PART 2 History of Money

Gold and silver as money go way back to the ancient greeks. The Greek civilization used a coin called the electrum, which was a natural combination of gold and silver.

(Greek Electrum)

(Greek Electrum)

(Roman Aureus)

(Roman Aureus)

The Romans had a gold coin called the

Aureus, a silver coin called the

Denarius, and also coins made of bronze.

The use of gold and silver as money came about through necessity really. Barter systems of exchange were and still are very inefficient. When the hat maker did not want a chicken for payment, there had to be a valued asset that could be more easily exchanged.

(Roman Denarius)

(Roman Denarius)

Gold and silver met the criteria for this and they have remained real

money for over 6,000 years.

In fact,

Plato and

Aristotle spoke of sound money to have the following characteristics.

1. The ability to be durable. It must stand

the test of time and not wither.

2. The ability to be portable. Good

money needs to hold value in a small

space.

(Statue of Aristotle)

(Statue of Aristotle)

3. The ability to be divisible.

Real money should have the

ability to be divided evenly and still hold its value. Also

known as

fungibility. Diamonds are not fungible because

each diamond has it’s own value, so therefore is not used as

money.

4. It must hold a rare value or quality.

Goldsmiths

As we will see later in this book, historically most

governments have used a gold standard for their monetary system, where a gold coin was circulating for daily

transactions.

When people wanted their gold and silver to be safe from thieves or whatever else could take their wealth, they would store their gold with a

goldsmith for a small storage fee.

The goldsmith would simply give the depositor a paper certificate that was proof of deposit and could be redeemed for gold at any time. So, people stopped dealing in gold coins and just transferred paper receipts. After all, they were the same as gold because they could be redeemed for gold any time.

Over time the goldsmith realized that he had large amounts of depositor’s gold and hardly anyone ever came to pull out all of their gold at the same time. So, the goldsmith lent out a small portion of the gold on reserve in exchange for an interest payment.

The goldsmith finally realized that he could lend up to 90% of the gold in his vault and collect interest on the loans with no problems. After all, there were never HUGE amounts of people coming to withdraw their holdings at one time, so the goldsmith could get away with it.

Once people finally caught on to the goldsmiths act, people panicked and went to redeem their paper receipts for their gold. The only problem was that there were now many more receipts in circulation than there was gold.

Of course, there was not enough gold to cover all of the receipts in circulation.

This is how the first run on the bank took place and also the beginning of what is known today as fractional reserve banking. It’s called "fractional reserve" because banks today are only required to keep a “fraction” of the customer’s reserves’ on deposit.

By the way, if you are not familiar with a run on the bank it's when everybody rushes to pull their money out at the same time.

Out of every $100 on deposit at most banks, $90 can be lent out to customers. Just like there were runs on the banks in the GREAT DEPRESSION and other times throughout history, there will be more runs on the banks in our future.

Panic of 1873-Bank Run

In fact, Citi bank recently announced a new change. They sent letters out to customers expressing that they reserved the right to have a written request seven days before depositors make a withdrawal from their checking accounts.

This is closely related to what is known as a bank holiday, where banks close the doors and don't let customers withdraw cash. This occurred during the runs on the

bank during the great depression. The banking industry is a very secretive practice, and not many people really understand the practices of the banking industry. It is meant to be confusing and secretive because if people understood the banking industry, they would be so OUTRAGED and disgusted that the banks would not be around for very long.

I'm getting off topic. Since goldsmiths did have actual gold in their vaults and therefore real value, people who got to the banks early could get their gold coins.

St. Gaudens $20 Gold Piece (1907-1933)

In 1930 you could have taken a $20 bill to the bank and exchanged it for a one ounce gold coin. What I find CRAZY is that today if you tried to take a $20 bill to the bank and exchange it for gold they would laugh at you because dollars are not exchangeable for gold at the bank anymore. That means that your dollar has no backing of any sort. The only thing giving our paper money value is the "faith" that we place in it.

It is also important to note that gold can not be inflated like dollars. If a bank decided to open and they only kept gold and silver on deposit and did not loan money against your gold and silver on deposit, then our money would be a true and sound money.

The Lakota Nation Bank is the only bank in the world who has done this. Since our dollars are just paper with no backing, the Federal Reserve can print as much as they want and never run out.

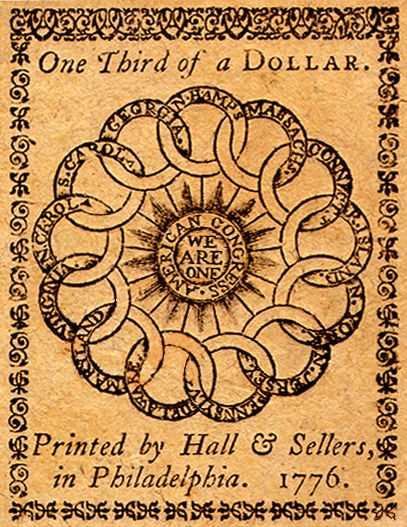

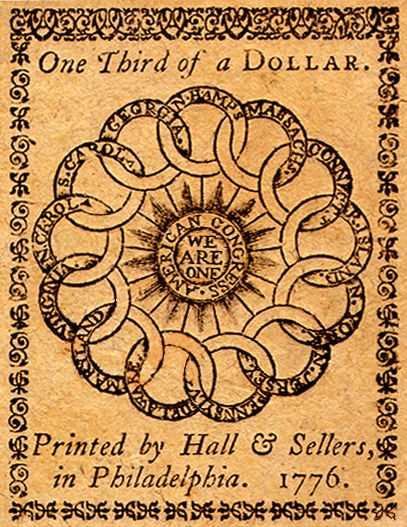

The "Continental"

During the Revolutionary war the continental Congress issued a fiat currency to finance the war against the British. The currency was dubbed the

"Continental" and it became worthless in a matter of a few years. That's where the saying "not worth a Continental" originated.

The British government made counterfeit "Continentals" and put them into circulation in all of the colonies as a way to try and stifle the resistance via inflating the money supply. The massive amount of paper money in circulation eventually led to a collapse of the currency.

"Continental" currency

Fiat Currency

A fiat currency, as it is known, is a paper currency that has no backing by any hard assets like gold or silver. It’s just paper with ink and no gold or silver in a vault backing it up. The U.S. Dollar is a fiat currency. Many people have trouble understanding the concept of fiat currencies and inflation, as it is rarely defined as clearly as it should be.

With no gold backing of any currency, governments are naturally going to take advantage of this by printing as much as they need. The U.S. government is doing just that. This is why many economists are practically screaming to buy gold, buy silver and buy commodities.

(Fiat money backed by nothing)

(Fiat money backed by nothing)

( Silver Certificate from 1935)

( Silver Certificate from 1935)

These two paper bills may look the same, but the

silver certificate was actually redeemable for real money; a silver coin.

The only currency that is not totally considered fiat is the Euro, and it only has a 7% gold backing. In other words, for all of the paper dollars in circulation, only 7% of the Euros could presumably be exchanged for gold.

So, you may be asking what your paper dollar is worth since you can’t exchange it for gold. Well, I’ve got news for you. Your paper dollar is just that, paper. The only thing giving your dollar any value at all is the faith that you put into it.

We have all read this note written on a dollar bill:

This note is legal tender for all debts public and private.

This is the governments’ way of saying that you have to accept paper dollars as a currency, even if it has zero intrinsic value like paper does. This is the fraud of the dollar.

Historically, legal tender laws had to be put in place in other countries because people finally stopped using the intrinsically worthless paper money.

The government knows that paper is worthless. That's why they have to put a legal tender note on our dollar to make people accept them. This isn't the first or last government to put forth legal tender laws.

Gold Certificate (1882-1933)

Gold Certificate (1882-1933)

Gold certificates were freely convertible into gold coins. They were made illegal in 1933, when the U.S. went off the gold standard.

The Gold Standard

The gold standard is a monetary system where the unit of account is a fixed weight of gold. These are the three different gold standards that have been used.

• Gold Specie Standard - In this monetary system, the monetary unit in circulation is a gold coin.

• Gold Exchange Standard - In this monetary system it references only to silver coins or coins made from other metals in circulation.

• Gold Bullion Standard - In this monetary system, gold coins are not circulated but the government allows the sell of gold bullion on demand.

Historically, when countries are on a gold standard they agree to keep each currency note issued equal to the amount of gold they have on reserve. If they increase the amount of currency in circulation and don't increase the amount of gold on reserve to back the currency, then the value of that currency falls against foreign currencies.

(

Gold Byzantine coin)

The Byzantine Empire used a gold standard and minted a gold coin called the Byzant. A silver standard was also commonly used in the 19th century.

Back in 1971, President Nixon took the U.S. off of the gold standard thereby making it impossible for foreign creditors to exchange their dollars for gold. Since that time, no country has used the gold standard.

The whole purpose of a gold standard is to keep the currency stable. As we will see, governments around the world have effectively abandoned the gold standard for a fiat based central banking model.

This model does not make much sense at all since it ensures that the rich get richer and the poor get poorer.