T H E S U M M A R Y

F O R E X S I M P L I F I E D

THE BEST FEELING IN THE WORLD IS HAVING

THE ABILITY TO GENERATE INCOME WITHOUT

HAVING A TYPICAL 9-5 JOB. THIS BECOMES

POSSIBLE AFTER YOU LEARN AND MASTER A SKILL TO HELP YOU OBTAIN WEALTH. THIS

BOOK WILL HELP GUIDE YOU ON YOUR

JOURNEY BY EXPANDING YOUR FOREX

KNOWLEDGE

The SHou

use m

of Cram

ne

ary

Forex simplified

House of Crane , LLC

Published 2022

Discl

Hous a

e of C iram

ne

er

The house of crane does not Give financial advice.

Nothing in this book should be considered financial advice. Trading comes with considerable risks and you will lose your money if you behave like an idiot. Please backtest and demo trade any concepts found in this book.

Click here to

join my mentorship

This book is a summary of how I trade. I simplified my concepts even further and I hope this will assist in your growth as a trader.

Part 1

THE MIND OF A TRADER

The mindset of a trader is a fragile one. It’s a mind full of anxiety and unnecessary fear, which causes a lot of losses in the market. Your trading suffers because you lack patience as well as the ability to keep your thoughts stable while trading.

Instead of learning one style of trading and mastering it, traders try to learn from any, and everyone. The worst part is when they include or immerse themselves in multiple group chats, relying on advice from their peers instead of looking within.

Traders tend to take way more trades than necessary. There’s no valid reason for taking 5-10

trades on a daily basis if you haven’t mastered the art of trading. Even those who have great trading ability are disciplined enough not to be in the market, constantly searching for trades.

The wealthiest traders in the world didn’t get rich from constant scalping. They had a plan along with the right mindset and attitude, which enabled them to succeed in the forex market. I recommend you do some research on the top 10 forex traders, but I’m sure you‘re not going to do it. You refuse to put in the extra work and it definitely shows.

Here’s where a lot of you fuck up. You enter a trade, the trade hits your profit target, but then something tells you to immediately look for another trading opportunity. You find the trade you’re looking for, except this time it hits your Stop Loss. The profit you gained earlier is given right back to the market and you sit there upset and confused.

This habit of over-trading is what plagues many retail traders in the foreign exchange market. Their impatience is a huge detriment to their psychology, and if this habit continues, it could ruin them financially.

So how do we solve these issues and overcome these negative habits? Well, we start by bringing awareness to the areas of our trading that cause us to fail.

When I say us, I’m referring to you lol. My trading is elite.

Once you’re aware of your problem areas, start figuring out ways of eliminating them. If you take multiple trades a day, narrow it down to 2-3 quality trades per week. Choose 1 or 2 forex pairs and focus on those only. By doing this, you remove most of the anxiety and pressure you place on yourself.

Stop letting the wrong things motivate you and stop chasing the money. If you don’t genuinely enjoy trading and your only goal is money, you’ll find it extremely hard to obtain the money. Trading is an art that requires passion and dedication.

Hopefully i’m not boring you too much. We’ll get to the charts soon, I just wanted to help you with your mindset first. Some of you probably skipped this first part and went straight to the charts lol. Fucking losers smh…

Part 2

Enter the Gann

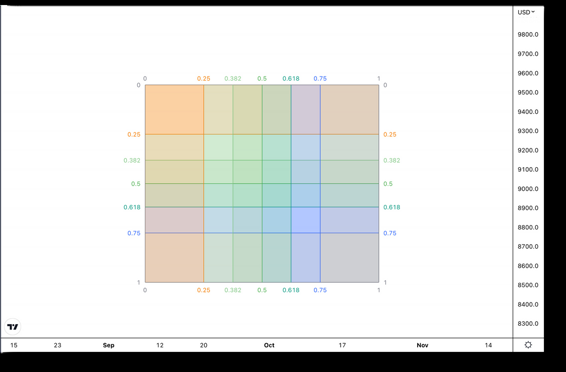

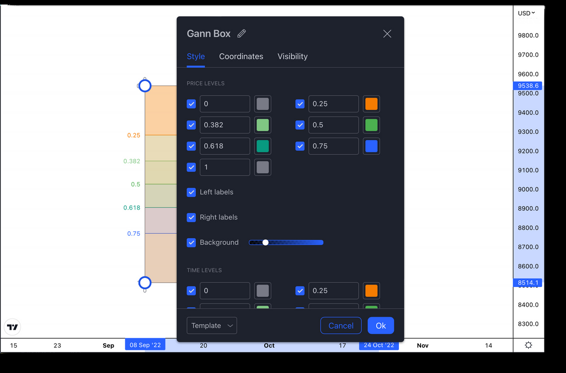

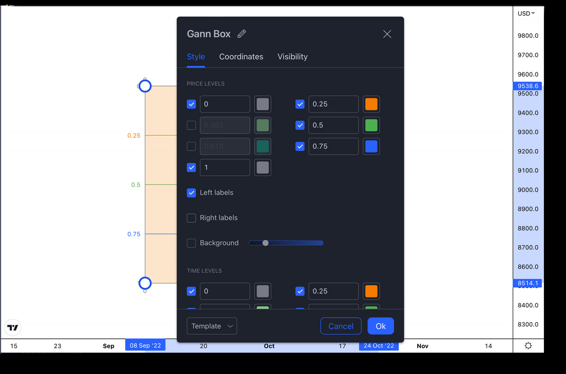

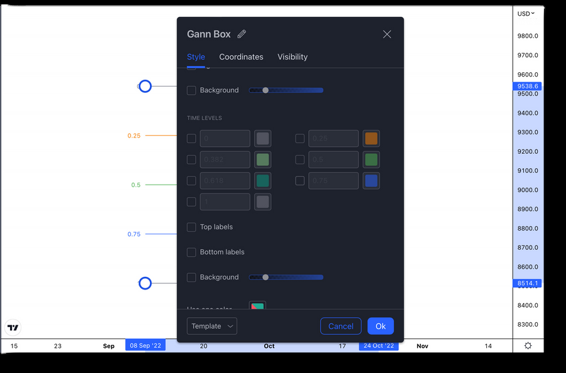

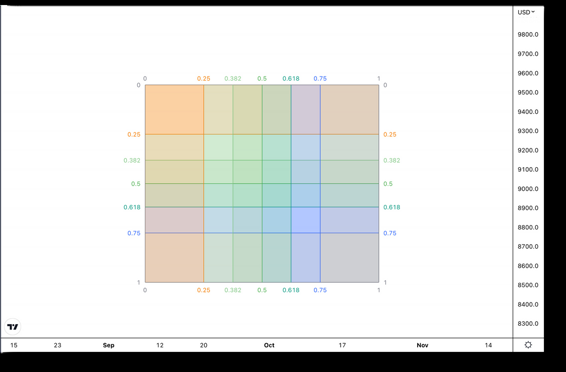

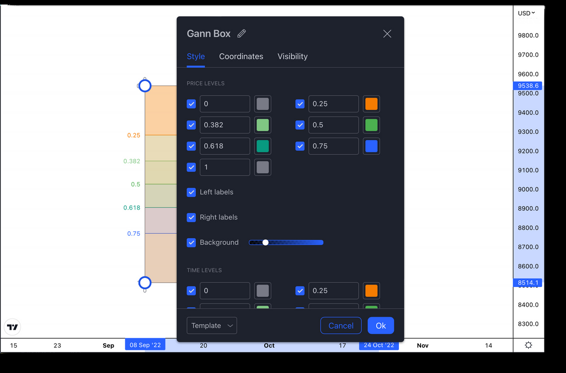

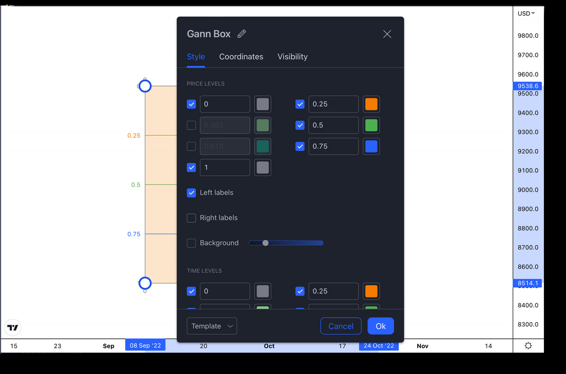

The main component of my trading is the Gann box. It provides the framework I need to find high probability trades in the forex market, as well as other markets like stocks and crypto. Below is an example of the default settings for the GAnn box, but I don’t use these settings.

I modify the Gann box to fit my method of price analysis. I do this by changing the settings and removing some of the numbers, lines and colors.

We’re going to go into the GANN settings and change a few things. For the horizontal price levels uncheck the 382 and 618 levels. Next, uncheck the right labels and background.

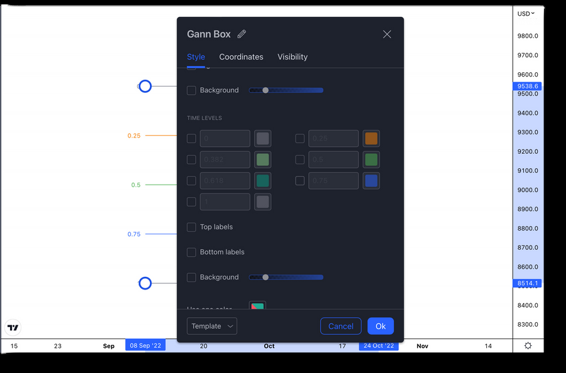

Scroll down in the settings and uncheck everything under time levels.

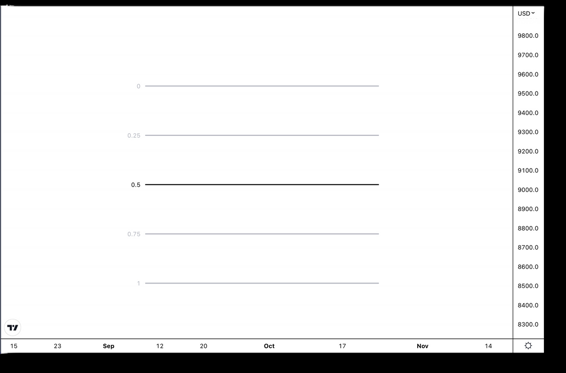

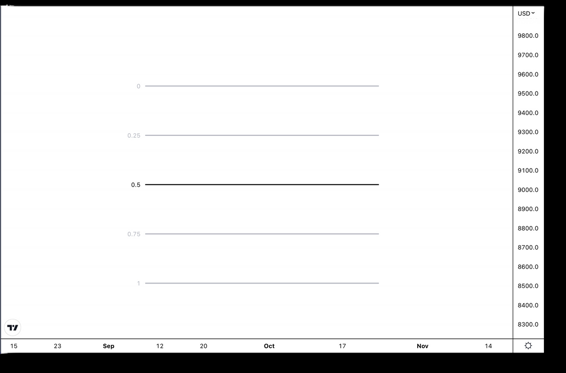

Your GANN box should look like the example below.

The colors are your choice, but highlight the 50

level with a different color.

Part 3

The Framework

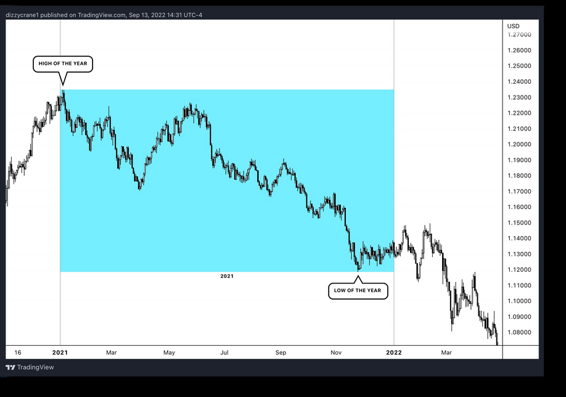

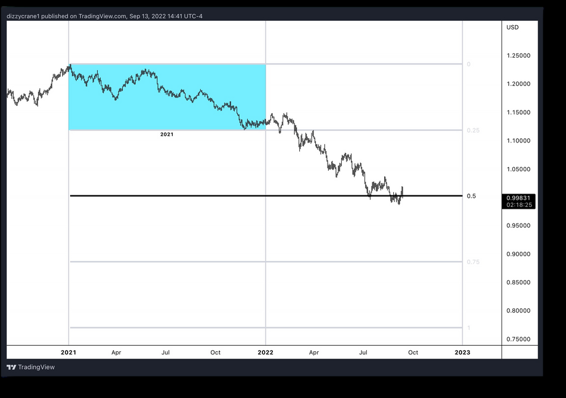

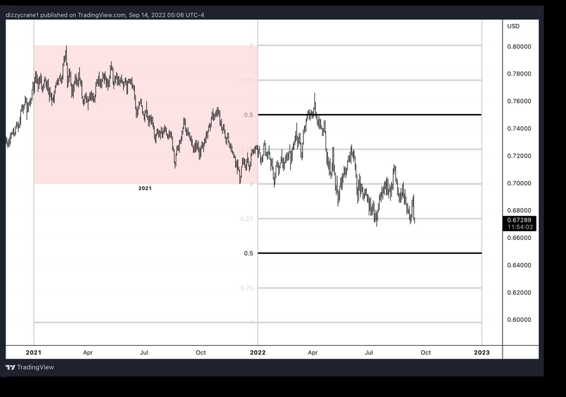

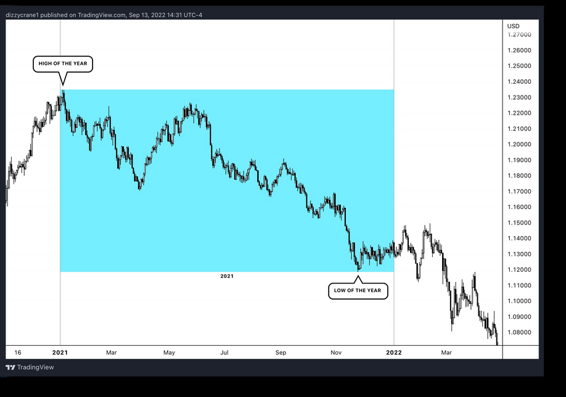

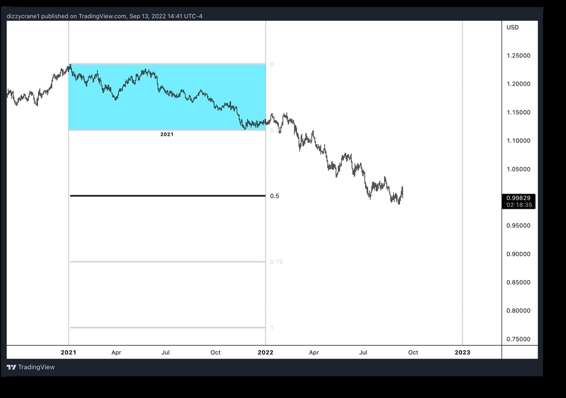

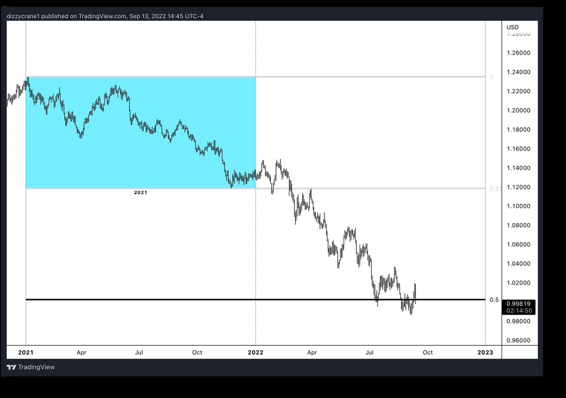

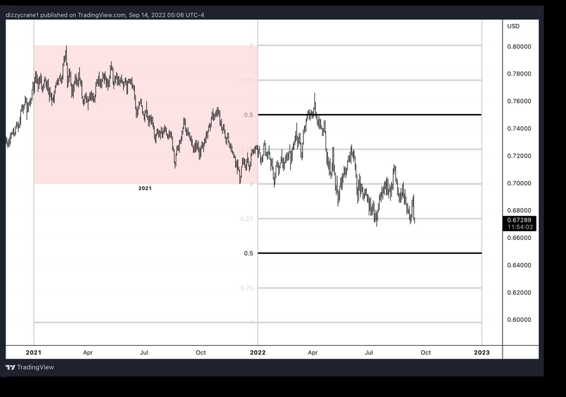

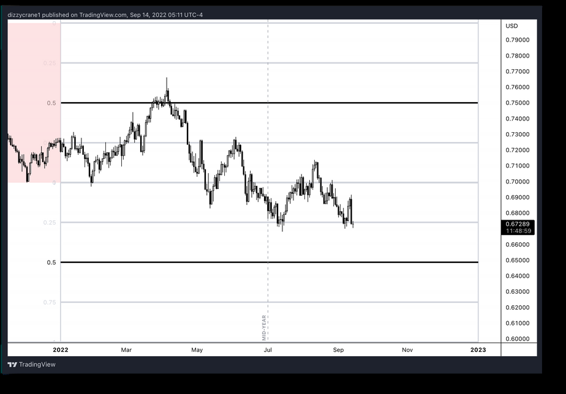

So now we’ll use GANN as the framework for our trades. Think of the GANN levels as true support and resistance levels, with the 50% level being the strongest. These Levels provide more accuracy for more efficient trading. Below is a chart of eurusd on the daily time frame.

We’ll discuss how to use an entire years price movement in sequence with GANN. This combination along with other confluences will help us discover high probability trades.

The price action of 2021 is highlighted in blue. We use everything from the high of the year to the low of the year. This information gives us the data we need to trade in 2022.

So essentially, we‘re using the summary of the previous year to trade the current year. Sounds crazy Right?

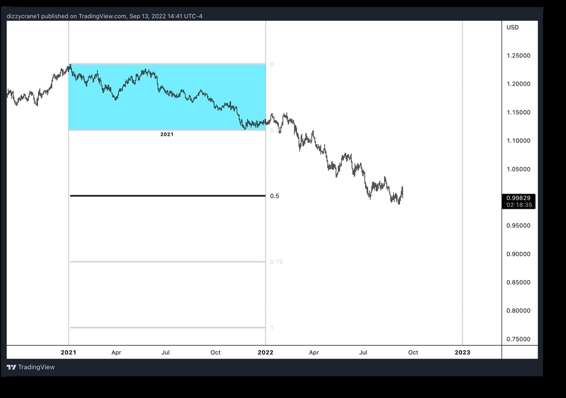

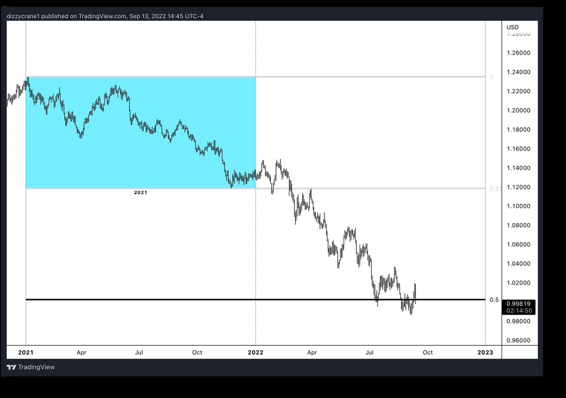

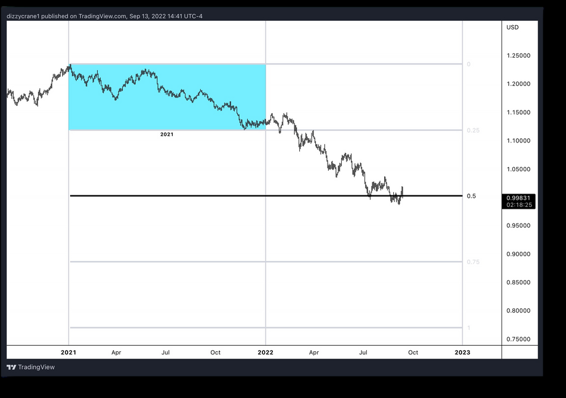

Place the gann from the top of the blue box and drag it down until the 25 level is at the bottom of the blue box. After that, extend the GANN box forward.

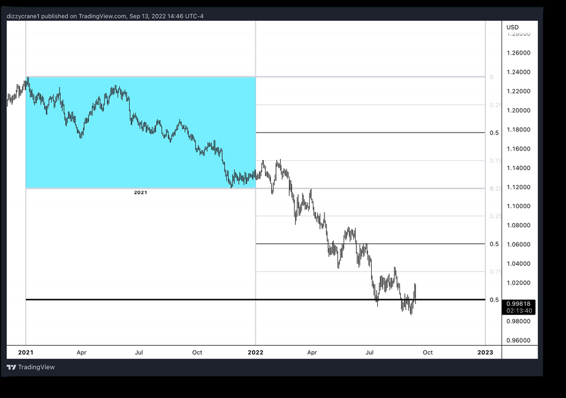

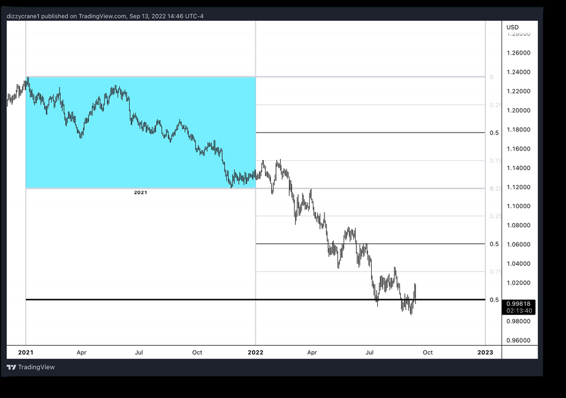

The next thing we want to do is add GANN levels within the GANN levels, just like in the images below.

The smaller GANN levels are known as sub GANN

levels and the bigger levels are key levels. Key levels are stronger than sub levels.

Like I stated earlier, we use the GANN levels in the same way a regular trader would use support and resistance. The main thing we look for is a break and retest of a level, but that’s not the only thing we look for.

Other than market pull backs, we look for moves after consolidation and/or divergences to help us determine the direction of the market. In the next section of this book, we’ll go over consolidations as well as divergence.

Click here to

join my mentorship

Part 4

Confluence

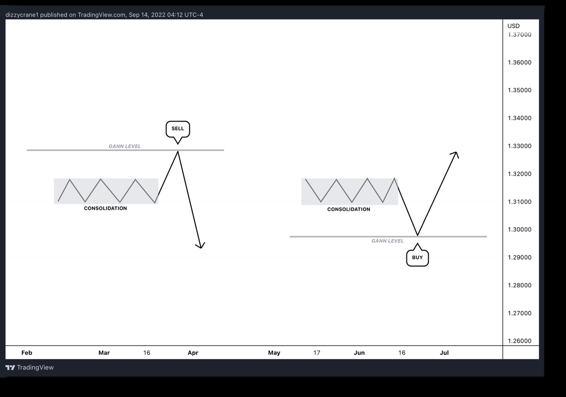

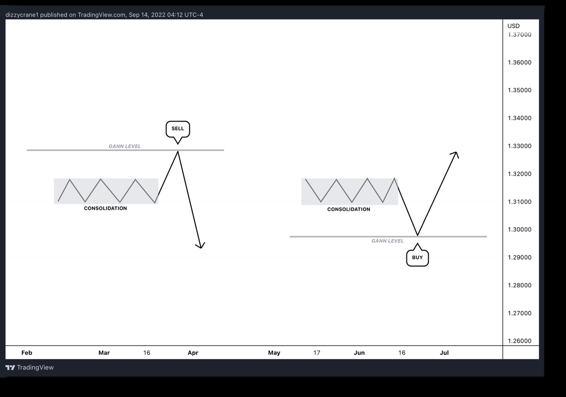

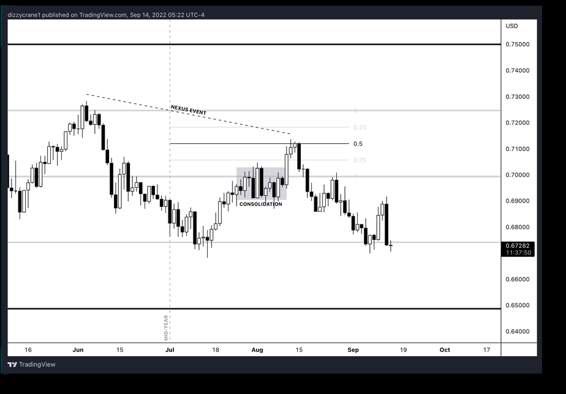

Even though my levels provide safe trading opportunities, I like to look for, or add things to provide more confluence in my trades. First we’ll talk about consolidation. When the market is trading sideways in a small range, this is known as consolidation.

We wait to see which direction the market moves after a consolidation period. If it moves up, we look for sell opportunities at a key GANN level. If it moves down after consolidation, we look for buys in the market at a key GANN level.

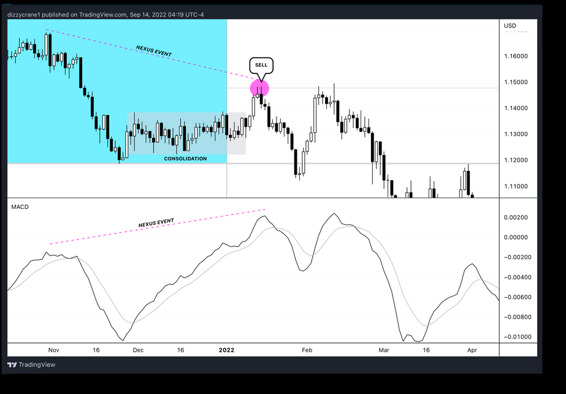

December 2021 was a month of consolidation. In the image below, you can see that price traded upwards in January and rejected from the GANN level. That’s where we sell from. We would assume bearishness until price reached the next GANN level.

Trade entry would be on the daily time frame with anticipation of holding the trade for 5-10 days or until it hits the next GANN level.We’LL talk more about the take profit as well as the stop loss later in this book.

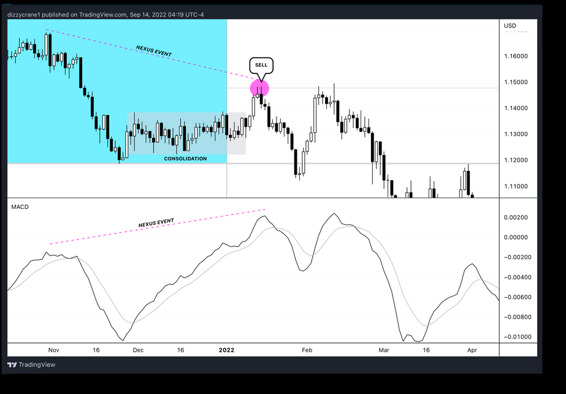

Divergence is a very powerful concept when utilized correctly. I use the moving averages on the macd indicator to find divergences in price action. I remove the histogram from the macd and only use the moving averages. This is what I call a nexus event.

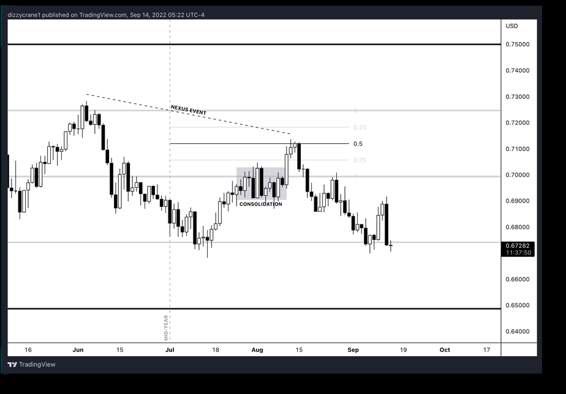

In the image below, eurusd made a high followed by a lower high, but the macd made a high followed by a higher high. This is a divergence in the market. When we see this happening at a GANN level, we place a trade. The combination of consolidation, gann and the nexus event made this a high probability trade.

As you can see, we’ve had three strong nexus events in 2022. Each one lead to an abundance of pips to the downside. The bottom image shows another consolidation before a nexus event.

Part 5

The Mids

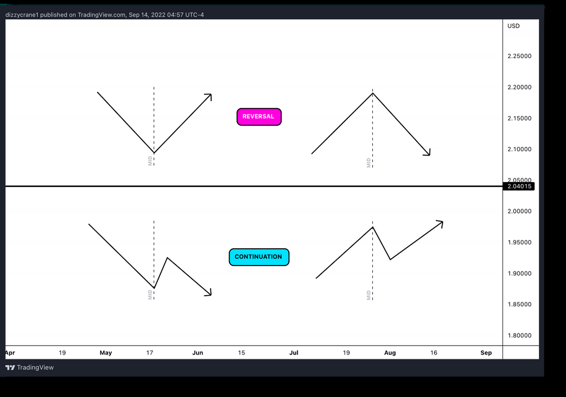

The “mids” represent the middle of a specific time frame. For example, the mid-year is the first trading day of July because it’s the middle of the trading year. Other variations include the mid-month, mid-week, and mid-day. Our focus will be the mid-year.

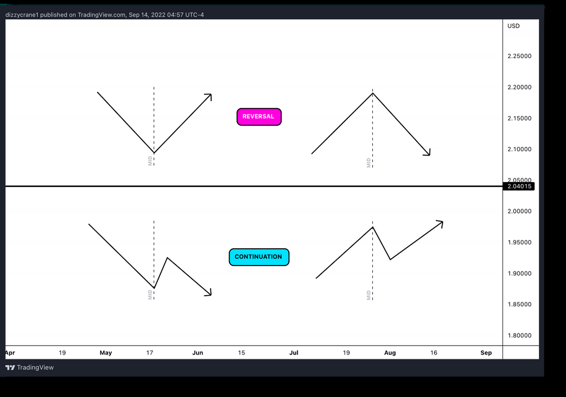

So let’s say price has been bearish for the first half of the year. Price will either reverse to the upside after the mid-year, or it will pullback before continuing downward.

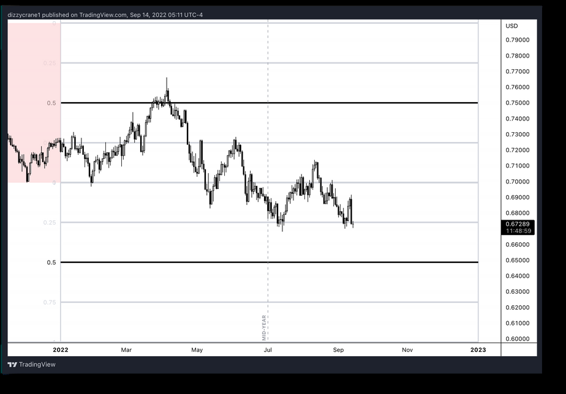

The above chart is AUDUSD on the daily time frame.

After adding our gann levels, we place a vertical line on the first trading day of july. This is the mid-year line.

PRICE WAS BEARISH FOR THE FIRST HALF OF THE YEAR.

AfTER THE MID-YEAR, THERE WAS A PULLBACK to the 50%

of a GANN sub level.

The easiest way to determine the direction of the market from this point is by waiting for a nexus event. If a bearish nexus event happens at a key GANN

level or the 50% of a sub level, take the trade. If there’s no nexus event, take the trade if there is consolidation beforehand.

If you see consolidation along with a nexus event at a GANN level, trade that shit!

Part 6

Risk to reward

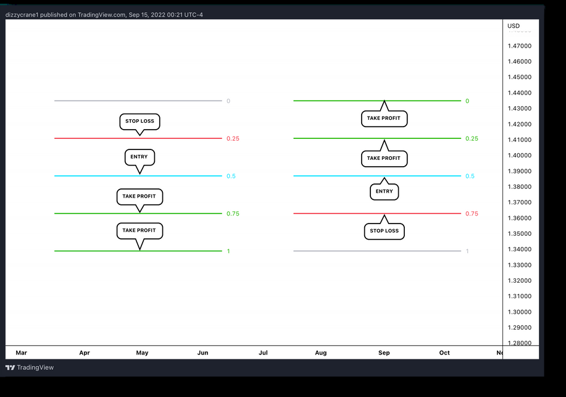

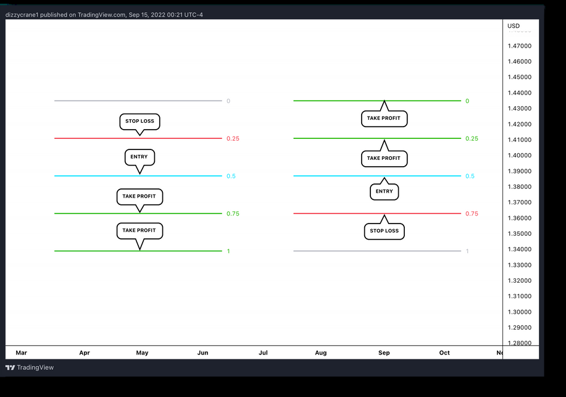

The GANN box makes it a lot easier to measure your risk to reward.

If you enter a trade from the 50%, place your stop loss one GANN level away and set your profit target one level away for a simple 1:1 risk to reward ratio.

You also have the option of placing your take profit two levels away for a 1:2 risk to reward ratio.

In the example below I used gbpusd to show you how it looks on a chart. Keep in mind, This doesn’t only apply to the 50% level. Do this regardless of which level you trade from.

A Nexus Event at a 50% level on the daily time frame has the highest probability of any trade ever taken by anyone in the history of mankind! If for some reason you’re too pussy to use a deep stop loss, you can use GANN sub levels to choose a closer stop loss You could also use the sub levels to move your stop loss down as price moves down. This helps take away some of your anxiety and fear.

You can take profit at any sub level after your entry or you can close positions as price moves down from level to level. Very simple concept to manage your risk to reward.

Wealth is gained through patience, prayer and preparation. Master the methods taught to you in this book, and I promise, you will change your life.

I simplified my concepts to ease any confusion you may have while learning from me, so hopefully this has helped you.

The End

Click here to

join my mentorship