The Middle East as a Geopolitical Arena

So what is it that the Americans, the Russians and the Chinese really want from the Middle East in the 21st century? Once this question is answered, everything becomes very simple. The US has increased its oil imports from Canada, Mexico, Venezuela, even from Russia, while at the same time it has increased its own oil and natural gas production too, and as a result it has drastically reduced its oil imports from the Middle East. Therefore the US is not dependent on the Middle East for oil in the same way it has been in the past, which was to a large extent what determined the US policies in the Middle East during the 20th century.

In the following Reuters and Financial Times articles, titled “U.S. Seen as Biggest Oil Producer After Overtaking Saudi Arabia”, July 2014, and “US Poised to Become World's Leading Liquid Petroleum Producer”, September 2014, you can read that in 2014, for the first time, the United States overtook Saudi Arabia and Russia as the largest oil producer in the world. Please note that Saudi Arabia and Russia still have larger oil reserves than the United States. The US simply managed to significantly increase its production.

http://www.bloomberg.com/news/2014-07-04/u-s-seen-as-biggest-oil-producer-after-overtaking- saudi.html

http://www.ft.com/intl/cms/s/0/98104974-47e4-11e4-be7b-00144feab7de.html

However even though the US became the world's largest oil producer, it remains one of the world's largest importers of oil. On the contrary, Russia is not only one of the world's largest producers of oil, but she is also one of the world's largest exporters. The difference is due to the fact that the Russian economy, with a GDP of only 2 trillion dollars, is a much smaller economy than the American one, which has a GDP of 16 trillion dollars. The Chinese economy is somewhere in the middle with a GDP of 8 trillion dollars. In the following Wikipedia table you can see the world's ten largest economies, as given by the United Nations.

Image 2

Source:http://en.wikipedia.org/wiki/List_of_countries_by_GDP_%28nominal%29

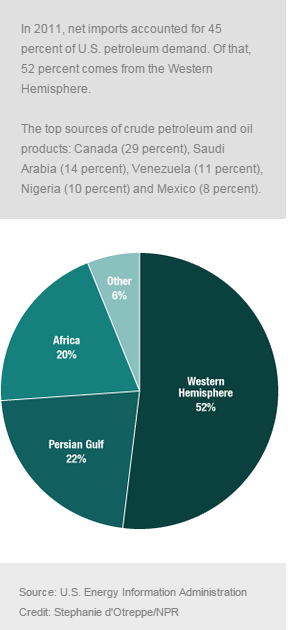

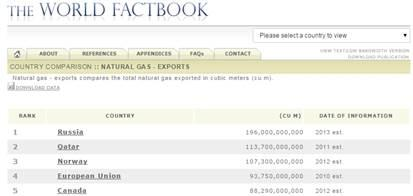

In the following pie chart, of the following National Public Radio article, titled “U.S. Rethinks Security As Mideast Oil Imports Drop”, November 2012, you can see that in 2012 the Persian Gulf accounted for only 22% of US oil imports.

Image 3

Source: http://www.npr.org/2012/11/14/165052133/u-s-rethinks-security-as-mideast-oil-imports-drop

As you can read in the following Wikipedia link, the National Public Radio is an American non-profit public radio. It is the association of the American public radios, and it was called the Association of Public Radio Stations before it was renamed to NPR.

http://en.wikipedia.org/wiki/NPR

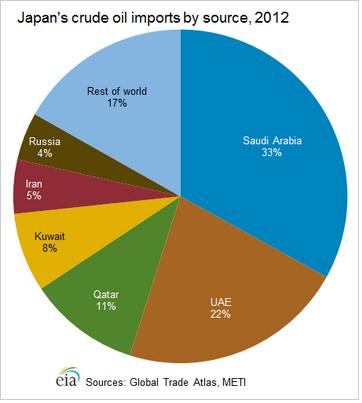

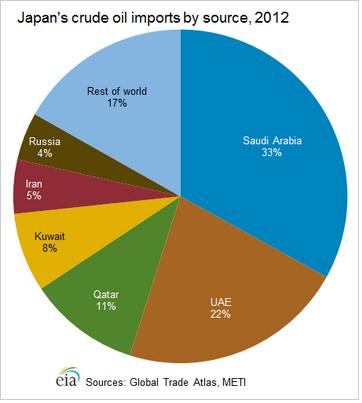

Therefore the Middle East is losing its geopolitical importance as the main oil provider for the US economy, which was the main American interest in the region during the 20th century. However the Middle East remains a region of high strategic and geopolitical importance, since it holds over 50% of the world's oil and natural gas reserves, and these reserves will be of crucial importance in case of future conflicts. Many US allies of the Asia Pacific region still count on the Persian Gulf for their oil and natural gas supplies. As you can see in the following pie chart, from the U.S. Energy Information Administration, Japan, a major US ally, imports 79% of its oil from the Middle East i.e. Saudi Arabia, UAE, Qatar, Kuwait and Iran.

Image 4

Source: http://www.eia.gov/countries/cab.cfm?fips=ja

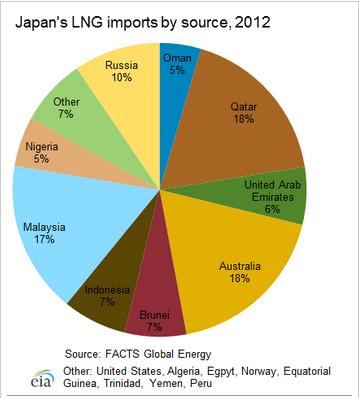

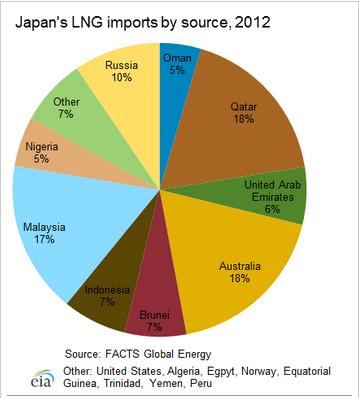

Moreover, as you can see at the following pie chart, Japan imports 29% of its natural gas from the Middle East i.e. Qatar, Oman and UAE.

Image 5

Source: http://www.eia.gov/countries/cab.cfm?fips=ja

The same is true for many other US allies in the Asia Pacific region. On the following map you can see in red circles the countries that have some kind of military doctrine with the US, i.e. Japan, Australia, South Korea, Thailand and Philippines, and in purple circles you can see the countries that have some kind of more relaxed military cooperation with the US i.e. New Zealand, India, Indonesia and Taiwan. All these countries feel the breath of Chinese communists and are eager to cooperate with the United States of America in order to protect themselves.

Image 6

The second, but by far the most important reason the Middle East is strategically important for the US, is because the Americans are hopping that they will eventually manage to construct a pipeline network that will connect the Middle East to Europe through Turkey. This is very important for the Americans and the EU, in order to provide a pipeline network that will reduce the Russian influence over Europe.

The Russians have a very important geographical advantage in the European energy market, and as a result they can exert significant political influence on European governments, by the use of carrot and stick. Sometimes by offering lucrative business deals, and sometimes by increasing the price of natural gas. This is causing great internal conflicts in NATO and the European Union, two traditional western alliances.

The way the Russian natural gas divides Europe and NATO is a very big issue, and I will very soon upload a separate document on the subject. For the time being you can have a look in the following Financial Times article, titled “Russia's South Stream gas pipeline to Europe divides EU”, May 2014.

http://www.ft.com/intl/cms/s/0/a3fb2954-d11d-11e3-9f90-00144feabdc0.html

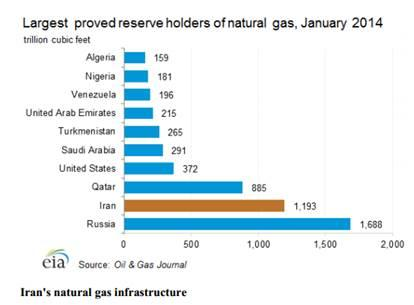

It is only in the Middle East that there are natural gas and oil reserves of comparable size to the Russian ones, which can provide a long term alternative to Russian natural gas and oil. It is true that Norway, Algeria and Libya do have some descent natural gas and oil reserves, and they are already connected to Europe by pipeline networks, but their reserves are peanuts when compared to the Russian ones (see following map).

Image 7

It is only Iran, Qatar, Iraq and Turkmenistan that possess natural gas reserves that could provide alternative to the Russian natural gas, and which could also travel to Europe with pipeline networks through Turkey (see following map). When natural gas travels by ships in liquefied form, i.e. LNG, it involves significant costs, and it is very difficult to compete with natural gas sold through pipeline networks, which is the case for the Russian sales in Europe.

Image 8

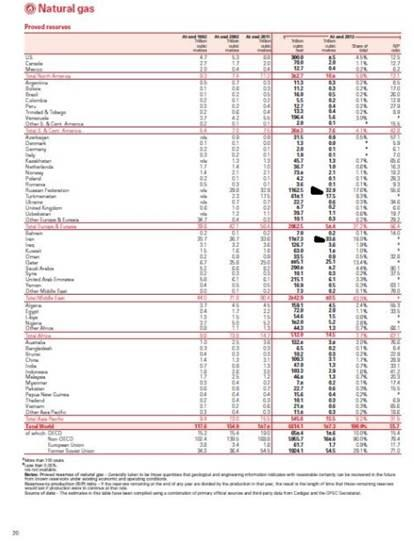

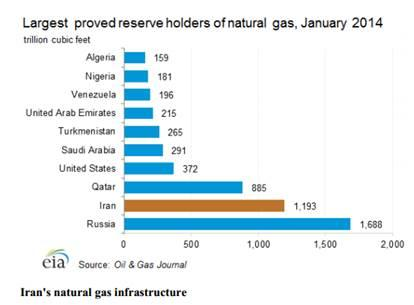

On page 21 of the following Energy Information Administration link, you can see the countries with the largest natural gas reserves in the world.

Image 9

http://www.eia.gov/countries/analysisbriefs/Iran/iran.pdf

Note that figures are given in trillion cubic feet, and in order to convert them to trillion cubic meters one needs to divide them by 35, i.e. Russia has 1.688/35= 48 trillion cubic meters of natural gas reserves. The following table shows the richest countries in natural gas reserves according to the CIA's World Factbook (given in trillion cubic meters).

Image 10

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2253rank.html

Estimating the natural gas and oil reserves can be a very difficult task, since they are changing every year as they are exploited by the countries hosting them. Therefore there are some differences between various rankings, but all the rankings I have seen so far have Russia, Iran and Qatar as the three richest countries in the world in terms of natural gas reserves.

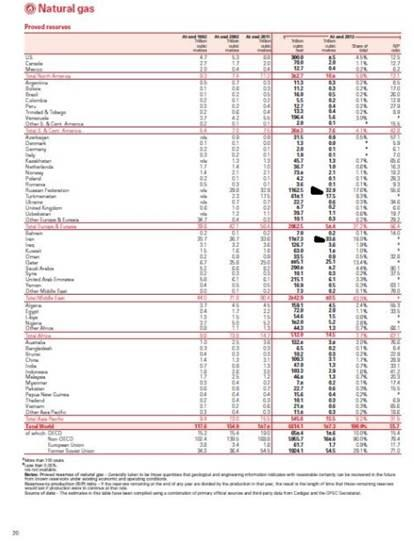

According to BP, Russia has used a large part of its natural gas reserves and it does not have 48, but 32 trillion cubic meters of natural gas, ranking second behind Iran. You can see the BP estimates in page 20 of the following link (see black triangles).

Image 11

Source: http://www.bp.com/content/dam/bp/pdf/statistical-review/statistical_review_of_world_energy_2013.pdf

The BP estimates are used in the following Business Insider article, titled “The 17 Countries Sitting on the Most Valuable Energy Reserves”, February 2014. The site is ranking Iran as the richest country in natural gas reserves, with 1.187 trillion cubic feet, and Russia second with 1.163 trillion cubic feet. However Business Insider ranks Russia as the richest country in energy reserves overall, because it takes into account oil, natural gas and coal reserves. Russian natural gas, oil and coal reserves have a commercial value of 40 trillion dollars, while Iran is in the second place with a value of total reserves of 35 trillion dollars.

http://www.businessinsider.com/countries-with-most-energy-reserves-2014-2?op=1

Therefore one must keep in mind that it is very difficult to accurately estimate world natural gas and oil reserves, and the available estimates should be only used as an approximation.

Having made this parenthesis about the world's natural gas reserves, I will return to the subject. I was saying that connecting Middle East and Europe through Turkey with a pipeline network, is by far the most important American geopolitical objective in the Middle East. Actually this was obvious in the way the Americans did not hesitate to cause severe problems in their relations with Israel and Saudi Arabia, their traditional allies in the region, in order to normalize their relations with Iran. Iran is one of the richest countries in the world in natural gas reserves, and as you can see on the above map, Iran is also the country best located in order to send natural gas to Europe through its neighbouring Turkey.

Now what does Russia want from the Middle East? Russia is one of the richest countries in the world in terms of oil and natural gas reserves, and never needed, and will never need the resources of the Middle East for herself. The main aim of Russia in the Middle East is to stop the United States and the European Union from connecting Europe to the Middle East with pipelines. This would cause more competition in the European energy market. This greater competition in the European market would result in lower prices and revenues for Russia, and it would also reduce the geopolitical might of the Russian natural gas and oil, since European countries would be far less dependent on Russia for their energy security.

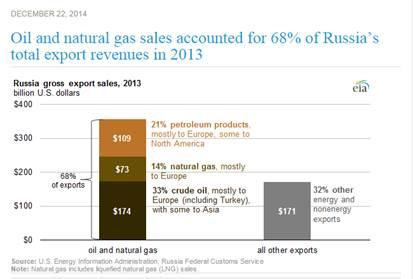

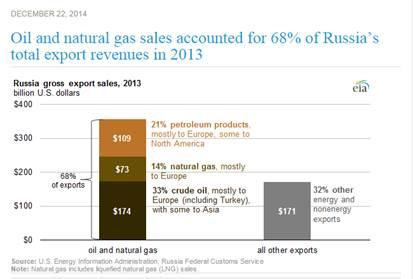

Russia is a highly corrupted country, and oil and natural gas account for most of her exports. Oil and natural gas sales account for 68% of Russia's exports, as you can read in the following article of the US Energy Information Administration, titled “Oil and Natural gas sales accounted for 68% of Russia's total export revenues in 2013”, December 2014.

Image 12

Source: http://www.eia.gov/todayinenergy/detail.cfm?id=19291

Natural gas accounts for only 14% of the Russian exports, but the importance of natural gas is quickly rising, firstly because the world's natural gas reserves are expected to last much longer than the oil ones, second because natural gas is much better for the environment, and most countries are trying to substitute oil with natural gas, and finally because natural gas can be used much more effectively than oil as a geopolitical tool, when it is supplied by pipelines and long term contracts. When it is supplied in liquid form by ships i.e. LNG, its geopolitical might is greatly reduced.

For the Russian oil and natural gas exports you can also read the following Telegraph article, titled “Russia faces oil export catastrophe, snared in OPEC price trap”, December 2014, which describes the economic hardships that Russia suffers due to Saudi Arabia's price war.

1st and 2nd Paragraphs

Vladimir Putin faces a catastrophic shortfall of at least $80bn (£51bn) in oil export revenue over the next year, after Opec kingpin Saudi Arabia signalled there will be no easing in the price war it has launched to recapture market share.

According to US Energy Information Administration (EIA) figures, oil and gas shipments accounted for 68pc of Russia's total $527bn of gross exports in 2013, when Brent crude - comparable to Russian Urals - traded at an average of $108 per barrel.

http://www.telegraph.co.uk/finance/newsbysector/energy/11310312/Russia-faces-oil-export-catastrophe-snared-in-Opec-price-trap.html

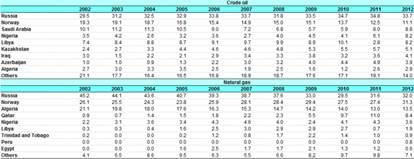

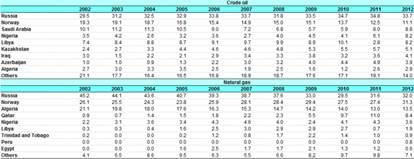

In the following Eurostat table you can see Europe's main oil and natural gas suppliers. It can be seen that in 2012 Europe imported 33.7% and 32% of her oil and natural gas respectively from Russia. Europe's second biggest supplier is Norway, which is not a member of the European Union. However as I already said Norway's natural gas and oil reserves are very small when compared to the Russian ones, and therefore Norway cannot provide a long term alternative to Russian gas and oil.

Image 13

http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/File:Main_origin_of_primary_energy_i

mports,_EU-28,_2002%E2%80%9312_(%25_of_extra_EU-28_imports)_YB14.png

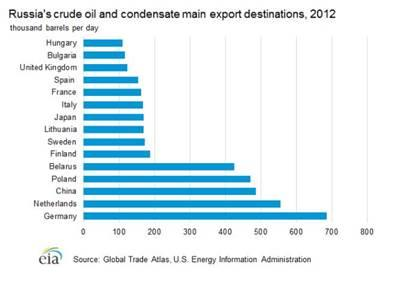

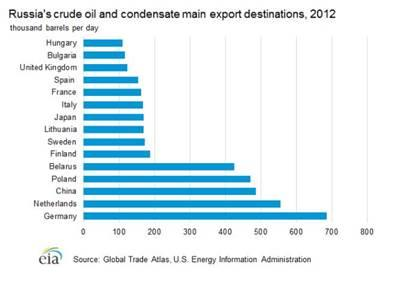

At the following US Energy Information Administration link you can see the best clients, i.e. importers, of Russian oil in 2012.

Image 14

http://www.eia.gov/countries/cab.cfm?fips=RS

Germany is Russia's best client, followed by the Netherlands. China is Russia's third best client, followed by another five European countries. In the following article of New York Times, titled “How Much Europe Depends on Russian Energy”, September 2014, you can see how dependent on Russian oil each individual European country is.

http://www.nytimes.com/interactive/2014/03/21/world/europe/how-much-europe-depends-on-russian-energy.html?_r=0

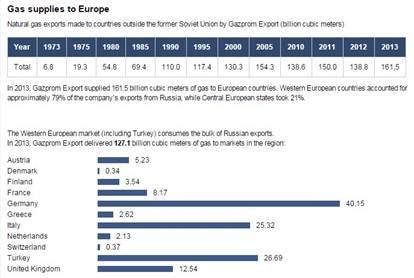

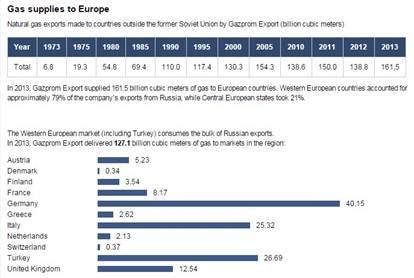

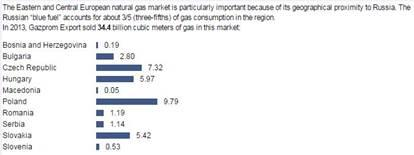

The following table shows the Russian natural gas exports to Europe, in billion cubic meters. The figures are taken from Gazprom. Gazprom is the Russian natural gas giant, and it is controlled by the Russian state.

Image 15

Image 16

Source: Gazprom http://www.gazpromexport.ru/en/statistics/

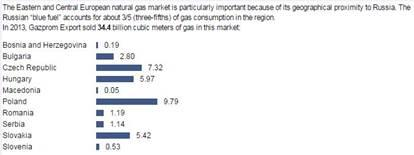

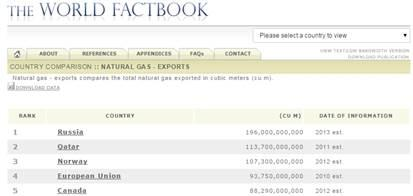

At the following link of the CIA's World Factbook, you can see that total Russian natural gas exports for 2013 were 193 billion cubic meters. As you saw from the Gazprom figures above, 161.5 billion cubic meters of these sales were made to Europe and Turkey. Therefore most of the Russian natural gas sales are made to Europe and Turkey.

Image 17

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2251rank.html

It is therefore clear that Europe and Turkey are by far Russia's best clients, and that's why Russia's main objective in the Middle East is to block the connection of Middle East to Europe through pipeline networks that would not be controlled by the Russian government. Such pipeline networks would hurt Russian sales both in Europe and Turkey. It is also important to keep in mind that the importance of natural gas is increasing very fast. Therefore the geopolitical aims of Russia in the Middle East are exactly the opposite from the American ones.

Now what is it that China wants from the Middle East? China sees the Persian Gulf, in exactly the same way the United States did at the end of the Second World War. For China the Middle East is the region that can guarantee her energy security for the next decades. China wants to keep for herself as much as possible from the region's natural gas and oil reserves, and she wants them in the lowest possible prices.

Therefore USA, China and Russia want very different things from the Middle East in the 21st century. The Americans want to use Middle East to reduce the Russian influence in Europe, the Russians want to protect their prices and market share in the European markets from the Middle East oil and natural gas, and the Chinese want the reserves of the Middle East for themselves at the lowest possible prices.

The following map depicts the pipeline networks that were supported by the Americans and the Europeans as competing to the Russian ones. The red-green line is Nabucco, a natural gas pipeline which was finally abandoned, and the red-purple line is the Baku-Ceyhan pipeline, an oil pipeline that has already been constructed. The Baku-Supsa oil pipeline has also been constructed, and it carries oil from Azerbaijan to Georgia and the Black Sea.

Image 18

Nabucco had the backing of the European Investment Bank, as you can read at the following Deutsche Welle article, titled “Proposed Nabucco Gas Pipeline Gets European Bank Backing”, January 2009

http://www.dw.de/proposed-nabucco-gas-pipeline-gets-european-bank-backing/a-3980038

The European Investment Bank (EIB), is the non-profit bank of the European Union, and its purpose is to finance projects that are of vital importance to the EU. At the following Reuters article, titled “U.S. throws weight behind EU's Nabucco pipeline”, February 2008, you can read that the United States of America strongly supported Nabucco too.

http://uk.reuters.com/article/2008/02/22/eu-energy-usa-idUKL2212241120080222