The Financial Markets Secrets Untold Sophia C. Mackintosh

Contents

1. Forex Trading

2. Cryptocurrency

3. POS Business

4. The Holy Spirit in the Place

of Trade.

1

FOREX TRADING

Your success as a trader has nothing to do with your educational background; you can be a doctor, a lawyer, or a physician scientist.

If you don"t follow the rules, you will end up blowing up your entire trading account.

Trading is like learning a new skill, you must be ready to put in time and effort, let me give you an example, if you want to get a degree from a university, and you have to spend at least 3 years.

You wake up every morning, you study hard, you follow up with your classes, and if you are enough serious and disciplined, you get your degree.

The same thing when it comes to trading, if you are enough disciplined and you put in time and effort to learn, you will acquire a skill to feed yourself and your family for the rest of your life, you will get your financial freedom. So, you will never think of a day job.

Some traders spend more than 10 years to find a winning strategy and become profitable, others spend 20 years without results.

Fortunately, this will not be the case with you. Because you have the map, you have the strategy here in this Book; you will not spend years trying different indicators and strategies.

You have everything you need here, what you will need is time to master these strategies, So give yourself some time and spend as much as you can to learn, because this is the only way to succeed in this business.

Over time you will develop these trading strategies, because you will determine what works for you, and what doesn"t work. Keep practicing, and learning from your mistakes, don"t think in term of making money as fast as possible, think in term of becoming an expert of what you do, and then money will follow you wherever you are.

Good luck.

EXAMINE THE NUMBERS IT TAKES TO GROSS $10,000 A YEAR.

• All you have to do is make 150 - $250.00 in trading each week!

• That is a 30 – 50 pips daily, for 5 days in a week!

You can easily get this number every week by doing two simple things:

1. Develop a disciplined approach to trading. E.g. 30-50 Pips daily.

Once you grow your trading account to $1000, here is my personal advice: kindly make sure all other profits after trading is transferred to your wallet, but if your wallet is same as your trading account you can transfer the money to your bank account, Binance, Blockchain or perfect money so you don"t risk being over confident and blowing your account.

2. Create a winning strategy, know your entry and exit points, grow your trading account

from $50-100 or $149.50 – $295.00 or even $495. Keep building, so you can maintain an average of 40 pips daily, once you hit your daily target of 40-50 pips you are done for the day, in a year it will be more than $10,000.

The way to get the larger amount is to first make the smaller.

There is no really mystery to success.

Doing these things will help you build a tremendous momentum that will keep you going

strong through any and all of the obstacles that are bound to get in your way every now

and then.

• You gain knowledge through your constant efforts.

• Every days worth of experience adds up synergistically with the previous day!

• Your knowledge grows.

• You learn while earning!

• Your confidence expands!

• You begin to gain new ideas of possibilities you have never thought of before!

• The ideas, methods, and strategies you develop for making more money in this

exciting business get better over accumulated days, weeks, and months of steady,

directed effort.

• Before long, you are a much different person than you are now!

You will feel better about yourself, confident about your future, and passionate about the work you do!

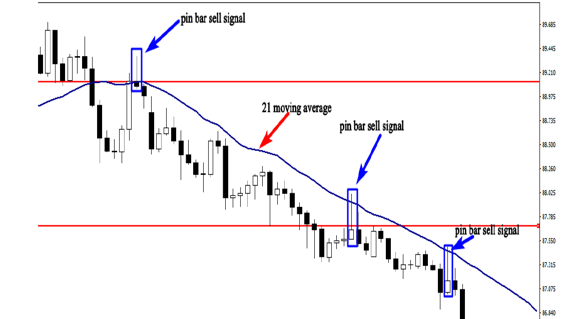

How to trade the false breakout

of the inside bar candlestick

pattern?

Have you ever placed an order with confidence thinking that the market is going to go up, but price hints your stop loss before it starts turning out to your predicted direction?? I have been a victim of stop hunting, and i was very disappointed, but that happens several times in the market.

Banks and financial institutions know how we trade the market, they know how we think, and where we put our stop losses and profit targets, this is the reason why they could easily take money from us.

One of the most famous strategies that big players use to take money from novice traders is called stop loss hunting strategy.

This strategy consists of driving prices to a certain level where there are massive stop loss orders, and the purpose is to create liquidity, because without liquidity, the market will not move.

Once stop losses are hunt, the market goes strongly in the predicted direction.

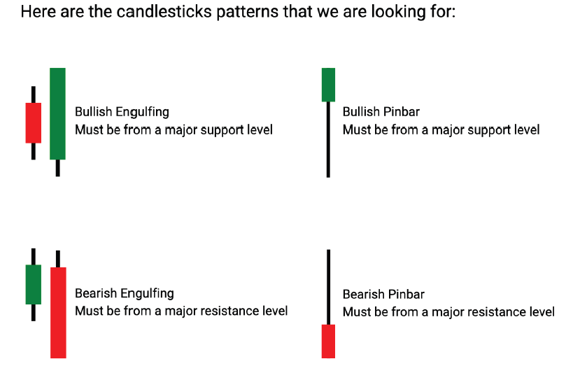

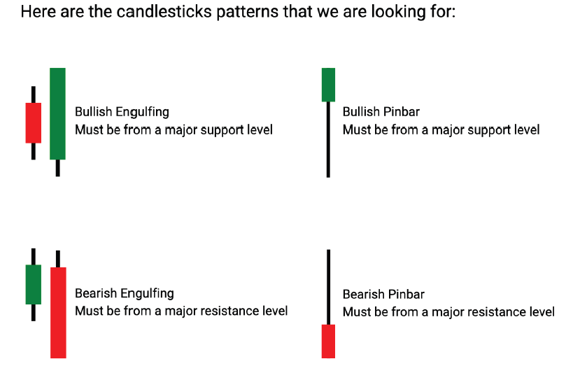

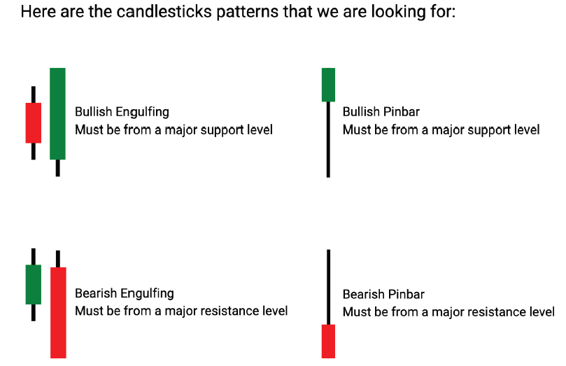

The interaction between big participants and novice traders create repetitive patterns in the market, one of the most important candlestick pattern that illustrates how big financial institutions manipulate the market is the inside bar false breakout pattern.

Your understanding of this repetitive setup and your ability to detect

it on your charts will help you better exploit it to make money instead of being a victim of market makers and banks manipulations.

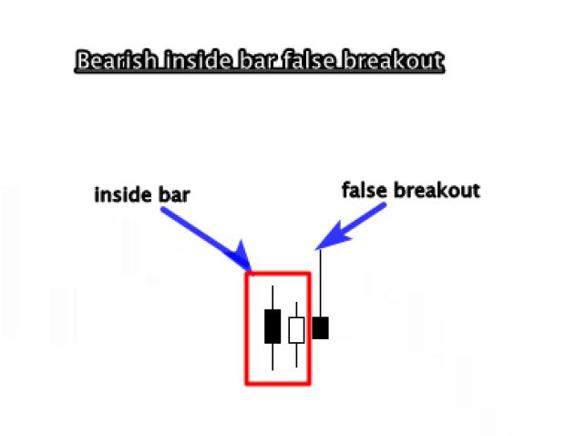

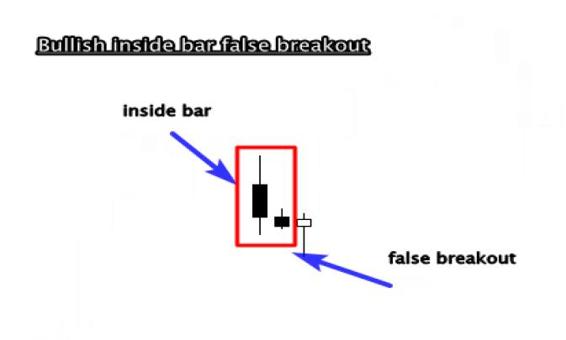

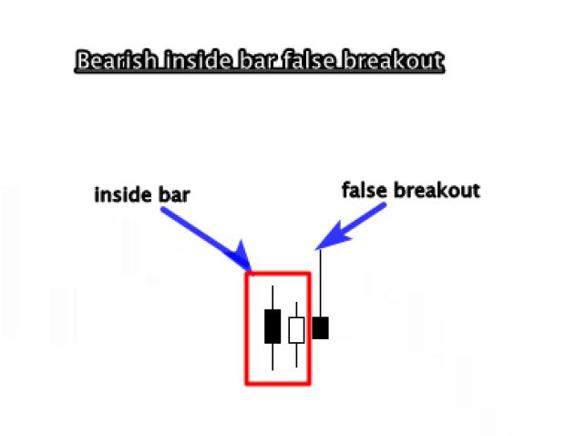

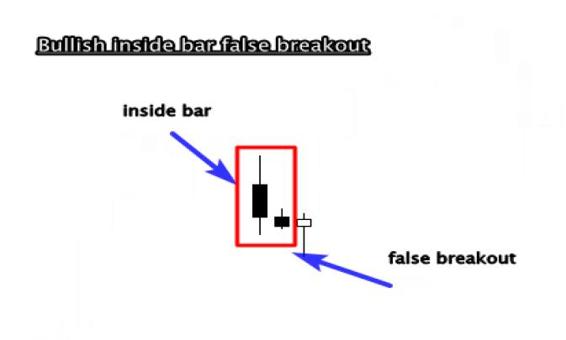

This price action signal is formed when price breaks out from the inside bar pattern and then quickly reverses to close within the range of the mother bar.

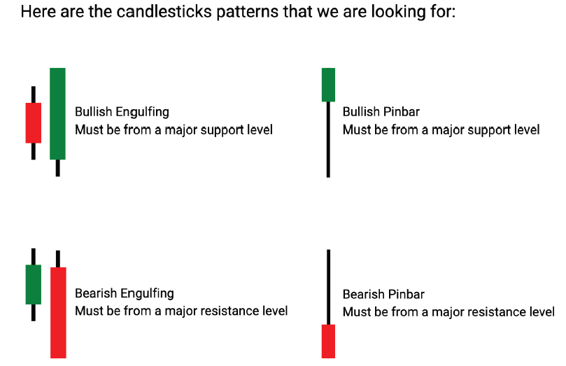

As you can see, there are two types of this price action pattern: A bullish inside bar false breakout that forms when the market is trending down and it is also considered as a bullish reversal signal when it is formed near a key support or resistance level.

A bearish inside bar false breakout that occurs in a bullish trend and it is seen as a bearish reversal pattern when it is found near an important level in the market.

This setup can be considered as a continuation pattern if it is traded with the trend.

Money management: Position

sizing

One of the most important component of money management is position sizing, what I mean by position sizing is the number of lots you are risking per trade.

All forex brokers now offer mini lots as the default position size. The smallest value for a mini lot is approximately 1$.

There are forex brokers that offer 10 cents for a mini lot which represent an opportunity for traders who don"t have bigger accounts, they can begin with 50-250$, and they still have chance to grow it.

When it comes to position sizing, you should think in terms of dollars instead of pips. Let"s say you are trading 3 mini lots of CAD/USD, this means you bought or sold 30.000 worth of us dollars.

If the market moves in your favor, you will win an amount of money equal to 3$ per pip. If you make 20 pips, you would have profited 60$.

Let"s break it down, 1standard lot is worth about 10$ per pip. And 1mini lot is worth about 1$ per pip, and 1 micro lot is equal to 10 cents.

If you open a mini trading account, you should think in term of the dollars risked instead of pips.

Let"s say you put 50 pips stop loss and 100 pips as a profit target. This means that if the market hits your stop loss you will lose 50 pips which is 50$, and if the market hit the profit target, you will win 100$.

The size of your position depends on whether you have a standard or a mini account, and how many lots you are trading. This information is important to you because this will help you know how much money you risk on each trade.

The risk to reward ratio

The risk to reward ratio concept is what will make you a winner in the long run.

Before you enter any trade, you have to know how much money you will win if the market goes in your favor, and how much money you will lose if the market goes against you.

Don"t never enter a trade in which the profit is less than the amount of money you risked.

If you will risk 100$ for example, your profit target should be at least 200$, this is a risk to reward ratio of 1:2.

Let"s suppose that you took 10 trades with 1:2 risks to reward ratio. In every trade you risk 100$.

You won 5trades, and you lost 5 trades. So you will lose 500$.but you will win 1000$.so the benefits is 500$.

This is the power of the risk to reward ratio, you shouldn"t think that you have to win all your trades to become a successful trader. If you can take the advantage of the risk to reward ratio, you will always be profitable.

The importance of a Stop loss

All good methodologies use stops. A protective stop loss is an order to exit a long or short position when prices move against you to specified price.

The stop loss insures against a usually large loss and has to be used in one way or another.

An initial stop loss can be placed with your order on the trading platform; the trade will be closed, automatically when if the stop loss is hit.

This type of stop loss will allow you to execute your trade and go spend time with your family or friends, this will help you to trade out of your emotion, because you know how much money you will lose if the market didn"t go in your direction.

Lot of traders use mental stops, when they enter a trade, they don"t place a stop loss, because they think that the broker will hit their stop loss which is not true.

The reason behind using mental stop is the human psychology, humans hate to lose money. And if you don"t accept losing money as a part of the game, you will never make money in the market.

Don"t ever think of using mental stops, because you can"t control the market, you can"t be sure that the market will do this or that.

Before you enter a trade, calculate how much you may win, and how much you may lose. Place your stop loss order. And your profit target.

And forget about your trade.

2

Cryptocurrency

Cryptocurrency is a virtual currency that uses cryptography to secure every transaction made, thus counterfeiting this kind of currency is very impossible to do because of this security feature. The invention of the so

called digital currency is not really intended by Satoshi Nakamoto the inventor of Bitcoin, which is the first cryptocurrency. In 2008, Nakamoto said that he has developed a “Peer-to-Peer Electronic Cash System,” and announced the first release of Bitcoin in 2009, which is an electronic cash

system that prevents double-spending. Bitcoin is completely decentralized with no central authority or server.

The first cryptocurrency to run online as a virtual is Bitcoin – launched in the year 2009 under the pseudonym Satoshi Nakamoto. As of February 6,

2016 there is about 15.2 million Bitcoins circulating in the world.

Cryptocurrency is just like a real physical money, you can keep it, spend it, and even do an investment with it. However, cryptocurrency can be wiped out by a system crash if a back-up copy doesn"t exist, since it is a virtual money and it doesn"t have any central repository.

Cryptocurrencies

are designed to decrease the production of money – The first cryptocurrency Bitcoin has an ultimate cap of 21 million BTC in total.

Mean to say, there are only 21 million Bitcoins can be mined, once the Bitcoin miners unlock this total number of BTC the supply will be totally tapped.

Having on hand a digital money requires „Mining", while others uses to trade theirs. People behind this gigantic invention still remains a secret, no one knows who Satoshi Nakamoto is – can"t even figure out if it"s a group or a single individual behind it.

CRYPTOCURRENCIES

With cryptocurrencies, your money is yours only and stays yours forever. You do not rely on financial institutions for holding or transferring it. You do not have to pay their exorbitant fees. In the long run, it can become the basis of a truly open and decentralized economy.

Cryptocurrencies are a real sign of the times; both joining and taking part is simple. You do not have to deal with any institutions, sign papers, or visit banks. You simply create an account, get a wallet, and track all your assets with no effort at all.

Cryptocurrencies offer you a level of independence impossible with other means. When you keep your money in a bank, you are at the mercy of other people and organizations. At any moment, your access to the money that is rightfully yours can be limited or closed by the bank outside of governmental structures. The bank can be robbed or go bankrupt.

Risk Disclosure

Trading in financial instruments and /or Cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount

, and may not be suitable for all investors.

Prices of Cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite.

3

POS Business – How To Start A POS

Business In Nigeria

POS business is a legitimate way to make money in Nigeria.

It"s more profitable in communities with no banks and places where ATMs are not enough to serve the financial needs of the community. It is also called agent banking business, and it"s an extension of the services offered by financial institutions to enable easy service offering to a wide range of customers.

POS (Point of Sale) business offers services like funds transfer and withdrawal, sales of airtime, bil payments like GOTV, DSTV, Startimes, PHCN, and other utility bil s. It is used in several places where goods and services are sold/rendered; places like retail shops, offices, supermarkets, fuel/gas stations, pharmacies, eateries, etc.

By creating easy access for financial transactions in different localities, the POS business has given individuals and business owners additional means of income. They are sometimes cal ed bank agents.

Although not serving as direct employees of a bank, they deliver banking services on behalf of banks on an agreed commission. It is a profitable business and one of the best means of getting passive income.

POS Business

Basical y, the POS business also known as agent banking began in 2013, after the Central Bank of Nigeria released its guideline on the operations and management of the business.

Since then, it has remained one of the retail channels of several commercial banks to make their banking services reach a large number of people.

A banking agent owns and operates a retail outlet. He/she conducts the financial transaction and al ows clients to deposit, withdraw, transfer funds, pay bil s, recharge airtime, inquire customer"s account balance, and other related services.

It thrives more in rural areas, semi-urban centers, the unbanked and underbanked communities. It is similar to any other remote banking channel. The banks equip the agents with point-of-sale (POS) card reader, mobile phone, barcode scanner, personal identification number (PIN) pads, personal computer, etc. They are third party agents and can be an agent to as many banks as they can serve.

If you have an existing smal business that brings in cash on a daily basis, you can diversify your revenue streams by venturing into the POS business.

Step 1: Have An Existing Business

The POS business has to do with finance and must, therefore, be approached careful y. Besides, the Central Bank of Nigeria is very particular about the business entities that qualify to be agents. So, extra care is taken by commercial banks before they authorise an agent for their retail banking.

To be eligible, you must have an existing business in operation at least for a period of 12 months. Also, you must have a shop or office from which you operate. Then, you must have been registered with the Corporate Affairs

Commission as any of the fol owing entities;

Limited Liability Company

Sole Proprietorship

Partnership

Cooperative Societies

Public Entities

Trusts or any other entity aside faith-based or NGOs.

As long as you have any of the above requirement, doing a POS business or serving as a bank agent is possible.

Step 2: Approach A Bank

Virtual y al Nigerian banks al ow agent banking services. So, as soon as you decide on the bank of your choice, the next thing

is to approach the bank and get the details of their requirement. The CBN guide allows being an agent for as many banks as you can serve.

You wil need to fil some documents/agreement forms on the transaction conditions. Then, the bank reviews the application in line with CBN, internal criteria, and enters into an agreement with you, if you meet al criteria.

Also, you must have an account for a direct deposit for the purpose of the business and provide some documents as part of the requirements for the proposal.

Some of the required documents include;

Valid means of identification e.g Driver"s license, National ID card, International passport or voter"s card.

BVN

2 passport photographs

2 current account references

Evidence of business registration (CAC Certificate)

Tax Identification Number (TIN)

Memorandum and Article of Association.

Credit Bureau Report

A minimum working capital of N50,000

Step 3: Get The Equipment Once your application to the bank has been considered, the bank then supplies the needed tools and equipment for the business. Aside from the mobile phone, the fol owing materials are usual y supplied by the bank:

Point of Sale Terminal; a portable device that facilitates payments of goods and services at bank agent locations using payment cards.

Card reader

Barcode scanner to scan bil s for bil payment transactions

Personal identification number (PIN) etc.

Step 4: Location

For you to thrive in the business, it"s advisable to choose a location with limited banks or places with few ATMs. Also, choose strategic locations like the bus stop, public market, event centers, etc. Al of these factors will have much effect on your daily profit.

Once you have a good location, either construct a shed or shop but create enough spaces for swift movement for you and the customers. Have a banner displayed at the entrance to show the retail banking services you offer.

Then, for security measures, you can have a special purse/pouch around your neck or a safe with a strong lock to prevent theft and burglary.

Also, if you notice that an ATM is not dispensing cash, you can go there to advertise your service. Some people there in need of cash might subscribe to your service.

Step 5: Render Services

The business is rendered through the use of POS terminals, card readers, mobile phones, and bank linked mobile wal ets for real-time transaction processing.

As soon as you have these, the next step is to start providing the following services;

Cash deposit and withdrawal

Balance inquiry

Funds transfer services (local money value transfer)

Bill payment (taxes, utilities, tenement rates, subscriptions, e.t.c)

Generation and issuance of mini statement

Cash disbursement and cash repayment of loans

Agent mobile payments/banking services

How It Works

In a POS business, the client first request transaction like withdrawal, transfer, or bil payment and presents the debit card. Next, the agent selects the type of transaction on the POS terminal device and enters the amounts, then, insert the debit card into the device and ask the client to secretly enter the four-digit pin. Using the network, the General Packet Radio Service (GPRS) connects with the bank"s server to authorize the transaction. When successful, it immediately prints out the receipt.

This process can be repeated for as many customers as you can, as long as you abide by the transaction rules of your host (bank).

The Importance Of POS Business

With a POS business, banks now reach a larger demographic.

Also, they offer more flexible and convenient access to existing and new customers. In addition, they ensure the safety of customers and help reduce traveling long distances to have access to banking. Most importantly, it plays a big role in boosting financial inclusion especial y to people in rural areas.

Also, the business has provided job opportunities and financial stability by helping the agent make money in the fol owing ways;

1. Commission; Banks pay agents commission based on the volume of transactions carried out on their behalf.

2. Service Charges; By rendering service to customers, you can also charge them a particular amount especial y on bil s payments, taxes, and subscriptions.

3. Float; Depending on your cash management policy, you can also make use of cash deposits, net of withdrawal for your primary business.

By operating this business, you are not only increasing your stream of income, but you are also serving the needs of the people in your community.

Conclusion

A POS business is an additional way of getting income. Aside from your existing business, it is a way to expand service offerings and one of the best methods to cross-sel your products/services to walk-in customers.

The business needs to situated in places where there are no bank branches or busy environments with enough security measures in place. You are sure to increase your daily revenue if you get everything right.

“The world is moving so fast that there are days when the person who says it can"t be done is interrupted by the person who is doing it.

-Harry

Forsdick”

4.

The Holy Spirit in the place of

trade

But the Comforter, which is the Holy Ghost, whom the Father will send in my name, he shall teach you all things, and bring all things to your remembrance, whatsoever I have said unto you.

John 14:26

From my experiences in trading there times when analysis, indicators and trends fail, in that time a still small voice instructs me on what to do, and once I trust and obey, I"m sure of winning that trade.

All things were made by him; and without him was not any thing made that was made. John 1:3

Don"t be stuck in your own ego.

Devine instruction and guidance, Self-discipline, patience and continuous learning are the most potent weapons in any trader"s arsenal.

They are essential for beginners who should never rush to trade live –

otherwise, they risk losing hard-earned money because they lack the patience for proper trading practice.

If you are new to the trading craft, you better save your funds while testing your strategy and proving yourself to be profitable.

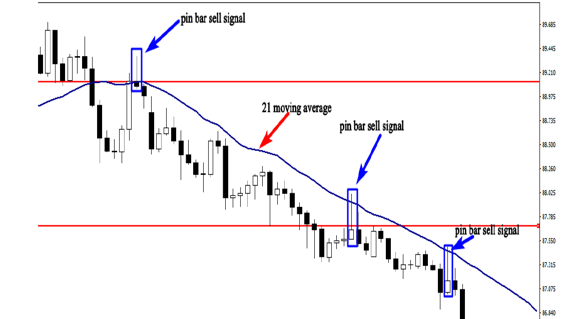

Learn to study the Forex graphs

A lot of beginner Forex traders believe that these huge Forex traders have access to some secret Forex trading scheme or use a secret set of indicators, but the reality is this is just not the case. These major Forex players are utilizing simple, but proven technical analysis techniques -

most commonly horizontal support/resistance, identification of trading ranges coupled with fundamental themes.

He that walketh with wise men shall be wise: but a companion of fools shall be destroyed. Proverbs 13:20

The Financial market is an intriguing place, but there's one matter every trader needs to learn. Always anticipate the unforeseen and don't get wrapped up in past successes. Regardless what your charts or indicators tell you; occasionally the Financial market will simply do the opposite.

Patience is king. You don"t have to go to Harvard or have a Goldman Sachs investing pedigree to have patience. And many times, that can be the difference between making money and losing money in trading.

Understand stock market history and psychology so you don"t fall victim.

Guide to trade Forex

Forex Trading isn't simple. You are able to become a good Forex trader through dedication and by treating Forex trading as you'd any other skill.

The truth is that it's hard work and must be treated with the same amount of sincerity as you would any other occupation.

The effect of all these gurus is that a lot of Forex traders start off excessively optimistic with unrealistic goals.

While there's nothing wrong with a positive attitude but this positivity has to be built on strong foundations and truthful expectations.

New Forex traders commonly begin their career by buying some secret set of indicators and they're quickly punished for their naivety.

Many of these Forex traders then buy another set of secret indicators till they become disillusioned and then stop trading. In point of fact, many Forex traders that are now successful went through this learning process.

This is only an issue if you refuse to learn from your errors. You have to break from this cycle of reliance on secret indicators and guru techniques to be successful.

You help yourself in the first place; by learning to think for yourself and understanding that while anybody may trade Forex, to be successful, you must learn to be a Forex trader.

To trade Forex is simple, all you require is a Forex trading account with money in it and then you enter the foreign exchange market and begin trading.

To be a Forex trader is more work. You have to grow from the starting point of having very little knowledge to the stage where you've a trading plan, comprehend the concepts and behavior of the Forex market and be able to trade with a cool head and comprehend that wins and losses are all part of being a trader.

Markets are made up of buyers and sellers, when buyers are more prevalent in the market, prices rise. When sellers are more prevalent in the market, prices tend to fall because the sellers have control.

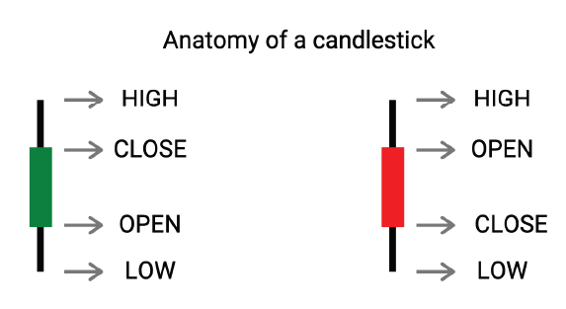

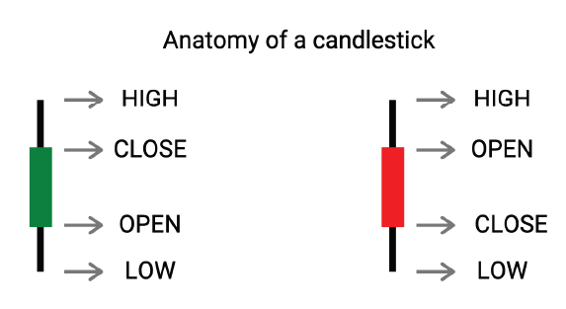

The Green Candles are the Buyers while the red are the Sellers.

Ways to improve your trading 1. Commit to learning

Follow expert advice Whether you are new to the trading craft or have a couple of years of experience in your pocket, you should always strive to learn and improve yourself. Ebooks, video lessons and helpful trading resources are your greatest ally, so make sure you save important information for when you need it most.

2. Do Your research

Following financial news is important for every successful trader.

You should keep yourself informed about latest industry developments to stay updated and get valuable ideas. A good source of information are specialised media outlets and publishers with timely and accurate announcements you can refer to.

3. Practice, practice and… more practice!

As with everything in life, becoming good at trading comes with practice, so take every chance to master new trading knowledge by applying it in real life.

4. Follow expert advice

This is best for all traders - getting access to expert tips and insights should be high on your priority list! Use the immense power of the Internet to connect to the best traders, follow them on social media and never miss an opportunity to network for success!

5. Keep a Trading Diary

A great idea to keep track of your progress is creating your own trading diary. Make sure you write down all relevant info before and after closing a trade, such as the date and time, the traded instrument, the direction of the trade, entry and exit prices, position sizes and the result of the trade once it's closed, so you can evaluate your results later on.

6. Outline your strategy Another good note is to make a step-by-step trading plan for a specific trading tournament. Or personal trading.Think of strategy as your path to victory, and make sure you set actionable goals along the way. Your strategy may vary depending on tournament requirements, so it is a good idea to set your strategic objectives as soon as you sign up with any broker of your choice.

7. Be consistent & positive

One of the most important qualities of a successful trader is his positive attitude. „Never give up" should be your mantra, and no matter how heated the trade becomes, you should always push forward and use failure as a driving force to keep you going.

There are plenty of trading tournaments available, so you always have a chance to get back on the trading arena and prove your worth!

8. Join a Community

Being part of а supportive community can be a great source of inspiration and knowledge. Joining groups on social media and discussing important topics with other traders can reap many benefits for both your social life and your trading skills, so why not give it a go?

Traders Tips

1. Organize your Time

Time management is everything! To make sure you have enough time to join a trading competition or trade personally, a good idea is to create your personal trading plan. Check tournament duration carefully beforehand to make sure you can fit it into your schedule. Choose appropriate time slots during the day that you can dedicate to the tournament. Dividing your time into smaller chunks will also help you stay fresh and avoid getting tired, which can negatively affect your trading performance.

2. Focus

Staying focused while you trade will help you achieve better results - having a focused mindset is vital for your trade, and it means remaining aware of your goals and aspirations at all times.

Essential tips are avoiding background noise and distractions while trading and having a strategy that gives you a clear idea of what you can do at any given time.

3. Practice Patience

One of the most remarkable qualities of successful traders is their patience and ability to remain calm under pressure.

You should never forget that practice makes perfect, and winning a trade requires time and effort. Improvements will not come overnight, so you should never lose courage if you do not win a trade right away. Furthermore, your mental balance is an essential factor for your success, so taking some time to do short prayers, meditations and breathing exercises can significantly improve your focus and overall mood.

4. Get Moving

Spending a lot of time in the digital world can negatively affect your mind and body, especially if you dedicate yourself to activities that require lots of screen time and concentration, such as trading. That is why you should set some healthy goals for yourself and integrate movement into your daily routine. Short walks, bike rides, going for a swim or even taking the stairs will help you get that blood pumping and lift your spirits after a long day of trading - guaranteed!

If you cannot bring yourself around to do it, make a deal with a friend for some „sports support" - hitting the gym together or going for a quick afternoon run will be so much more fun in good company!

5. Take a Break

We cannot stress enough how important breaks are! Make sure you take some time to relax and appreciate yourself! As a trader, you are brave, independent and ambitious, and you should always recognize your strengths and unique qualities by finding some time for rewards and positive experiences. A good idea is to take short breaks every one hour or so, remember to sleep enough at night, drink plenty of water and generally, take good care of yourself because, after all, you are your most valuable asset.

The Financial Markets Secrets Untold Is a timely masterpiece, with simplified expositories in Forex, Cryptocurrencies, POS Business and ways to trade and succeed in the market.

Make sure you get your copy, for your wife, kids and friends.

Sophia C. Mackintosh

Is highly anointed by the Holy Ghost in Knowledge.

Knowing the age and its trend is a rare gift that academics or intellect can"t afford, he started as a trader but is now a mentor.

He is from Port Harcourt, Nigeria.