UNDERSTANDING THE FINANCIAL STATEMENTS OF A COMPANY

Most of the companies are interested in providing their existing and potential investors with actual information on its performance and financial position. This is commonly being done through a complex report on firm’s activities and financial condition over the year called annual report. Usually, it is being issued to company’s stockholders and creditors after the end of a fiscal year. Different regulatory organizations also are the users of the annual report analysis.

Typically company’s annual report consists of the introduction section, balance sheet, profit and loss report, cash flow statement and notes to the financial statements. Sometimes it also includes some other components, such as chairperson’s statement, director’s report or auditors’ report.

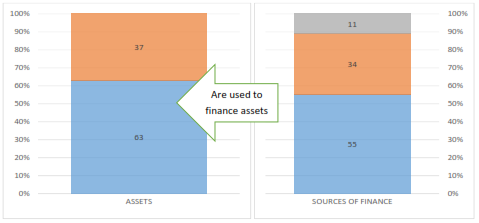

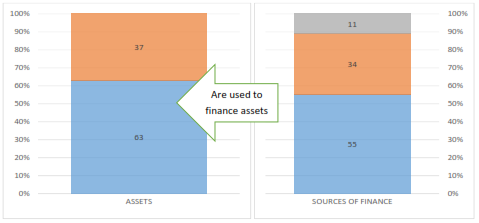

Chart 1. Assets and sources of finance

Balance sheet is one of the most important statements of a company. Also referred a statement of financial position, it contains information about company’s total assets, liabilities and shareholders’ equity as of the date stated. The information from the balance sheet is commonly used for performing the analysis of company’s liquidity, financial sustainability and other indicators. Main information indicating firm’s financial condition as of the date stated can be found in its balance sheet. It summarizes company’s debts and assets, and the stockholders’ equity. Actually, whole balance sheet is based on one simple equation:

Assets = Source of Finance (Liabilities + Stockholders’ Equity)

As creditors’ and company owners’ funds are two main sources of financing company’s assets, at any time firm’s assets must equal the sum of its liabilities and equity.

Assets are the resources of a company, including physical resources, such as buildings, materials, equipment, etc.; and also intangible, such as trademarks, or patents. Normally, assets are categorized into current (also referred as short-term) and noncurrent (long-term).

Current are assets, which can by expectations be converted to cash within one operating cycle (or year). Often their listing in the balance sheet is being made in order of their liquidity. They include:

1. Cash (and its equivalents). This is an asset with the highest liquidity. Treasury bills, bank deposits and other money market instruments are also included to this entry of the statement of financial position.

2. Accounts Receivable. This entry summarizes the amount of money, which a company has a right to receive for providing its customers with goods or services. The amount reflected commonly only includes the amount of money that is expected to be collected. Long overdue or uncollectible accounts are not shown in this entry of the balance sheet.

3. Inventories. Inventories include materials for production, work-in-progress products and ready products that the company is planning to sell in future. Supplies like pencils, envelopes, folders are also included to inventories.

4. Marketable Securities. This is the entry, where short-term investments with a very high level of liquidity are listed. The reason for holding marketable securities for a firm is earning a return on near-cash resources.

5. Other current assets. All other assets, convertible into cash within a business cycle, or a year (prepaids, etc.).

Noncurrent are assets, which take longer than an operating cycle to be converted to cash and they include:

1. Buildings and equipment. This type of assets is also classified, as fixed assets. They include buildings, land, machinery, constructions in progress and all the other tangible assets, which are owned by a company and being used in goods or services production process from one business cycle to another.

2. Intangible Assets. This is a type of noncurrent assets in company’s ownership that aren’t in physical form and their conversion to cash takes longer than a business cycle (or year). These assets include patents, copyrights, trademarks, licensing agreements, franchises and others.

3. Long-Term Investments. These are such kind of investments, as bond or preferred stock, which are made for a period over 10 years. The main difference between them and short-term investments is liquidity level. While short-term investments are relatively easily convertible to cash, long-term investments are difficult to sell.

4. Other noncurrent assets. Liabilities are reflected in company’s balance sheet obligations to provide goods or services, or transfer assets to other firms. Being a result of the past transactions, firm’s liabilities are also divided into current liabilities and long-term liabilities.

Current liabilities are obligations due within one business cycle (or year). The liquidation of current liabilities most likely would require the use of company’s current assets, or creating other current liabilities by involving some short-term loans. Following items are included:

1. Accounts Payable. These are accounts, which were created by the acquisition of some goods or services and should be paid by a company in the near time.

2. Unearned Income. Unearned income includes money received in advance of selling a good or providing a service.

3. Other current liabilities.

Long-term liabilities are obligations due in a period more than a year, or alternatively, more than a business cycle. Balance sheet includes such kinds of long-term liabilities, as notes payable, bonds payable, capital lease obligations, postretirement benefit obligations, etc. Normally, they are classified as liabilities relating to financing agreements and operational obligations:

1. Financial agreements relating liabilities. This kind of liabilities include notes payable, bonds payable, credit agreements. These obligations most commonly require making regular payments of interest.

2. Operational obligations relating liabilities. These are obligations, connected with the operational activity of a firm. Most common kinds of operational obligations relating liabilities are pension obligations, deferred taxes, service warranties, etc.

Stockholders’ equity (also very often being referred as net worth, or shareholders’ equity) is an amount, representing shareholders’ interest in firm’s net assets. In other words, it shows the amount of money, by which a firm is being financed through the common and preferred stock. By applying some minor changes to the basic balance sheet equation we receive a formula for stockholders’ equity computation:

Stockholders’ Equity = Total Assets – Total Liabilities

There are two main sources of shareholders’ equity. First is the paid-in capital, which includes all the investments into company that have been made, originally at the very beginning and additionally thereafter. Retained earnings are the second source of the shareholders’ equity, and they include all the earnings, that the company has been able to accumulate through its operations.

Paid-in capital is the total amount of money that has been invested into company during the issuances of common or preferred stock. While common stock represents ownership, having the rights of voting and liquidation, preferred stock usually do not have such rights. Main important decisions on the company, including electing the board of directors, are usually being made by the holders of common stock.

Paid-in capital may also include donated capital. It includes donations from stockholders, creditors and other parties.

Retained earnings represent that part of net earnings, that aren’t being distributed by a company between the investors as dividends, but are being reinvested into business again, or into debts pay off. The formula for retained earnings calculation is as follows:

Retained Earnings = Beginning Retained Earnings + Net Income – Dividends

All the necessary information for calculation is available in company’s balance sheet. Negative net income (net loss) would mean negative retained earnings.

Profit and loss report (often referred as P&L report, income statement, or statement of operations) is one of the primary reports in the system of enterprise accounting, which plays an important role in the financial statement analysis. It contains summarized information about firm’s revenues and expenses over the reporting period. Most common are income statements that contain the quarterly and yearly information. The goal of the statement of income is to measure the profit of a business over the reporting period by excluding the expenses of a firm from its revenues.

The general form of P&L report starts with the revenue entry, from which the operative expense, salary, depreciation expense interest expense and other expenses are being subtracted to compute the net earnings in the end. The net earnings are presented as an absolute value, and also as the division of net earnings by the number of shares outstanding (earnings per share). Both horizontal and vertical analysis can be applied to the income statement; as the P&L report most commonly contains quarterly information, the ratios calculated can be analyzed in dynamics over some time and for some certain reporting period.

Basic elements of the profit and loss report are:

1. Revenue (Net Sales). This entry represents the value of goods or services a company has sold to its customers. Commonly sales are presented net of different discounts, returns, etc.

2. Cost of Goods Sold. This element measures the total amount of expenses, related to the product creation process, including the cost of materials, labor, etc. Costs of goods sold include direct costs and overhead costs. Direct costs (materials; parts of product purchased for its construction; items, purchased for resale; labor costs; shipping costs, etc.) are the expenses that can be actually associated with the object and its production. Overhead costs (labor costs, equipment costs, rent costs, etc.) are the expenses that are related to the business running process, but cannot be directly associated with the particular object of production.

3. Gross Profit. Gross profit is net revenue excluding costs of goods sold.

4. Operating Expenses. Operating expenses include selling and administrative expenses.

Selling are the expenses, which relate to the process of generating sales by a company, including miscellaneous advertisement expenses, sales commission, etc. All the expenses connected with company’s operation administration, such as salaries of the office employees, insurance, etc., refer to the administrative expenses.

5. Operating Income. Operating income is gross profit excluding operating expenses.

6. Other income or expense. This entry contains all the other income or expense values, which weren’t included to any of the previous entries. It may be dividends, interest income, interest expense, net losses on derivatives, etc.

7. Income Before Income Taxes. Income before income taxes is operating income including (or excluding) other income or expense.

8. Income Taxes. This entry includes all state and local taxes, which are based on the reported profit of an enterprise.

9. Net Income. Net income is the amount of money remaining after taking the net sales of a business and excluding all the expenses, taxes depreciation and other costs. In other words, this entry reflects the basic goal of an enterprise functioning – its profit. It is also often referred as net profit or net earnings. Following the net income in the profit and loss report is a very important part of the company’s financial report analysis.

10. Earnings Per Share. This entry is often included at the end of P&L report. It reflects the net profit as its division by the total number of shares outstanding. The result is the amount of net profit, earned by one share of common stock. This measurement can be useful for the risk management of a stockholder.

Another primary statement of an enterprise is the statement of cash flows. Since cash is being one of the most important and liquid assets, all the managers, shareholders and analysts are interested in closely following firm’s cash balances. This statement reports all transactions that affect the cash flow of a firm, including the most liquid assets. All the inflows and outflows are being separated into different groups, which relate to operating activities, investing activities and financing activities.

Cash flow statement is also a basis for different ratios calculation. For a long time analysts used mainly the information from the balance sheet and income statement for the financial ratios calculation, but during few last decades the statement of cash flow has become an object of their close attention too. Most of the financial ratios, based on the cash flow statement information, detect the ability of the operating cash flow to cover company’s debt, cash dividends, etc. Most commonly calculated are operating cash flow to total debt, operating cash flow per share, operating cash flow to cash dividends ratios.

All things considered, the annual report analysis can provide its user with a complete vision of company’s performance and position. By analyzing different components of firm’s annual report one can make conclusions on its liquidity, financial sustainability, debt-paying ability and other characteristics.