Business Standard Article Storyline

Wealth / investment management is a big opportunity globally…..

Global private wealth is projected to post a compound annual growth rate (CAGR) of 4.8% over the next five years to reach $171.2 trillion by the end of 2017. The Asia-Pacific region (excluding Japan)—and especially its new wealth—will account for the bulk of this increase in global wealth through 2017 (reference: BCG Report). Assets owned by mass affluent (people having investable assets between US$ 100K to US$ 1 Million) is projected to increase from $59 Trillion in 2012 to over $100 Trillion in 2020, one of the fastest segment of population in wealth increase, and a largely underserved by wealth management industry as of now. The global middle class (investable assets between US$ 10K to US$ 100K) is projected to grow by 180% between 2010 and 2040, with Asia replacing Europe as home to the highest proportion of middle classes, as early as 2015. This further adds to a huge underserved market for wealth management. (Reference: PwC Report)

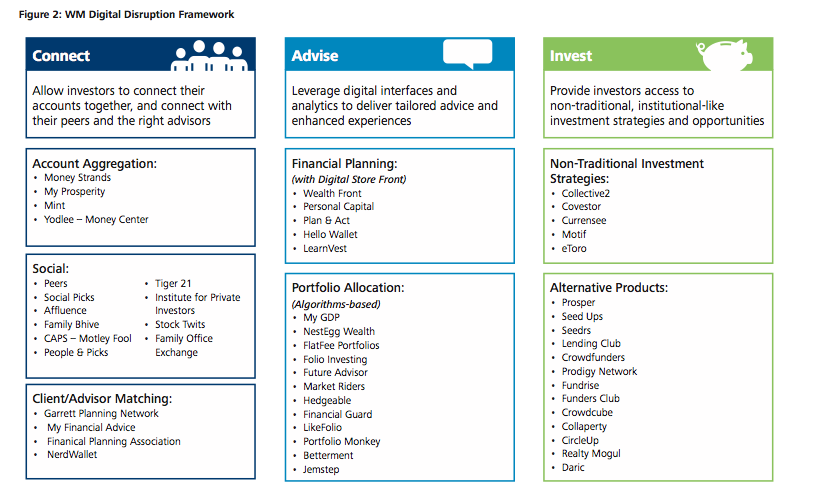

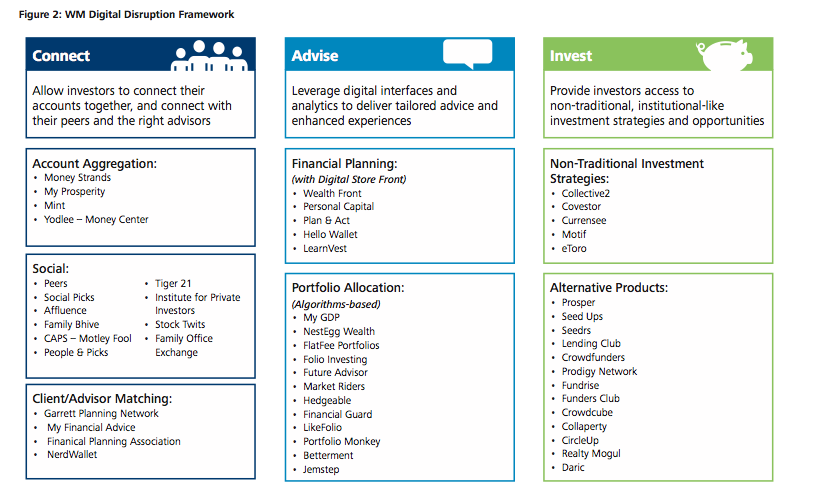

This calls for hundreds of billions of dollars in revenue for the currently underserved and growing customer base for Wealth Management. Moreover, this generation is mostly digital and is always connected and mobile. Traditional players (banks, brokers and advisors) have a long way to catch up with this divide and are nowhere close to offering a seamless, personalized, “on the go” wealth management advice. This has resulted in disruption through innovative startups and even bigger players hoping to catch a big pie of this trillion dollar industry.

Wealth Management Disruption – Already taking hold and here to stay….

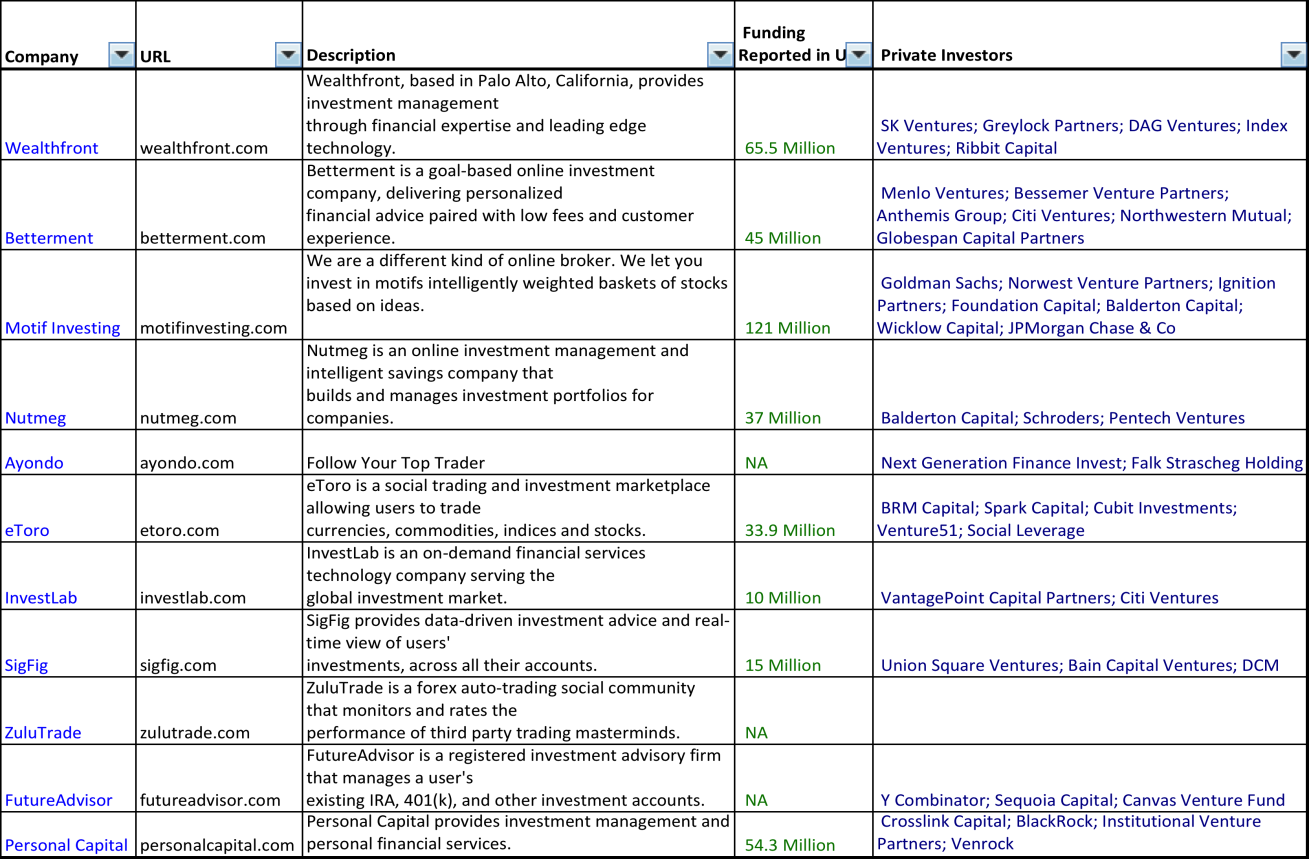

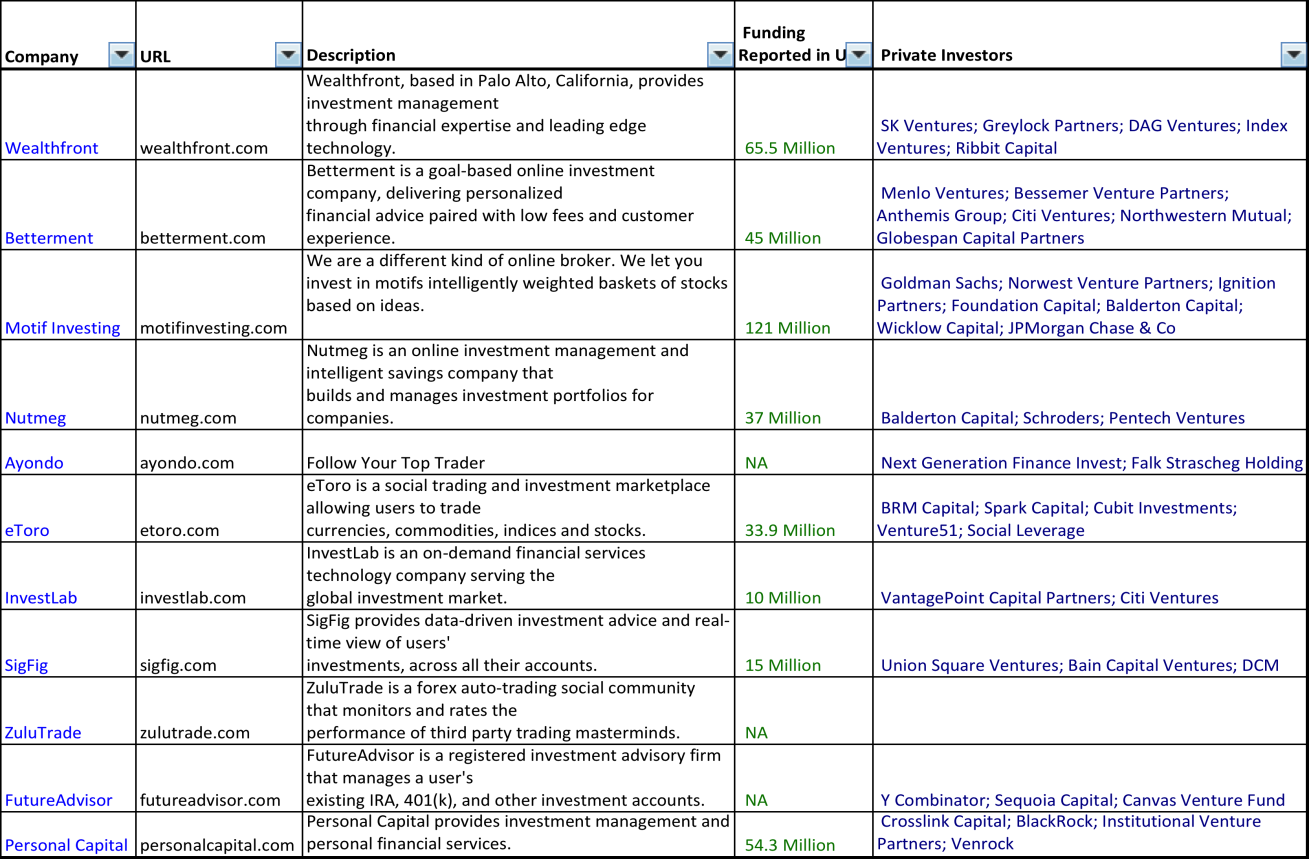

Various startups backed by some big investors like Goldman Sachs, JP Morgan, Sequoia Capital, Index Ventures and having financial biggies like Arthur Levitt Jr. (former chairman of the Securities and Exchange Commission), Sally Krawcheck (former president of BoA’s Global Wealth and Investment Management group) and Dr. Burton (former dean of Yale School of Management) on their boards have innovated around a few models. The most famous of these disruptive startups are:

- Wealthfront – Silicon Valley based automated investment advice based on risk profile, with a low fee of up to 25 bps. They recently crossed $ 1 Billion in AUM and have raised over $65 Million (reference TechCrunch: http://techcrunch.com/2014/04/02/automated-investment-service-wealthfront-raises-35mfrom-index-ribbit-capital/)

- Motif Investing – This biggie startup, which has already raised over $ 121 Million from strategic investors like Goldman Sachs is disrupting the likes of Blackrock. The online brokerage allows investors to build stock and bond portfolios based on everyday ideas and broad economic trends—and share those ideas with friends. They were ranked the 4th most disruptive startup in 2014 by CNBC (reference TechCrunch: http://techcrunch.com/2013/04/12/motif-investing-gets-25m-series-c-goldmansachs/)

- Personal Capital – Backed by Blackrock and with a funding of above $ 54 Million, it provides a full financial service online with a host of its own wealth managers, taking on Fidelity and Schwab in the large market of individually managed investable assets – a $32 trillion dollar market in the United States. (reference TechCrunch: http://techcrunch.com/2013/06/05/personal-capital-closes-25-millionin-series-c-funding-for-online-wealth-management-platform/)

- Nutmeg –UK based startup funded by Balderton Capital and offering investment management for the masses. Nutmeg offers portfolio management services to anyone with as little as £1,000 to invest. It now has over 35,000 registered users and claims its customer acquisition in Q1 was 350% up on last year and is already in the top 25 of wealth managers in the UK (reference TechCrunch: http://techcrunch.com/2014/06/25/nutmeg-raises-another-32m-to-disrupt-wealth-management-startup/)

- E-Toro – A European startup with a very big social angle and believing in crowds wisdom and mirror trading. It is an investment network that uses real-time features to let users follow and trade based on other users’ activities. They already have over 2 million users (reference TechCrunch: http://techcrunch.com/2012/03/13/social-investment-network-etoro-is-picking-up-another-15-millionfrom-spark-others/)

Below is a more detailed list of startups which have been funded in this domain globally:

Asia and India – A virgin market and the next frontier for funding

The Middle Class (investible assets of $10K to $100K) and Mass Affluent in Asia (investible assets of $100K to $1 Mn) currently comprise a market of over 560 Mn people, which is set to grow to over 1.75 Billion by 2020. With wealth creation and savings rate in these segments growing, there is an increasing need for simple, trustworthy investment options, which can be easily executed on. However, most mainstream investment advisory, wealth management solutions or trading providers cater only to sophisticated/ high network clientele or offer complicated/opaque products. “Private banking industry in Asia over the last 15 years has been about selling over-priced products with big margins and limited transparency. As a result of this approach, bankers across the industry have generally not been able to cultivate the skills to sell real wealth management. Coupled with this, a lot of clients don’t trust the banks” (reference: Hubbis Report).

Closer home, total individual wealth in India was ~ $ 3.4 Trillion in 2013 out of which $ 1.9 Trillion was in financial assets. However, while cash and savings deposits comprise 25% of financial assets, MFs comprise only 3% and FDs/Bonds comprise 23% and Direct Equity comprises 22%. Hence the potential for wealth management advisory solution is huge but untapped as of today (reference: Karvy India Wealth Report 2013). Consequently, we anticipate wealth management disruption by startups to percolate down to India and Asia as well.

Early movers in this are already making inroads, however competition is still very limited. And VC funds are actively focusing on these select high quality opportunities in Asia. One such startup is TradeHero based out of Singapore which lets people play stock markets using gamification models. TradeHero raised $10 Million in 2013 from KPCB and IPV Capital. Another interesting startup which is seeking to change wealth management advice and investments distribution in India is InvestEaze set up by Delhi based company Info Assembly Pvt. Ltd.. Started by three IITians (2 are from IIT Delhi and one from IIT Roorkee), InvestEaze leverages a proprietary platform to provide online, simple to use, goal-based investment choices that are socially proofed by a network. The founders who have over 20 years of trading, capital raising and investing experience across the US and Asia at PIMCO, O3 Capital and McKinsey have leveraged their personal experience onto combining innovative financial models and product curation into a social platform. The founders call it “the Facebook of Investments”. Their unique launch page at http://investeaze.com/ received nearly 700 signups within one week of launching. Already funded by ARK in the US and one of the showcases at the upcoming Techcircle Conference in New Delhi, InvestEaze aspires to be a pioneer in enabling disruption within the financial space in Asia just like Wealthfront and Motif in the US. It remains to be seen whether they can succeed.

Select Backup Articles Attached Below

Reference: Deloitte Report