Part one - for those with defined contribution (DC) schemes

In this rst part of the guide we will set out exactly what options are available to you, if you have a de ned contribution pension scheme and are planning to move abroad, or are already abroad and have pension assets left in the UK.

There are three main choices:

1. Leave the pension in the UK and purchase an annuity

2. Leave the pension in the UK and enter "pension drawdown"

3. Move the pension outside of the UK into a scheme known as a QROPS

1. Buying an annuity

An annuity is a traditional pension arrangement; one which is becoming less common now that the Government has granted people more flexible access to their pensions - more on this later.

An annuity purchase is a one-off transaction in which an individual's entire pension savings, minus any pension commencement lump sum (sometimes called a tax free lump sum), are exchanged for a contractual arrangement that guarantees an income for life.

Before you purchase an annuity, you are allowed to The decisions you make as you approach retirement will have a lasting impact on your future nancial wellbeing - and should - shop around using what is known as the Open Market Option to see what rates of income are available and to see if you can get a better deal than that offered to you by your existing pension company.

If you do decide to take this route, make sure you thoroughly research your options as the difference between the available rates of income can be considerable.

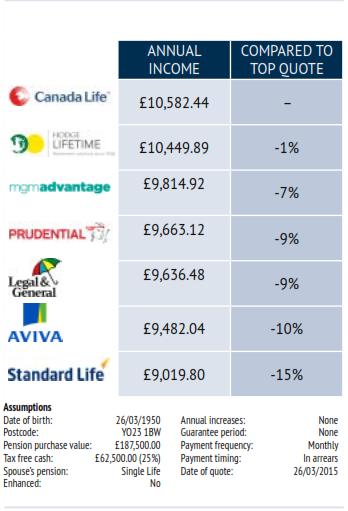

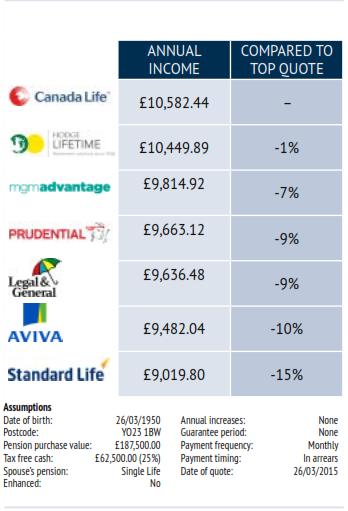

The table below shows the incomes offered by different insurance companies for a pension of £250,000, after £62,500 tax-free cash (25%).

Higher rates of income are available for a wide range of health conditions and even for being a smoker, so make sure you fully understand your options before you commit to buying an annuity.

For instance, in the above example, someone slightly overweight, who smokes 10 cigarettes a day, with high blood pressure and high cholesterol could receive a maximum income of £12,537.24 (as at 26/03/2015).

It is also important to note that, generally speaking, the annuity dies with the policyholder so there is no option to pass on any bene ts on death. There are some exceptions though:

It is also important to note that, generally speaking, the annuity dies with the policyholder so there is no option to pass on any bene ts on death. There are some exceptions though:

• A joint life annuity will allow you to pass annuity bene ts onto a spouse on death

• Choosing a “guaranteed period where your income is assured for a certain number of years even if you die before the period ends. If this were to happen the income would then be paid to your bene ciaries for the rest of the guaranteed term

• Using an annuity protection lump sum. If you die before a certain age, which is pre-agreed with your provider, the fund value, minus any income already taken, can be paid to your bene ciaries.

Before buying an annuity, you are allowed to take up to 25% of your pension as a tax free lump sum. However, it is worth bearing in mind that this will decrease the amount of annuity income you will then receive for the rest of your life or the amount you will then be able to pass on to any beneficiaries.

If you decide to buy an annuity, do not forget that the income will be subject to your marginal rate of UK income tax before it reaches your account.

2. Pension drawdown

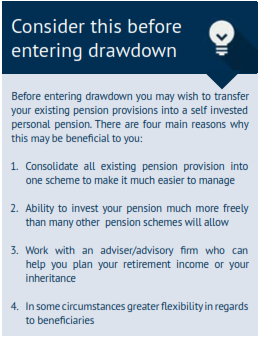

In pension drawdown, your pension fund remains whole and you take an income from it.

Because your pension remains invested you are able to continue to grow its value – or at least slow the impact of taking an income – once you have begun Retirement

. Drawdown is much more flexible than an annuity. With drawdown you are able to change the amount of income you would like to take at any time and the frequency. You are also able to pass on benefits after death. This can be passed on without being taxed if death occurs before the age of 75.

Before commencing drawdown, you are allowed to take up to 25% of your pension as a tax free lump sum.

Drawdown is an attractive option as it gives people flexibility over how much income they take. Also, if the underlying investments perform well, they can offer some protection against inflation.

It is worth noting that drawdown carries more risk than an annuity option because there is no guaranteed income and the value of your pension may fall.

As with an annuity, by leaving the pension in the UK, it will be subject to UK income tax at the normal rates.

New pension flexibility – what does it mean?

The UK has just undergone the biggest shake-up of its pension rules since the pension regime was introduced in 1921, with wide-sweeping changes granting people unprecedented access to their pension savings.

From 6 April 2015, UK pension holders can access as much of their fund as they like, as often as they like, from age 55.

There are of course some considerations to bear in mind as, although you will be able to access your pension cash much more freely, you will still have to pay tax on any withdrawals.

Under the new rules, you could decide to take your entire pension as a cash lump sum. But if you do this, only the first 25% will be tax free, with the remaining 75% taxed at your highest marginal rate of tax.

You are also free to decide how much and how often you would like to receive payments from your pension.

Before you reach the age of 75, or before what is known as a benefit crystallisation event, you will be able to take lump sums out of your pension each year, with the first 25% tax free.

After age 75, or a benefit crystallisation event, you will be taxed on each withdrawal at your highest marginal rate as you withdraw the remaining 75%.

The most important thing to remember is that the new pension flexibility rules mean you can decide how much and how often you would like to withdraw cash but that it is still subject to income tax.

The rules also mean you will have more choice in how you use your money to support your retirement. For example, you could invest in a buy-to-let property or even start a new business venture.

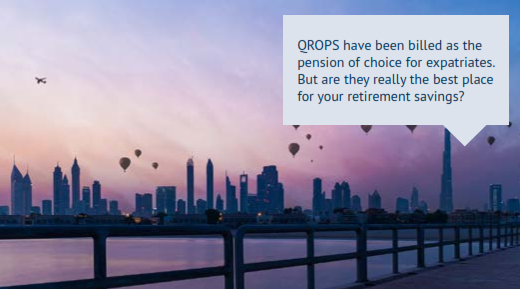

3. A Qualifying Recognised Overseas Pension Scheme (QROPS)

QROPS were introduced in April 2006 and allow people to transfer their pension to another country if they decide to move outside the UK.

It is really important to know that QROPS are only suitable for those who intend to leave the UK permanently and who are also prepared to completely cut financial ties with the UK.

There are a very wide choice of QROPS available, with trustees based in a number of different jurisdictions. Each jurisdiction has different tax levels and rules which will impact the amount of tax you pay on your pension and how this is managed.

At the end of this chapter we give an example of how transferring your DC scheme into a QROPS could work in practice.

There are a number reasons why moving your pension into a QROPS could make financial sense. One of the biggest reasons is because you could pay much lower rates of tax.

Here are three big tax advantages a QROPS can offer:

1. Income is not subject to UK tax at source therefore allowing low/no taxation depending on jurisdiction and country of residence

2. For those with larger pensions, a QROPS transfer is a benefit crystallisation event and can ringfence monies against taxation as/when exceeding Lifetime Allowance

3. No tax on passing on benefits post age 75, which is significant considering current life expectancy Rates.

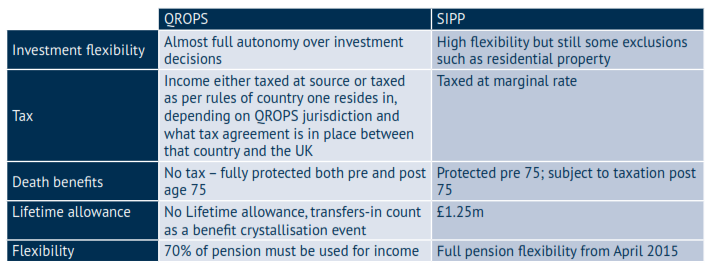

In addition, QROPS will usually allow a slightly wider range of investments than those available within a SIPP. One popular investment made by people through their QROPS is into residential property, something not permitted within UK pensions.

At retirement, you are still able to take a tax free lump sum – the amount of which depends on the scheme you use.

However, at the time of publishing this guide, only QROPS based within the EU are able to offer clients access to 100% of their pension as with the new flexibility rules in the UK. Most QROPS will still stipulate that at least 70% of the fund’s value must be used to provide an income for the life of the beneficiary.

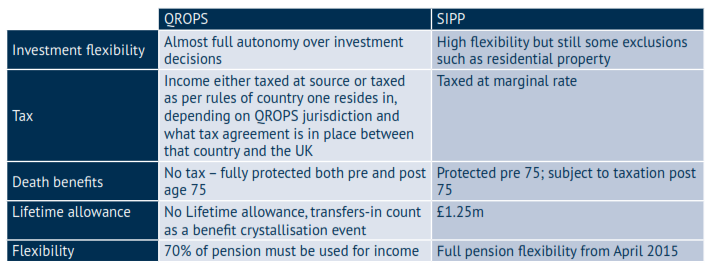

At a glance: QROPS vs. SIPP

In practice – transferring from a DC pension into a Maltese QROPS

Mr Shepherd had three occupational personal pension schemes which had a combined value of £950,000. At age 50 he emigrated to Spain, took pension transfer advice and transferred to a Maltese QROPS.

One of his primary concerns was having more control over what he invested his money into, given there were only a limited range of options available through his current schemes. By working with a financial adviser he was able to place his money inta wide range of funds with an aggressive attitude trisk. It was also much easier to monitor within one Scheme.

When the funds were transferred it counted as a benefit crystallisation event, meaning that he did not exceed the current lifetime allowance of £1.25m. This allowance is due to be reduced to £1m in 2016 and as his pot grew substantially beyond this limit by age 55, the decision to transfer into a QROPS saved tens of thousands of pounds in tax.

At age 55 he decided to use his entire pension for income as he had other cash savings and used only around 3% per annum.

He passed away at age 77 with around £500,000 left in his pension but, even though he had passed his 75th birthday, because he was in a QROPS he was able to leave this money to his children, completely tax free.

It is also important to note that, generally speaking, the annuity dies with the policyholder so there is no option to pass on any bene ts on death. There are some exceptions though:

It is also important to note that, generally speaking, the annuity dies with the policyholder so there is no option to pass on any bene ts on death. There are some exceptions though: