25, 1949 regarding Morgan’s possible role in spreading rumors about the insolvency of the Knickerbocker Bank and The

Trust Company of America - rumors which might have triggered the 1907 panic.

In answer to the question: “Did Morgan precipitate the panic?” Allen reports:

“Oakleigh Thorne, the president of that particular trust company, testified later before a Congressional Committee that his

bank had been subjected to only moderate withdrawals...that he had not applied for help, and that it was the [Morgan’s]

‘sore point’ statement alone that had caused the run on his bank. From this testimony, plus the disciplinary measures

taken by the Clearing House against the Heinze, Morse and Thomas banks, plus other fragments of supposedly pertinent

evidence, certain chroniclers have arrived at the ingenious conclusion that the Morgan interests took advantage of the un-

settled conditions during the autumn of 1907 to precipitate the panic, guiding it shrewdly as it progressed so that it would

kill off rival banks and consolidate the preeminence of the banks within the Morgan orbit.” 3

*Note: It is a common misinterpretation with regard to “Zeitgeist: The Movie” that the Panics described were directly and

solely caused by the acts of a few individuals/groups. This is not what is being expressed. The fact is, panics and banking

failures are natural occurrences in the Fractional Reserve - ‘Expansion/Contraction” money system we have. Panics, or

severe economic contractions, can be seen as inevitable in the current model for, again, no economy can “grow” forever.

Periodic contraction, whether small or large, will continue to occur. The point being made in Zeitgeist: The Movie, howev-

er, is that these events can be “anticipated” by those inside the system- (i.e. Bankers/”Money Trust”) - and hence triggered

and controlled with the intent of personal gain and/or power/wealth consolidation.

As will be explored with regard to the Panic of 1907, evidence shows that JP Morgan and his associates, while seeing a

possible contraction coming, took control of the situation and guided the events so assure their benefit.

1

http://query.nytimes.com/mem/archive-free/pdf?res=9904E5DB1531E233A25751C2A96E9C946096D6CF

2

Charles Lindbergh, “Banking and currency and the money trust, p.87-90

3

Frederick Lewis Allen, Life Magazine of April 25, 1949 [ LINK: http://books.google.com/books?id=IE4EAAAAMBAJ&pg=PA126

&lpg=PA126&dq=the+president+of+that+particular+trust++++++company,+++testified+++later++before+++a+++congressional++++++c

ommittee++that++his++bank+had+been++subjected++to++only++++++moderate+withdrawals&source=bl&ots=AvgkSaVDJ3&sig=H

OF5ZZ08WWyxLPRKsr9KulTFbfA&hl=en&ei=8TnoS7-aI8G88gamoKHwDA&sa=X&oi=book_result&ct=result&resnum=7&ved=0CC

0Q6AEwBg#v=onepage&q=the%20president%20of%20that%20particular%20trust%20%20%20%20%20%20company%2C%20%20

%20testified%20%20%20later%20%20before%20%20%20a%20%20%20congressional%20%20%20%20%20%20committee%20%20

that%20%20his%20%20bank%20had%20been%20%20subjected%20%20to%20%20only%20%20%20%20%20%20moderate%20

withdrawals&f=false ]

Regarding the Events:

Since the “Panic of 1907” occurred, economists, politicians and historians have expressed a vast number of possible

causes/combination of causes. It appears the most commonly cited ‘text book’ cause denoted is Otto/F. Augustus Hei-

nze’s failed attempt to corner the market for copper stock, and this led to a chain reaction of instability due to financing

associated with the Knickerbocker Trust, in part. 1

Others view the overall economic climate/liquidity issues at the time as a cause, while still others related it to stock market

speculation patterns. Economist Fred E. Foldvary provides a summery of his view:

“The main cause of the crash was stock market and real estate speculation. Also contributing were attempted company

takeovers and the San Francisco earthquake of 1906. Much of the real estate of San Francisco was insured by com-

panies in London. Payouts to San Francisco drained money from the U.K., which raised interest rates there and in the

U.S. But interest rates mostly rose due to borrowing for speculation, and the high rates and real estate prices then halted

investment in capital goods. The U.S. stock market crashed on March 14, 1907 and then again after a failed attempt on

October 16, 1907, of a scheme to corner the stock of the United Copper Company, which highlighted the close connec-

tions then among banks, trusts, and brokers. The panic began on October 18, 1907, following the collapse of United Cop-

per share prices. On October 21, there was a run on the large Knickerbocker Trust Company, which then shut down.” 2

While there is support for all of these issues, what is missing from the analysis is how these economic issues actually trig-

gered the Panic itself, which started with Banks Runs on some of the Trusts. What triggered the Runs? It is important to

note that Bank Runs themselves are always initially caused by public fear. There is no systemic chain reaction within the

system itself that leads to bank runs as an inevitable consequence. It is the psychology of fear that causes people to act

in such a manner. Regardless of the existing problems in an economy or such possible destabilizing events as denoted in

the above description by Foldvary, these events are still detached from the trigger itself.

Ellis W. Tallman and Jon R. Moen in their work “Lessons from the Panic of 1907” point out this causal reality:

“How does a financial crisis begin? What prompts a panic? Most answers suggest that financial calamities result from an

unusual combination of economic conditions and events. In the case of the 1907 Panic the collapse of F. Augustus Hei-

nze’s attempt to corner the market for copper stock apparently triggered the chain of events, but informed observers agree

that the same developments probably would not have led to a panic in a more benign economic environment. ” 3

So, while we understand the relevance of the state of affairs overall and the problems occurring, we are still missing the

link that sparked the public perception to make such a dramatic, mass Bank Run on some of the Trusts. It is here where

the speculation of Senator Robert Owen, Charles A Lindbergh Sr. resides with regard to the possibility that JP Morgan

and the “Money Trust”, aware of the pending instability, chose to trigger the event/shakeout by spreading rumors about

certain Trusts’ insolvency/distress and hence guiding the events so it would work out to their advantage.

In a review/summery of the book “The Panic of 1907: Lessons Learned from the Market’s Perfect Storm,” investor Clif

Droke expresses how the Trust companies where rivals of the traditional banking establishments and how JP Morgan

viewed them as “upstart competitors”:

“One prominent institution in the 1907 Panic was the Knickerbocker Trust of New York. Headed by the colorful Charles

Barney, the financial institution was one of the largest and most successful trust companies in the country and was the

third largest trust in New York City, with nearly 18,000 depositors.

Trust companies engaged in most of the functions of both common and private banks, including making loans, industry

consolidation and underwriting, and distribution of new securities... Trusts were a hot commodity at the turn of the last

century, attracting investment funds from countless Americans of all walks of life. They also attracted scorn from the con-

ventional banking community. America’s leading financier at that time, J.P. Morgan, was particularly critical of the invest-

ment trusts and viewed them as upstart competitors to his banking interests. ” 4

This is an important point to consider when analyzing the events of the 1907 Panic.

1

http://en.wikipedia.org/wiki/Panic_of_1907#Cornering_copper

2

http://www.progress.org/2007/fold505.htm

3

http://www.google.com/url?sa=t&source=web&cd=1&ved=0CBIQFjAA&url=http%3A%2F%2Ffraser.stlouisfed.

org%2Fdocs%2Fmeltzer%2Ftalles90.pdf&ei=ktYsTNrOFcP68Abhl-WNDQ&usg=AFQjCNHn0zMSq-H2k0kTodUf-Cz4XqTNrg

4

http://www.financialsense.com/editorials/droke/2010/0122.html

Biographer Frederick Lewis Allen further details the attitude of J.P. Morgan in a similar regard:

“Morgan seemed to feel that the business machinery of America should be honestly and decently managed by a few of

the best people, people like his friends and associates... When he put his resources behind a company, he expected to

stay with it; this, he felt, was how a gentleman behaved….That Morgan was a mighty force for decent finance is unques-

tionable. But so also is the fact that he was a mighty force working toward the concentration into a few hands of authority

over more and more of American business. ” 1

Now, J.P. Morgan’s character/general intents aside, Clif Droke writes also about the occurrence of the infamous “rumors”

occurring around the subject of instability of the Trusts, including the Knickerbocker bank, and the effect it had to trigger

the panic:

“Morgan’s antipathy toward “speculative gangs” and to trusts in general was brought to the fore when rumors started

swirling over the solvency of the Knickerbocker Trust. The rumors concerning the solvency of the Knickerbocker were less

a question of the firm’s standing in the New York financial community than a question of the Trust’s president, Charles

Barney, who was believe to have connections to a failed corner on the stock of United Copper by August Heinze and

Charles Morse. The connection between Heinze, Morse and Barney, however tenuous, was all that the increasingly jittery

public needed to hear. Before long depositors in the Knickerbocker Trust began withdrawing funds and from there the

public’s fears of the Trust’s solvency spread to other financial institutions in New York. It led to a full-scale banking panic

that swept the country.” 2

The panic itself as it related to the Knickerbocker Trust was “triggered”, it appears, not by the internal financial integrity of

the institutions itself, but rather by the publicly expressed association of Charles Barney, the head of the Knickerbocker

Trust, and United Copper.

Sean Carr, one of the coauthors of ‘The Panic of 1907: Lessons Learned from the Market’s Perfect Storm’, had this to say

in an interview with Registered Rep:

RR: “And that implicated others, right, including the head of a trust company? People got scared?”

Carr: “Yes, it was because Charles Barney, the head of the Knickerbocker Trust, along with other trust companies, funded

the mining company venture. Barney’s mere association with Augustus Heinze had panicked the trust company’s thou-

sands of depositors. It created a run, and the Knickerbocker Trust failed. Two weeks after the crisis was resolved, Barney

killed himself.” 3

Charles Barney, the president of the Knickerbocker Bank requested a meeting with J.P. Morgan to discuss financial assis-

tance for the bank, but was rejected. Because of this and the failure of the bank, he shot himself on November 14, 1907.

For further clarification of the positive financial integrity of the Trusts in general, a January 18, 1907 New York Times

article detailed the positive financial status and the high profitability of the majority of these institutions and the sector as a

whole.4

Droke expands on this point as well, specifically regarding the Knickerbocker Trust, while also bringing up the common

speculation with regard to JP Morgan’s vested interests:

“A classic bank run was soon underway and the Knickerbocker was to be among the first casualties of the developing cri-

sis. As Bruner and Carr observe, “Despite the assurances of the financiers…the day before, the officials of Knickerbocker

said that no money was forthcoming when needed.” J.P. Morgan needed a high-profile victim for his plans to revolutionize

the U.S. financial system and economy and he had one in the Knickerbocker Trust.

According to Bruner and Carr, the Morgan team concluded that the Knickerbocker wasn’t solvent after a review of the

company’s accounts. Yet a state banking examiner who had reviewed the Knickerbocker’s accounts as recently as two

weeks before the crisis had determined that the institution had sufficient funds to pay its depositors. The evidence points

to the fact that the Knickerbocker was set up to fail by Morgan. ” 5

Now - where are the rumors themselves? Public expression of these rumors are firmly denoted in the press history related

to the 1907 Panic.

For example, the Heinze Butte Bank, the bank of F. Augustus Heinze who was involved in the aforementioned event

1

http://www.financialsense.com/editorials/droke/2010/0122.html

2

http://www.financialsense.com/editorials/droke/2010/0122.html

3

http://registeredrep.com/investing/altinvestments/alan_greenspan_market/

4

http://query.nytimes.com/gst/abstract.html?res=9E04E2D9153EE033A2575BC1A9679C946697D6CF&scp=1&sq=knickerbock

er+trust&st=p

5

http://www.financialsense.com/editorials/droke/2010/0122.html

regarding a failed copper corner which is said to have been a cause of the Panic, shut down on Oct. 17th, 1907.

In an Oct. 18th 1907 New York Times report, a reprint of the ‘Notice’ which was posted on the bank’s door reads:

“Because of unsettled conditions and rumors that cannot be verified that many cause unusual and excessive demands by

depositors. ...the management had deem it advisable ...to suspend for the time being. The Bank is solvent.” 1

A NY Times article of Oct. 23rd 1907 confirms the instance of “rumors” as the cause of the Bank Runs. It describes vari-

ous conferences occurring regarding the Panic and a particular meeting between many officers of leading Trust Compa-

nies is denoted, along with the following confirmation of rumors:

“There were incipient runs of this nature yesterday upon several companies, started by rumors of one kind or another...

John E. Borne, Chairman of the Board of Director of the Trust Company of America...said that rumors affecting that com-

pany’s credit were entirely unfounded, and that the company had no business relations...with Charles W. Morse, as the

rumors had intimated...” 2

Likewise, on June 11th 1912, The New York Times reported Q & A testimony from Oakleigh Thorne, President of the Trust

Company of America (which Charles T. Barney, President of the Knickerbocker, was also a Director) which was also se-

verely effected during the time of the 1907 Panic. This testimony, in part, discussed a publication which occurred on Oct.

23rd 1907, which included a public “statement” made by George W. Perkins that, from the perspective of Thorne, was the

reason his institution was hit with a bank run right after the Knickerbocker was. Please note that George W. Perkins was a

close Partner with J.P. Morgan 3 and joined J. P. Morgan’s bank in 1905. 4 This testimony is very revealing as to the source

of some of the rumors, which invariably lead back to J.P. Morgan and Company.

The article states:

Oakleigh Thorne, who was President of the Trust Company of America...was questioned about the publication of Oct. 23,

1907, of a statement made by George W. Perkins that aid was to be extended to his company, which Mr. Thorne said

caused the run on it...He said that after the run started Mr. Perkins, as well as J. Pierpont Morgan, did everything they

could to help the company through its troubles.” 5

It continues with Q & A testimony from Thorne and the subject of the rumors are brought up in more detail:

“Q-There had been rumors affecting your bank?

A [Thorne]- Yes I don’t know when they started. I did not see the article in The Evening Sun of Oct. 22 till Mr. Perkins

showed it to me...

Q- It spoke of your bank being in trouble?

A- Something to that effect.

Q- Did the bankers perform the promises Perkins and Davison had made to you?

A- I don’t think they did “ 6

This article then goes on to discuss the George Perkin’s (Partner of JP Morgan) “article”, as published on Oct. 23rd men-

tioned, which Thorne states “caused the run on his bank”

1

http://query.nytimes.com/gst/abstract.html?res=9906E0D81F30E233A2575BC1A9669D946697D6CF&scp=2&sq=Augustus+H

einze&st=p

2

http://query.nytimes.com/gst/abstract.html?res=950DE0DF173EE233A25750C2A9669D946697D6CF&scp=2&sq=Trust+comp

nay+of+america&st=p

3

http://en.wikipedia.org/wiki/J._P._Morgan#Career

4

http://en.wikipedia.org/wiki/George_Walbridge_Perkins

5

http://query.nytimes.com/gst/abstract.html?res=9F00E1D81F31E233A25752C1A9609C946396D6CF

6

http://query.nytimes.com/gst/abstract.html?res=9F00E1D81F31E233A25752C1A9609C946396D6CF

This is where it gets interesting. As denoted in the reprinted section above, numerous reports came out simultaneously

regarding the financial integrity of the Trust Company of America. As described in the same article, the night before the

publication of the aforementioned announcement, Osmind Phillips, financial editor of The Times (who also appears to be

the person who informed other news agencies about Perkin’s statement) met with Perkins to get information about J.P.

Morgan’s meeting regarding the Panic and especially the Trust Company of America, which was a central focus.:

“Osmund Phillips...testified that he obtained from George W. Perkins the information contained in the article published on

Oct. 23. He told of going on the evening of Oct. 22 to the Hotel Manhattan, where a conference of financiers...was held.”

The testimony then describes Phillips meeting with Perkins at the Union League Club later in the evening:

“[Osmund states regarding his conversation with Perkins] “He [Perkins] said he presumed that I wanted to know about the

Trust Company of America. I told him I did. He said it had been discussed...that it had been decided to help them if the

statement of their condition was found to be correct, the idea being that his statement to that effect would relieve pub-

lic anxiety. I called his attention to the fact that a similar statement had been made in regard to the Knickerbocker Trust

Company, which had subsequently closed [due to mass bank runs]. I suggested that the public might infer that the circum-

stances were similar and the statement might not be helpful to the Trust Company of Amerca... “ 1

This is very revealing - not only does this statement show evidence that such possiblly published “rumors” were in exis-

tence prior to and hence related to the fall of the Knickerbocker bank, it is interesting to see the foresight of Osmund to

challenge the idea to publish what George Perkins stated... for he knew it could cause panic, even if the language osten-

sibly appeared to show reassurance to the public. From this statement alone we see a direct relationship between JP Mor-

gan and Co. and the spread of speculations/rumors prior to the runs on both of these large Trust Banks.

More proof that the Perkin’s statement was a cause in the run on the Trust Company of America - Thorne states:

“ ‘The run had started,’ said Mr. Thorne, ‘ when the article was shown to me and a number fo people told me that it was on

account of the article that they had come for their money.’ ” 2

However, it gets even more interesting in with regard to this article. In certain variations of the publication of this state-

ment, some, such as the New York Tribune of Oct. 23, included the unfounded notion that

“It was reported last night that more than $4,000,000 of deposits had been withdrawn from the Trust Company of America

yesterday.” 3 It also states in most cases that the person who made the statement about the 4 million was a “member of

the conference” giving no details as to the exact source. What is found, based on the testimony of President Thorne, is

that this was completely untrue and there were “no unusual withdrawals from the Trust Company of America” as of Oct.

22nd. This is also confirmed when Thorne is asked directly about a parallel rumor that $3,000,000 had been removed on

Oct. 22- which Thorne states did not happen at all. Nothing happened prior to Oct. 23rd- when the J.P. Morgan and Co. /

Perkins statement was published. 4

Now, J.P. Morgan today is looked upon as the “savior” of the 1907 panic, for it is true he went in after it began and pro-

vided financial support to select Trusts. (Not the Knickerbocker) which helped stop the bank runs and panic. While we can

never know the full intent of the published statement coming from JP Morgan and Co., the causality is clear enough to see

that these statements made did escalate the panic.

Why would they do this? Well, The Panic of 1907 is what essentially created the public support to install the Federal

Reserve Central Bank, which was/is a cartel created out of the major private banks (what Charles Lindbergh Sr. called

the “Money Trust”), which gave monopoly control of monetary policy to J.P. Morgan and a few of his banking friends.

(See section of the creation of the Fed later in this Source Guide for details on this cartel) The Panic of 1907 hence set

in motion dramatic changes with regard to US monetary management and control. If this interest was in the back of J.P.

Morgan’s mind is something we will never know but the evidence supports this possible reality when everything is consid-

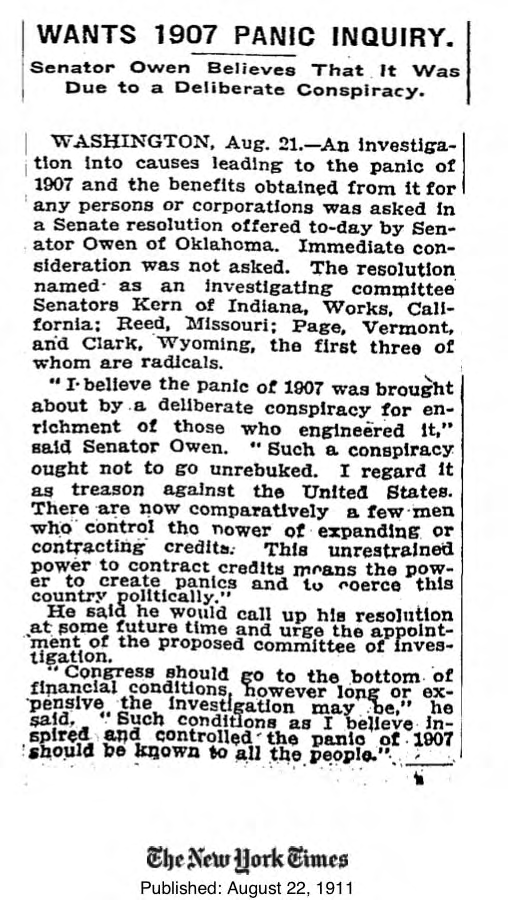

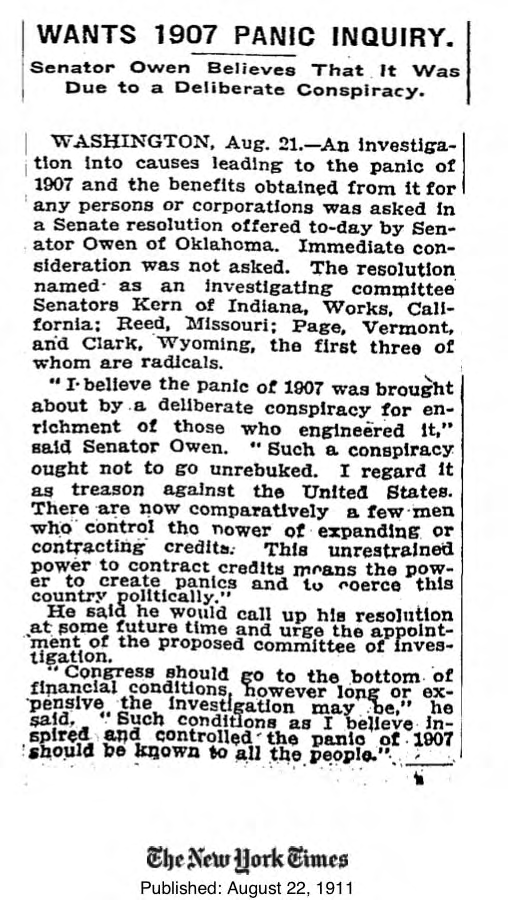

ered. This is why so much speculation has occurred for so many years. In an article in “Current Literature”, Senator Owen

concerns about a “conspiracy” are summarized:

“Senator Owen takes the view that the panic [of 1907] was “a deliberate conspiracy for the enrichment of those who

engineered it”...the radical Philadelphia ‘North American’ [publication], in an editorial reprinted in Mr. Bryan’s ‘Commoner’,

asserts that back in the early months of 1907, when prosperity was general in this country, John D. Rockefeller gave to

the American press a statement that financial disaster would soon overtake the country. From time to time thereafter Wall

1

http://query.nytimes.com/gst/abstract.html?res=9F00E1D81F31E233A25752C1A9609C946396D6CF

2

http://query.nytimes.com/gst/abstract.html?res=9F00E1D81F31E233A25752C1A9609C946396D6CF

3

New York Tribune, Oct 23rd 1907 [reprinted: http://query.nytimes.com/gst/abstract.html?res=9F00E1D81F31E233A25752C1A

9609C946396D6CF ]

4

http://query.nytimes.com/gst/abstract.html?res=9F00E1D81F31E233A25752C1A9609C946396D6CF

Street financiers echoed the same opinion. The Standard Oil and Morgan group of banks, the paper goes on to assert,

had determined to make great profits out of a money panic. George W. Perkins, then a partner of Morgan “started the

run on the Knickerbocker Trust Company.” The panic thus created was at its most acute state when Mr. Roosevelt was

“deluded into the worst mistake of his career with the best possible intention.” ” 1

(13) The public in fear of losing their deposits immediately began mass withdrawals. Consequently, the banks

were forced to call in their loans causing the recipients to sell their property and thus a spiral of bankruptcies,

repossessions and turmoil emerged. [a]

Putting the pieces together years later, Congressman Charles Lindbergh wrote:

[“The king bankers put in motion, in 1907, a great scheme. They had gambled and speculated on Wall Street until so many

watered stocks and bonds had been manufactured...The king bankers knew the condition and informed the favored of their

friends what was to come. There was to be a panic in the fall of 1907 that would be advertised as the result of our bad banking

and currency laws.” [b]

[a] While this is needless to point out, the systemic result of the panic can be found in any basic encyclopedia reference

on the event. This is common knowledge. 2

[b] C. Lindbergh Sr. Quote from his “Banking and Currency and the Money Trust” 3

(14) The panic of 1907 led to the Congressional investigation headed by Senator Nelson Aldrich, who had inti-

mate ties to the financial powers and later became part of the Rockefeller family through marriage. The commis-

sion led by Aldrich recommended a central bank should be implemented so a panic like 1907 could never happen

again. This was the spark that the bankers needed to initiate their plan.

On May 27, 1908, the Aldrich–Vreeland Act was created essentially in response to the panic of 1907. Both the Act and the

National Monetary Commission created suggested the basics for a new central bank as a solution to panics. This become

the Federal Reserve Act. This is common knowledge. 4 5

Charles Lindbergh, again, made his view very clear:

“...1907 panic was to be t