my buddies. They’ll confirm I’m anal on documentation. So

have an area to list your assumptions. Your projections are only as good as your assumptions.

7. Finally, have a summary section showing the big picture. There are scores of ways to this.

Bottom line, the CEO should determine what he/she wants in the summary section.

I recommend doing this activity weekly in either 5, 9 or 13-week increments. There is no right

or wrong time period. But here’s a good rule of thumb. Bigger cash flow problems should

equal a longer time horizon. So if you are always living week to week, consider a 13-week

rolling forecast (and fix the causes of your problems too).

Copyright © 2012 B2B CFO® 11

The Ultimate Small Business Playbook

Finally, your cash projection tool needs to be actionable. Serious problems should lead to a

smal handful of activities that need to be carried out (for example, calling past-dues ASAP or

asking select vendors for an extra ten days).

Copyright © 2012 B2B CFO® 12

The Ultimate Small Business Playbook

Articles By David Kirkup

How to break out of your business plateau

Entrepreneurs often hit plateaus as their business transitions from the startup phase into the

next growth phase. It might be that sales growth is stal ed, or that more and more procedural

tasks seem to pile up. It might that the business owner is starting to feel a little burned out.

But plateaus can offer a good opportunity for improvement. Here are several steps help you

push through to the next level:

Find experts

You can find experts in every field or industry where you might need help. There are experts in

every field, industry, hobby or any area you need help with. Seeking advice from others, who

have been there, may help find a short cut.

Ramp up your reading

The web offers a huge window on knowledge and research via Google will often locate a fire

hose of good information. Find PowerPoint’s to jump start your own presentation, solutions

you have not thought of, ideas to take to the bank. Read a good business book, in fact, read a

good business book or journal at least every month.

Network with Peers

Find someone on LinkedIn in a similar but non competing role and network. Build an Advisory

Board of like-minded professionals to share information and ideas.

Brainstorm new Ideas

Spend some time brainstorming new ideas to implement. Break out of the rut and do some in-

depth thinking about tasks, procedures, objectives.

Work Harder

Force yourself to do the things you have been putting off. De-clutter. Clearing your desk may

make you feel refreshed and ready for a new chal enge.

Copyright © 2012 B2B CFO® 13

The Ultimate Small Business Playbook

Work Smarter

Sometimes, working harder isn’t the solution, but working smarter is. Try focusing on #1

priorities for longer periods of time, and refuse to allow the #2s and #3s to intrude for a while.

Work these productivity stretches into your daily timetable.

Look at Your Productivity

How much are things like email, social media and consistent interruptions impacting your day?

If distraction is adding to your inability to get past the plateau, work on a plan to eliminate or

reduce it. A simple change, such as checking email and social media sites just a few times a day,

can be just what you need to get past a plateau.

Cal In Reinforcements

We all need a little help from time to time. If your plateau is caused by simply too much on your

plate, get rid of something. As an Entrepreneur you are – or should be – the Finder. If you’re

not finding new business and improving customer relationships then you’re failing. Partner up

with trusted advisors – like a B2BCFO to make your workload more manageable.

Personal Branding – Taking Control

In a 1997 Fast Company article, management guru Tom Peters is credited with inventing the

term Personal Brand. Peters said, “Regardless of age, regardless of position, regardless of the

business we happen to be in, al of us need to understand the importance of branding. We are

CEOs of our own companies: Me Inc. To be in business today, our most important job is to be

head marketer for the brand called You.

It’s that simple — and that hard. And that inescapable.”

So how do you build your Personal Brand in the age of Social Media? Is it time to get on

LinkedIn? Some would say that if you’re not already LinkedIn, Facebooked, Tweeted and

Digged then you don’t exist – brand-wise, that is.

British branding coach, Lesley Everett (author of Walking TALL) describes a Personal Brand as being just like a corporate or product brand. It’s how you make others feel about you, what

people say about you, and the words they use to describe you. If it’s that important, then

constant Brand Management is obviously going to be necessary.

Copyright © 2012 B2B CFO® 14

The Ultimate Small Business Playbook

Everett has several key steps to build that brand including:

1. Who you really are – Getting feedback from others on how they see you is a good

beginning. Ask others for three words to describe you. This collection of perceptions from

others is your brand. Is it working?

2. The First Seven Seconds – that’s al it takes for others to judge us. People make snap

decisions based on what you look like, what you sound like and what you say.

3. Dress like you mean it – style, dress and grooming are important components of your

brand. Are you presenting yourself in a way that invites trust and credibility? Do you smile

and have a good handshake with positive eye contact.

4. Consistency – this is key since the consumer experience has to be repeatable in order to

build value.

While much of this may sound like Etiquette 101, it’s certainly true that each of us has the

capacity to control our external image, and that image is part of the reason that others will do

business with us.

Two Numbers that Every Business Owner needs to know.

There are real y only two numbers you need to track in your business. You should know your

Current Business Value and your Potential Business Value. Together these numbers can help

you improve your earnings, build your retirement fund and ensure you have a successful Exit

strategy. In a typical business the Potential Business Value can be two or three times the

Current Business Value. We call that ratio the Business Value Improvement Index™ (BVI

Index™), and your long term goal is to equate Current and Potential Business Value and get a

BVI index of around 1.0.

The BVI Index™ promises to reinvent the way companies are sold by focusing on benchmarking

the Market Readiness of a company. Many companies are undervalued due to sub-par

financial management, poor operational strategies or poor execution of planning, and these

gaps can lead to significantly unrealized value and earnings.

So…what exactly is Potential Business Value? It’s the unrealized value and earnings that could

be achieved by systematic focus on business process improvement. By using more

sophisticated financial management, and by creating a detailed plan you can determine how

much of your Potential is achievable and over what time. It is possible to take any promising

business and identify the factors that will drive increased business value.

Copyright © 2012 B2B CFO® 15

The Ultimate Small Business Playbook

The first step in understanding your company’s Potential Value is to review your financial

information, your core strategies, the strengths of your staff and the ability of the company to

perform to plan. You are looking to benchmark your current situation. You need to answer the

question: where are you now? And, more importantly, what is the potential value of your

business? Business buyers wil fight to acquire companies that can demonstrate consistency,

solid management, good process and strong profitability. If you can document the strengths

and weaknesses of your company you wil start to find ways in which your business value can

be improved.

Once you have identified areas of improvement and gained an idea of the potential locked in

your business, you should lay out a financial strategy for improvement. Is it possible for your

business to go beyond its current business goals? What kind of investments will you need to

make and what resources might you need to bring on? And what would be the return on

investment of doing that? How can you improve profitability, better manage cash flow and

improve internal processes. Most important, how can you – the owner – start to disengage

from the minding activities that have you working 18 hour days, and that, frankly, unless

corrected will cause any serious buyers to pass on your company in the future. You are laying

out the process to achieve your retirement goals.

The end game is to create a company with increased business value and better marketability.

It’s now time to help the company create a leadership position in their market. How can you

identify and implement business growth strategies to surpass, outclass and outrival your

competitors – resulting in profit maximization and continued business value growth. With a

focus on market prominence you can now start to attract the attention of strategic buyers

willing to pay a premium for a company like yours.

Whether a business owner uses the powerful data from a BVI Index™ analysis to build company

value over time, or to negotiate with a buyer to get a better offer today, the benefits are

substantial. This process can show you how to dramatically increase current earnings and as

much as double or triple the value in your company. Hiring an as-needed CFO to guide you is

the first step.

B2B CFO® , the world’s largest CFO firm, can be your partner and help guide you through the

Business Value Improvement process and the Exit Strategy process using techniques and

resources unique to our firm.

The terms “BVI Index™“, “Market Readiness” and “Potential Value” are all terms owned by BVIresources Group. Use of the BVI Index™ and associated tools and Programs are authorized

Copyright © 2012 B2B CFO® 16

The Ultimate Small Business Playbook

under a BVI-PM User licensing agreement by Nixon Childs, President, BVIresources Group. More

information can be found at www.bviresourcesgroup.com

Business Predictions for 2020

Long range predictions are really quite easy. Rarely does anyone check up on you in ten years,

and most of what you predict wil not happen. Futurologists always predict the emergence of

“space city” and what we actually get are cars that do two more miles per gallon. But it’s

necessary for a serious blogger to make predictions in order to add to one’s gravitas. So here

we go…

1. Solar energy development will exponentially grow, according to futurist Ray Kurzweil. Solar

Power capacity is now doubling every year to the point that we wil be energy independent

within 10 to 15 years. This should take care of Global Warming, clean water, and food

shortages.

2. Middle East democracy will continue to spread in fits and starts. Iraq will stabilize and

flourish, Afghanistan will regain the peace and prosperity it enjoyed for nearly three centuries

prior to the Soviet invasion. Tourism, improbably, will flourish as aging boomers once again hit

the hippie trail to Kabul – this time riding Harleys (three wheelers).

3. Audiovisual communication will become much more personal. Audio and video will be used

as routinely for personal communication as text or images, requiring audiovisual production to

become part of the school curriculum and a standard skill in the workplace. Better look into

Video Blogging – your LinkedIn profile with ten connections is not going to cut it.

4. Smart phone technology will continue to grow rapidly, and shrink dramatically. Look soon for

implantable devices that will reside on the eye. These upgrades will give you a number of

options for visible information, flipping from thermal to night vision and back to ‘standard’

easily, as well as allowing for augmented reality (a scientific term for 24/7 advertising). The

technology will be known as I-Glasses.

5. Women’s fashions wil enjoy tremendous growth due to the continuous development of

robotic manufacturing technology, which will allow for almost daily complete changes in

fashion wardrobe featuring lots of silver metallic fabrics. Dramatic changes in men’s fashions

will result in business suits with 1/2” wider lapels.

Copyright © 2012 B2B CFO® 17

The Ultimate Small Business Playbook

6. Enhanced Reality will create a new way of seeing and interacting with the world. Social

networking applications will benefit from apps that will give you personal data ‘tags’ appearing

over participating users. That way, as you stroll down the street, you may see someone who is

also logged in and above them will be such ‘tweets’ as: “Going out for d