Volatility Smile Volatility Skew

50 50

4545

4040

3535

30

30

25

25 20

20 15

30 50 70 30 50 70 Strike Strike

Gamma

Theta

Vega

Rho

The change in Delta with relation to a 1 point change in stock price. Delta discusses how much an option’s value changes with respect to the stock. Therefore, Gamma is a measure of how volatile an option is in reference to the underlying stock.

Measure of how much value an option loses per day. Every option has an expiration date. As the calendar moves towards this expiration, the option’s value moves closer to the intrinsic value of the option, and loses more of its time value. Theta is an indication of how much the time value erodes each day. For example, if an option costs $4.40, and has a Theta of -.4, it will be worth $4 on the next trading day, assuming everything else remains the same (which most likely won’t happen, since stocks change values every day). Theta increases (meaning the value of an option decreases) rapidly when the option gets closer to expiration.

Measure of the change in price of an option in relation to a 1 point change in volatility. For example, if the price of a option is $3 and Vega is .20, with an underlying volatility of 30%, then if the volatility increases to 31%, the price of the option will increase to $3.20.

Change in option price with relation to a 1 point change in interest rates. For example, if the price of a option is $1 and Rho is .25, then if the interest rates increase from 4% to 5%, the price of the option will increase to $1.25.

1.2.4 Further Explanation

This section provides further explanation on some of the above concepts. We then provide useful links to sites that provide helpful information on options.

Strike Prices: When someone purchases an option, they are buying the right to purchase or sell a stock (or index) for a specific strike price, within a period of time. The available strike prices are typically relative to the price of the underlying. In general, overall strike prices available for equity options start at 5, and increment by 2 ½ up to approximately 50. They then increment by 5 up to 100, where they begin incrementing by 10. Index options have strikes that typically increment by 1 or 2.

Leverage: Each option contract (call or put) represents 100 shares of the underlying. Therefore, when observing the price of a contract, we must multiply by 100 to obtain the true price for entering an agreement.

For example, let’s say we are examining the XYZ stock. It is currently trading at $35 per share, and the date is currently early December. If we were to obtain the option chain, which lists the available options, we would likely see strike prices ranging from approximately 5 to 65, depending on the volatility of the stock. (Note: all prices would be available, but many data sources only show the strikes near the trading value of the stock.) They would likely increment in value by 2.5 from 5 to 50 (i.e. 5, 7.5, 10, 12.5, etc). They would then increment by 5. We would also see expiration months of December, January, April, and July. Once the Saturday after the 3rd Friday passed, we would see expiration months of January, February, April, and July.

Let’s imagine we wish to buy the January 40 Call, which costs $2. This call is considered out of the money (OTM), because the strike is above the current price of the stock. This would allow us to purchase XYZ for $40 per share, any time between now and the 3rd Friday in January. It would cost us $200 ($2 X 100) to buy one contract, since each represents 100 shares. If we chose to exercise the contract, we’d have to pay $4,000 ($40 X 100) to purchase the stock, regardless of the current price of the stock. Therefore, we would only exercise if the stock was above $40 per share.

Let’s imagine that it has a delta of .25, a gamma of .05, and a theta of -.08. If the stock price went to $36, the price of the option would increase to $2.25, and the delta would increase to .3. If the stock remained the same, we’d expect it to be $1.92 on the following day due to the theta value.

1.2.5 Additional Resources

1.2.5.1 Overviews and Introductory Tutorial Links

Here are several links to options tutorials.

• http://www.investopedia.com/university/options/

• http://www.cboe.com/LearnCenter/Tutorials.aspx

• http://www.accesstrading.com/optionstutorial.php

• http://www.stockoptionstutorial.com/

1.2.5.2 Advanced Terms and Concepts Links

Black-Scholes Links

• http://www.optiontradingtips.com/pricing/black-and-scholes.html

• http://en.wikipedia.org/wiki/Black-Scholes

• http://www.gummy-stuff.org/black-scholes.htm

• http://www.superbasescientific.com/example_black-scholes.htm

• http://www.hoadley.net/options/bs.htm

Greeks Links

• http://www.optiontradingtips.com/greeks/delta.html

• http://www.optiontradingtips.com/greeks/gamma.html

• http://www.optiontradingtips.com/greeks/theta.html

• http://www.optiontradingtips.com/greeks/vega.html

• http://www.optiontradingtips.com/greeks/rho.html

• http://www.optiontradingtips.com/greeks/charm.html

• http://www.investopedia.com/articles/optioninvestor/03/021403.asp

• http://www.investopedia.com/articles/optioninvestor/04/121604.asp

• http://en.wikipedia.org/wiki/Greeks_(finance)

1.2.5.3 Overviews and Introductory Videos

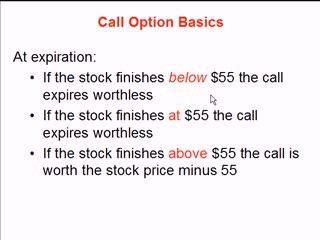

Call Options Education w/

the Zecco Zirens

Call Options Education w/

the Zecco Zirens

The Basics of Call Options

Put Options Education w/ the

Zecco Zirens

Calls & Puts

Options Primer - Basics

Stock Options Tutorial

Introduction to Options

Introduction to Options

1.2.5.4 Advanced Terms and Concepts Videos

Stock Option Greeks

Stock Option Greeks

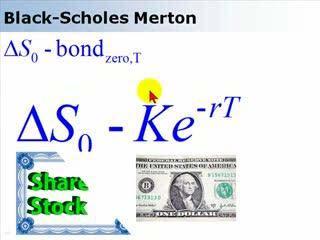

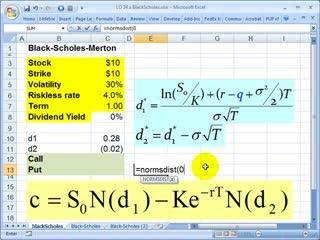

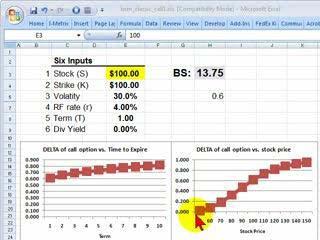

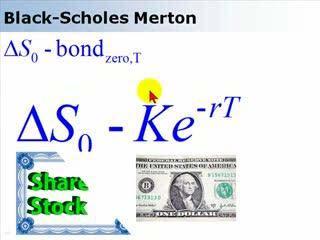

Intuition Behind BlackScholes-Merton

Intuition Behind BlackScholes-Merton

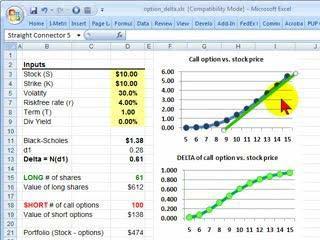

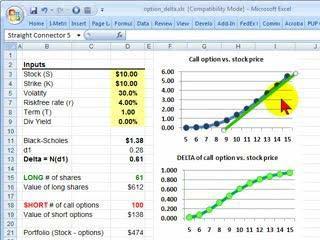

Option Delta

Option Delta

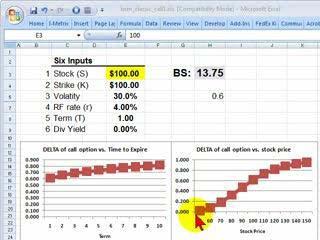

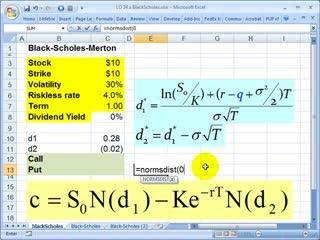

Use Excel to Calculate

Black-Scholes Option Price

Use Excel to Calculate

Black-Scholes Option Price

What is Delta

What is Delta

Theta Time Decay

Theta Time Decay

1.3 Why trade options?

Options provide advantages over traditional investment strategies. These advantages include the following.

1.3.1 Leverage

People invest to earn a profit. As the stock increases in value, the investor’s portfolio increases. This is typically represented with a 1 to 1 ratio with the number of shares owned. For example, if a person owns 100 shares of stock XYZ, a $1 increase in the price will earn the investor $100. If XYZ is currently trading at $50 per share, 100 shares would cost $5,000.

The investor could control the same number of shares at a much lower price if they were using options. Each XYZ option contract represents 100 shares of the underlying stock. However, the price of the option may be $2. If XYZ rises in value, the options investor would still benefit $100 for each $1 rise in XYZ. Therefore, the $200 worth of options has the same earning potential as $5,000 worth of stock.

1.3.2 Protection

People are often told to diversify their portfolio. One reason for this diversification is that if any one investment falls sharply, the portfolio will still contain significant value. For example, if a person owns $5000 worth each of ABC, XYZ, and PDQ (each trading at $50), they are somewhat protected if their ABC investment falls to $10 per share or $1000. However, the portfolio will still suffer losses in relation to the percentage ABC represents.

Options investors can have greater protection from sharp drops in stock through the use of puts. Let’s say the above investor purchases $50 puts on ABC. These puts would allow the investor to sell his stock for $50 per share, or $5,000, even though the current value is only $1,000. The only loss would be the amount paid for the put options. Therefore, puts can act as insurance on a stock.

1.3.3 Advanced trading strategies

Stocks allow a limited variety of earning money on an investment. They mainly consist of buying a stock at a low price and then selling at a higher price. Some savvy investors may short a stock, where they try to sell at a higher price and then buy at a lower price. Others may benefit from dividend payouts if the company earns a profit.

Options’ investing allows many more trading opportunities. For example, an option strategy can be achieved that is profitable if a stock moves in any direction, up or down. Other strategies are profitable as long as the stock doesn’t move much at all. Still other strategies earn money as long as the stock doesn’t rise sharply, or drop sharply, or stays within a range, or stays out of another range, or stays below one value, or above another, and so on.

1.4 Why do people avoid options?

Although options offer many advantages over normal investing, they are still avoided by many people. This is due to several reasons.

1.4.1 Lack of exposure

Most people, including non-investors, are familiar with typical trading instruments such as stocks, bonds, and CDs. This is because the normal stock market is covered in newspapers, magazines, radio, TV, and other forms of media. Nearly all news programs include some snapshot of what is happening in the stock market, including indices such as the Dow Jones, S&P 500, and NASDAQ. Even people that aren’t currently invested use this information as an indication as how things are going in the economy. However, even shows devoted to investing often leave out what happens in options. When options are covered, they are only referenced in terms of the stock options corporate executives and founders receive (usually with some negative connotation such as how some executive cashed in big on his stock options while the company did poorly). As a result, most people have no knowledge of stock options, or their potential advantages.

1.4.2 Risk

Most investment account applications include a selection box to include the ability to trade options. However, there is typically an extra set of guidelines the investor must read for approval. The guidelines discuss the risks of investing in options, and that they should only be used by experienced investors. Options CAN be much riskier than normal stock investing. However, this is not necessarily the case. In actuality, options can be much safer in some forms. For example, when a person invests in a stock, their entire investment is at risk. Although it is unlikely, they could lose 100% of their investment if the stock falls to zero. With options, the investor could protect a large portion of their investment. Even if the stock fell to zero, the investor would still be able to recover most of their money. This aspect is not typically discussed when people are told about the risks of options.

1.4.3 Complexity

Stocks are fairly simple: buy the stock low, and sell at a higher price. If the stock goes up in price, you make money. If the stock goes down, you lose money. The only complexity with stock investing is determining which stock to buy, or when to buy.

Options, on the other hand, are inherently difficult to understand. Most people can grasp the concept of purchasing an item and then selling it. It can become confusing when discussing buying the right to purchase an item. Throw in the counterpart of purchasing the right to sell an item and many people are incredibly confused. Then, there’s the perspective of the option buyer vs. the option seller, expiration dates, strike prices, bullish strategies, bearish strategies, neutral strategies, and the Greeks. Not to mention time value and implied volatility. This can be overwhelming for the average person who spends more time reading about their favorite celebrity than reading about their financial future.

2Option strategies

Unlike normal investing, where a user intends to buy a stock at a low value and sell at a higher value, options investors have a multitude of strategies in their arsenal. There is a strategy that can be extremely profitable in any market condition. This chapter discusses different strategies employed when using options. We have separated the strategies into the three categories of basic, intermediate, and advanced strategies. The categories are defined based on the complexity of the strategy, and not necessarily their risks. Therefore, a basic strategy may be more risky than an advanced strategy.

2.1 Basic strategies

The following strategies will be explained using the example of an undeveloped property near a rumored mall.

2.1.1 Buying a Call

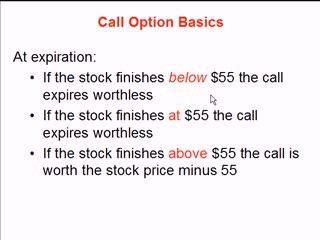

2.1.1.1 Call Recap

A call option is a contract that allows the purchase of the underlying at a given strike price, within a given period of time. A call option typically involves two parties: the option buyer and the option seller. The option buyer has a long position, while the seller has a short position. Once the option is purchased, the option buyer is in control of what happens next. (S)He can choose to exercise, or go through with the purchase of the underlying asset, or (s)he can choose to let the option expire. If the buyer does choose to exercise, the seller must fulfill the contract at the agreed upon price.

When to buy: One should purchase a call when (s)he feels the stock will increase significantly in the near future. Therefore, purchasing a call is considered a bullish strategy.

2.1.1.2 Example of Buying a Call

Next, we will discuss the basics from the point of view of the call buyer using the real estate example.

The buyer has a “gut feeling” the land is going to increase in value sometime in the near future. 2.1.1.2.1 The OpportunityHis research suggests that the land will increase in value to $500,000 once the announcement is made. If he were able to buy the land for $100,000, this would be approximately a 400% return on his money!!!

The buyer also knows the risks involved with these investments. He also knows that if the mall 2.1.1.2.2 Riskisn’t built, the value of the land will likely remain stagnant for many years to come. He also knows it’s possible it could drop significantly, especially if the planners decide to put some other type of property there (e.g. water treatment facility). $100,000 tied up in one property would be a large risk for this investor.

For the buyer, the call option represents a method to enhance their investments and limit their 2.1.1.2.3 Buying the Callrisk. By using the call option, the buyer could put up only 10% of the value, and still be able to enjoy any rise in the price of the land.

If the rumor is true, and the land does increase to $500,000, he could exercise his option and buy 2.1.1.2.4 The Win the land for $100,000. He could then sell the land on the open market for $500,000, and enjoy his $390,000 profit ($500,000 - $100,000 (for the land) - $10,000 (for the call)).

Let’s imagine the option buyer doesn’t have the $100,000 needed to buy the land. Thus, he’s 2.1.1.2.5 An Added Bonusholding the opportunity to buy $500,000 worth of land for $100,000, and can’t take advantage. He could, in this case, sell the actual option itself. Remember, it is now worth $400,000 ($500,000 (price of underlying) - $100,000 (strike price)). Thus, he could sell the option for $400,000, and enjoy a $390,000 profit. Since his initial investment was only $10,000, that would be a 3900% profit!!!

If the rumor is false, the buyer loses the $10,000 completely. He’s lost 100% of his investment!!! 2.1.1.2.6 The Injury While this may sound bad, this is okay to the buyer because he didn’t have to pay $100,000, and doesn’t have to deal with property that isn’t going anywhere fast. However, on the other hand, land values tend to go up over time. If he’d purchased the land outright, he could still put it back on the market, and in time turn the transaction into a complete profit.

Let’s imagine the buyer was right, but just a bit too early. Let’s say that after delays, tabled 2.1.1.2.7 Adding Insult to Injuryitems, and numerous council and town hall meetings, the planning committee decides to approve the mall…1 day after the option expired!!! The value of the land jumps to $500,000. Thus, the option buyer was correct in his research, imaginative in looking for his opportunity. However, he must face the fact that, despite being absolutely correct, he’s lost 100% of his investment!! If he’d simply bought the land outright, he could have simply waited for the planning committee’s decision…be it the following week, month, or even years down the road.

$500,000 LongCall

$400,000

$300,000

Profit/ $200,000Loss $100,000

$0

-$100,000 $0 $200 $400 $600

ThousandsLand Value

Figure 1 Plot of Profit of Long Call Position

Figure 1 shows a plot of buyer’s position. The maximum loss on the position is $10,000, which is the price paid to enter the contract. Because there’s no limit to how much the land could increase in value, the position has an unlimited maximum profit.

2.1.2 Selling a Call

2.1.2.1 Call Recap

Remember, once the call option contract has been entered, the buyer has all the control. The buyer has the choice to exercise the option. If the buyer exercises, the seller must deliver the stock at the strike price, regardless of the current price of the stock. If the seller currently owns the stock, (s)he can deliver the stock to the option buyer from his/her portfolio. This is a covered call situation, because the seller is covered if the option is exercised. If the seller doesn’t own the stock, (s)he must go and purchase the stock from the market. This is a naked call situation, because the stock could experience a sharp rise. This has a theoretically infinite risk. Therefore, many brokerages require significant assets to engage in naked call writing.

When to sell: One should sell a call when (s)he feels the stock will remain the same or fall in the near future. Therefore, selling a call is considered a bearish or non-bullish strategy.

2.1.2.2 Example of Selling a Call

Next, we will discuss the basics from the point of view of the call seller using the real estate example.

The seller knows that the property is worth $100,000. She has been trying to sell this property for 2.1.2.2.1 The Opportunitya while when presented with the proposition to sell a call to the buyer. She has heard of the announcement, but has lived through these planning sessions before. Her research suggests that the value of the property will remain the same, or increase very little, especially in the short term. Once she sells this option to the buyer, she would make a 10% return on her money in a three month period of time, regardless of the outcome!!!

The seller has limited risk in this endeavor. If the transaction goes through, she would sell her 2.1.2.2.2 Riskproperty for the current price. The risk is that she would not be able to enjoy the significant rise in the value of the property if the rumor is true.

For the seller, the call option represents a method to enhance their investments. By selling calls, 2.1.2.2.3 Selling the Callthe landowner can have an additional means of income, and still have ownership of the land. The seller would receive an additional $10,000, and not have to do anything. Also, remember that the seller receives this money immediately. She could spend this money any way she deems fit, including buying another acre of land.

If the rumor is false, the land remains relatively the same in value. The seller, of course, received 2.1.2.2.4 The Winthe $10,000 three months ago. She has earned an additional 10% on her property, and can use the money to enhance her investments (e.g. reinvest in more land).

Let’s imagine the rumor was true, but was announced after the option expired. The seller waits, 2.1.2.2.5 An Added Bonus #1and the property skyrockets to $500,000. The seller then sells, and pockets the $400,000 profit on the property, plus the $10,000 she received from the option.

Let’s imagine the planning commission hasn’t made the decision within the three months. They 2.1.2.2.6 An Added Bonus #2promise to revisit the idea within a few weeks. The seller could then sell the option again for an additional $10,000!!!

Let’s imagine the price of the land doesn’t skyrocket, but rises gradually. After the initial option 2.1.2.2.7 An Added Bonus #3expired worthless, the seller sells a new option, but with a new strike price of $125,000. She does this because she knows she’d receive an additional $10,000 for the property, plus a $25,000 on the appreciation of her land. That’s a 35% profit, not counting the initial 10% profit!!! Let’s assume that when that option expires, the property is worth just under $125,000, and the buyer doesn’t exercise. She could then sell another option for $150,000. If she is good, she could repeat this cycle all the way to $500,000, and pocket several premiums on the way!!!

If the rumor is true, the value of the land will increase significantly. The seller’s phone is ringing 2.1.2.2.8 The Injuryoff the hook with people wishing to buy the property for $500,000. However, she must reject those offers, and sell the property for $100,000. If she hadn’t sold the option, she could have sold the property for a huge profit.

The planning commission decides to put a water treatment facility near her property. The value 2.1.2.2.9 Another Injuryof her property plummets to $10,000. This is offset somewhat due to the $10,000 she earned selling the call. However, she is down $80,000. The option buyer merely lost $10,000. She realizes she may never recoup her investment.

Figures 2 & 3 show the total profit and loss from the seller’s point of view. Figure 2 shows the value if she’s covered, while Figure 3 shows the value if she were uncovered.

Covered Call Position

$120,000

$100,000

$80,000

Profit/ $60,000Loss

$40,000

$20,000

$0

$0 $100 $200 $300 $400 000's Land Value

Figure 2 Plot of Covered Call Position

Un-Covered Call Position

$50,000

$0

-$50,000

Profit/Loss -$100,000

-$150,000

-$200,000

$0 $100 $200 $300 $400 000's Land Value

Figure 3 Plot of Un-Covered Call Position

2.1.3 Buying a Put

2.1.3.1 Put Recap

A put option is a contract that allows the sale of the underlying at a given strike price, within a given period of time. A put option typically invo