1.1 Key statistics

Banks

According to the Central Bank, in April 2014, there were 841 active banks in Russia working through 45,268 branches.7 The number of bank branches increased by 3.7 percent in two years since the CGAP Financial Inclusion Landscaping study (Lyman, Staschen, and Tomilova 2013). The banking sector in Russia also includes so-called nonbank credit organizations (NBCOs), which are essentially banks with a limited banking license; these can perform various banking operations except retail deposit taking.

According to the IMF Financial Access Survey, there were 38.22 bank branches per 100,000 adults in 2012, and 182 automated teller machines (ATMs).8 This puts Russia ahead of some highly developed countries. For example, in 2012, Germany had 13.9 bank branches per 100,000 adults, and the United States had 35.26 bank branches per 100,000 adults. At the same time, there are only 2.83 bank branches and 13.49 ATMs per 1,000 sq. km in Russia — which is about 4–5 times less than in countries comparable in size, such as China and the United States.

Among the top 10 banks in Russia by net assets size, the top six are banks with state ownership.9 The largest one — Sberbank — has the widest branch infrastructure (about 18,500 branches)10 and holds 46.7 percent of all retail deposits volume in the country as of January 2014, according to the Central Bank.

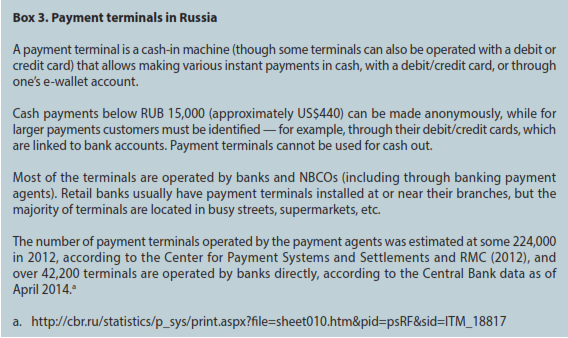

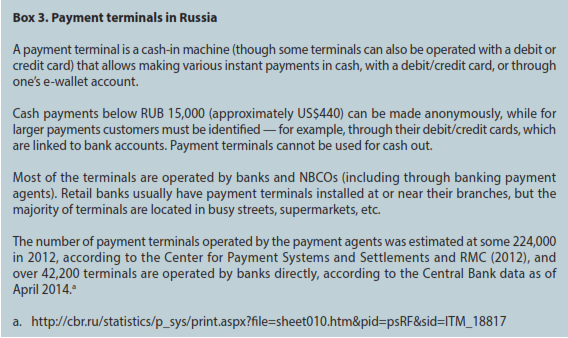

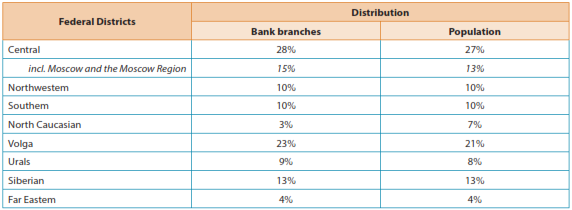

As shown in Table 1, the distribution of bank branches across Russia generally follows the distribution of the population. The North Caucasian FD is the region with the least sufficient infrastructure, which is reflected in the usage figures, as will be discussed further in Chapter 2. The Central FD, and especially Moscow, is better supplied in terms of physical access infrastructure.

Banks are the only financial service providers in Russia authorized to take retail deposits, which are protected by the state Deposit Insurance Scheme up to RUB 700,000 (approximately US$20,600) per depositor, per each bank.11 Some of the nonbank financial service providers can offer limited deposit-like products that are not protected by the deposit insurance scheme (see below).

Table 1. Distribution of bank branches by region, April 2014

Source: Central Bank of the Russian Federation: http://cbr.ru/statistics/print.aspx?file=bank_system/cr_inst_branch_010414.htm&pid=pdko_sub&sid=sprav_cdko

Other providers

Other providers of financial services in Russia include the following:12

-

The Russian Post: This is a state-owned organization that has the largest number of branches Russia-wide — about 42,000 (almost the same as the number of branches for the whole banking system). It administers the disbursement of pensions and provides a number of financial services in cooperation with other financial service providers — such as payments, domestic and international money transfers, loan repayments, bank account top-ups, etc. It also sells insurance policies and credit cards acting as an agent of several financial service providers.13

-

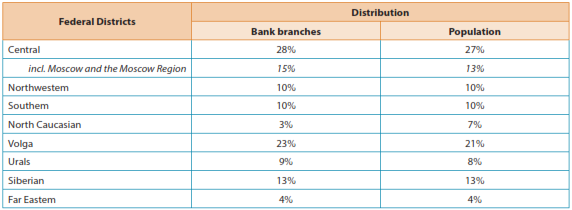

Banking payment agents: These include various retail networks, of which the most numerous are mobile phone shops and supermarkets. The agents can provide only cash-in services, most of which are payments. In 2012, there were over 12,000 banking agents serving customers through some 319,000 service points (CRPSS and RMC 2012). Approximately 70 percent of the service points were equipped with automated payment terminals — a specific Russian branchless banking innovation (see Box 3).

-

Microfinance organizations (MFOs): As of mid-2014 there were 4,294 MFOs registered in Russia since January 2011,14 when the Law on Microfinance Activity and Microfinance Organizations came into force.

Microloans are defined as loans up to RUB 1 million (approximately US$29,400) and can be offered both for business and consumption. In 2013, MFOs were collectively serving some 950,000 borrowers, of which about 900,000 were consumer loan recipients.15 The latter include so-called payday loans. Although there is no legal definition16 for payday lending in Russia, these companies offer very high interest, very short term consumer loans, and are thus similar to payday lenders in other countries;17 however, other than the name would suggest, in most cases the lending is not secured with borrowers’ salaries. In the absence of a formal definition, the exact extent of payday lending currently cannot be established.18

MFOs cannot take deposits, but can take loans from natural persons in amounts exceeding RUB 1.5 million (approximately US$44,100), that is, from more sophisticated lenders. Starting 1 July 2014, they can also issue bonds in amounts less than RUB 1.5 million, but only to qualified investors as defined in the law.19

-

Credit cooperatives: According to the Central Bank, in 2014, there were 3,494 credit cooperatives in Russia; in 2013, they were serving about 1.1 million people. Credit cooperatives can provide lending and savings services, but only to their members. Most credit cooperatives work in areas that are less covered by bank branches. MFOs and credit cooperatives are often collectively referred to as “microfinance institutions” as both provide microloans.

-

Insurance companies: As of July 2014, there were 587 insurance companies registered in Russia.20 In 2013, the top 10 insurance companies had about 57 percent of the market, while the top 50 had 87 percent.21

-

Mobile network operators: There are four large mobile network operators in Russia, together they control 92 percent of the Russian market (Dostov and Shoust 2013). All of them offer a facility to make payments from the prepaid airtime account. To offer such services, they must operate in partnership with either a bank or an NBCO.22

-

E-money operators: As of February 2014, there were 82 authorized e-money operators in Russia (64 banks and 18 NBCOs).23 To use their services offered through internet-based e-wallets, customers must be identified if the balance of their e-wallet exceeds RUB 15,000 (approximately US$440) or monthly transaction volume exceeds RUB 40,000 (approximately US$1,176); otherwise e-wallets can be anonymous.

-

Mutual funds: There are 2,806 mutual funds registered in Russia in 2014.24 Of them, 20 percent control about 80 percent of the market.25 These financial service providers are the least known and the least used by Russians, as will be discussed further in Chapter 2.

Except for the Russian Post, payment agents, and mobile network operators, all of the above nonbank providers in Russia were regulated and supervised by the Central Bank starting September 2013.26

Regarding physical access for financial services in Russia, it should be noted that Russia has a very sparse infrastructure of point-of-sale (POS) terminals at retail outlets as compared to other countries. In 2012, there were only 4.8 POS terminals per 1,000 residents versus 18.7 POS terminals per 1,000 residents in the European Union. The highest share of retail outlets accepting cards was in the town of Surgut (home to one of the largest oil and gas companies) with 26.5 percent. In Moscow, only 16.4 percent retail outlets accepted cards in 2012.27 Relative to the number of cards, experts estimate that the number of POS terminals in Russia is two times lower than that in developed countries.28