Swings

the stock must be experiencing a minor decline/pullback within the context of a uptrend

or

the stock must be experiencing a minor rally as part of a downtrend

FORCESWING

Title:

LONG

We use this scan to search for stock that has been in an uptrend but experiencing a minor decline/pullback.

With this scan we try to detect stocks for potential long swing trades.

Code:

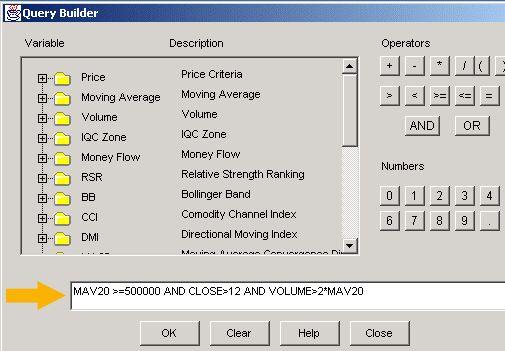

MAV20 >=500000 AND we stay away from stocks that trade less than 500,000 shares of the 20-day Volume Average to ensure liquidity (sometimes we use 250,000 instead, depending on market conditions)

CLOSE>

12 AND

to be sure we do not trade cheap stocks (sometimes we use 7$ instead, depending on market conditions)

CLOSE > SMAC10 and CLOSE > SMAC20 AND

to be sure the stock is still in an uptrend HIGH < HIGH1 and HIGH1 < HIGH2 AND

the stock must be experiencing a 3 day decline/pullback within the context of a uptrend

FORCE3<=0 AND FORCE13>=0 AND

the short term battle is now won by the bears, but still the bulls are in control of the longer-term battle

ADX20>30

to be sure the stock is still trending

(s): swings

long

Only trade what you like !

FORCESWING

Title:

SHORT

We use this scan to search for stock that has been in an downtrend but has experiencing a minor rally.

With this scan we try to detect stocks for potential short swing trades.

Code: MAV20 >=500000 AND we stay away from stocks that trade less than 500,000 shares of the 20-day Volume Average to ensure liquidity (sometimes we use 250,000 instead, depending on market conditions)

CLOSE>

12 AND

to be sure we do not trade cheap stocks (sometimes we use 7$ instead, depending on market conditions)

CLOSE < SMAC10 and CLOSE < SMAC20 AND

to be sure the stock is still in an downtrend LOW > LOW1 and LOW1 > LOW2 AND

the stock must be experiencing a 3 day RALLY within the context of a DOWNtrend FORCE3<=0 AND FORCE13>=0 AND

the short term battle is now won by the bulls, but still the bears are in control of the longer-term battle

ADX20>30

to be sure the stock is still trending

Type(s): swings

short

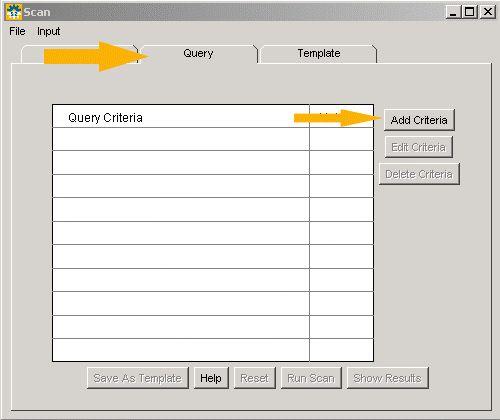

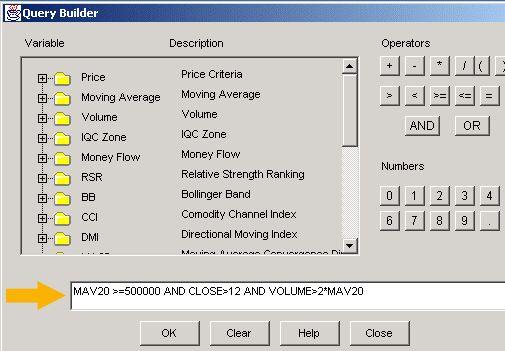

10.1.2 Cut and Paste

Here is how to cut and paste SwingLab scans into SwingTracker. To build your own, just type a formula into Step 4.

1. Open SwingTracker (runs on Windows & Mac OS)

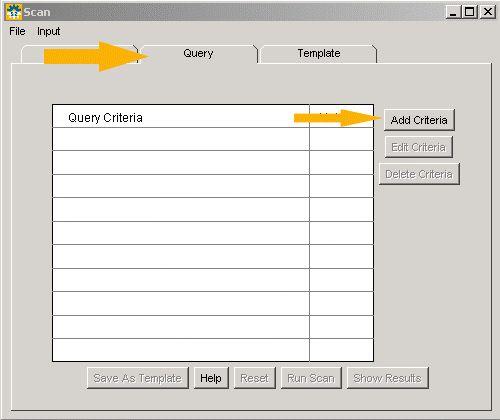

2. Click on the SCAN button

3. Then Click on the Query button & Add Criteria

3. Then Click on the Query button & Add Criteria

4. Paste (CTRL-V) the code into query & press OK

4. Paste (CTRL-V) the code into query & press OK

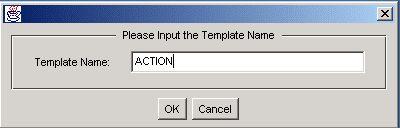

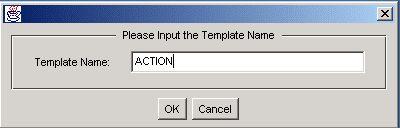

5. Run & Save the Template

5. Run & Save the Template

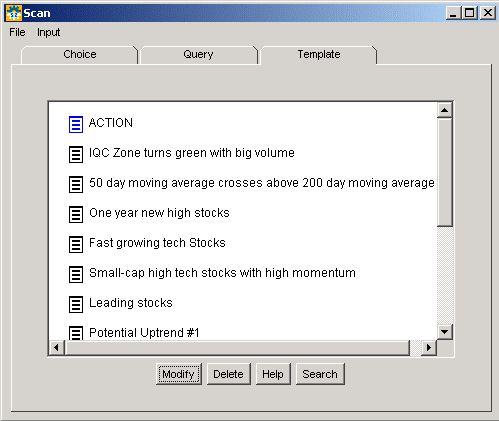

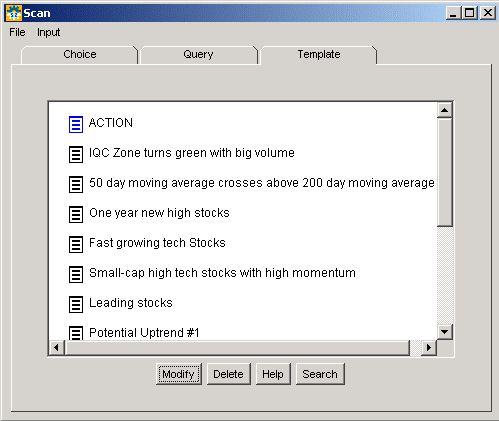

6. Once Saved, will it always be part of your swinging templates!

6. Once Saved, will it always be part of your swinging templates!

7. Press Search and analyze/enjoy the results!

7. Press Search and analyze/enjoy the results!

8. Only trade what you like!!! 11 Case Studies

Trade: DFXI

Trade: DFXI

Date: 04/26/2002 Reasons for trade/setup: CLOSE > SMAC50 and CLOSE > SMAC20 (to be sure the stock is still in an uptrend) and HIGH < HIGH1 and HIGH1 < HIGH2 AND (the stock must be experiencing a 3 day decline/pullback within the context of a uptrend) and FORCE3<=0 AND FORCE13>=0 (the short term battle is now won by the bears, but still the bulls are in control of the longer-term battle)

Swing Entry price: $42.48 (High of yesterday $42.42 + $0.06)

Stop Loss price: $41.35 (order $0.06 below the low of the previous day $41.41 - $0.06)

Target: $45.45 (entry price +7%)

Exit: $45.45 (05/02/2002) & $43.44 (05/02/2002)

Reason for exit: $45.45 at a 7% gain on the long swing trade & $43.44 trailing stop low of yesterday $43.50 - $0.06

Trade: PFG

Date: 04/12/2002

Reasons for trade/setup: CLOSE > SMAC50 and CLOSE > SMAC20 (to be sure the stock is still in an uptrend) and HIGH < HIGH1 and HIGH1 < HIGH2 AND (the stock must be experiencing a 3 day decline/pullback within the context of a uptrend) and FORCE3<=0 AND FORCE13>=0 (the short term battle is now won by the bears, but still the bulls are in control of the longer-term battle)

Swing Entry price: $27.26 (High of yesterday $27.20 + $0.06)

Stop Loss price: $26.35 (order $0.06 below the low of the previous day $26.41 - $0.06)

Target: $29.17 (entry price +7%)

Exit: $27.94 (04/18/2002)

Reason for exit: $27.94 trailing stop low of yesterday $28.00 - $0.06 & Target of 7% never met

Profit/loss: $0.68 or gain of 2.49%

Trade: PTEN

Date: 03/26/2002

Reasons for trade/setup: CLOSE > SMAC50 and CLOSE > SMAC20 (to be sure the stock is still in an uptrend) and HIGH < HIGH1 and HIGH1 < HIGH2 AND (the stock must be experiencing a 3 day decline/pullback within the context of a uptrend) and FORCE3<=0 AND FORCE13>=0 (the short term battle is now won by the bears, but still the bulls are in control of the longer-term battle)

Swing Entry price: $26.84 (High of yesterday $26.78 + $0.06)

Stop Loss price: $25.94 (order $0.06 below the low of the previous day $26.00 - $0.06)

Target: $28.72 (entry price +7%)

Exit: $28.72 (03/28/2002) & $29.99 (04/03/2002) at open

Reason for exit: $28.72 at a

7% gain on the

long swing trade & $29.99 trailing stop low of yesterday $30.31 - $0.06

12 Appendix A–Short Selling

Traditionally the premise of investing is that you buy an asset and hold it until it rises enough to make a sizable profit, it doesn't get much easier than that. What about the times you come across a stock that you wouldn't invest a cent in, you know that thing is doomed, a sure loser. If you knew that the stock was going to decline wouldn't be nice to be able to profit from its decline.

Well you can profit from the decline of a stock and although it sounds easy, there are substantial risks and pitfalls that you need to watch out for. The mechanics of a short sale are somewhat complicated and the investor's risks are high so it is important that you understand the transaction before getting into it. Let’s dive in!

12.1.1 What does it mean to sell short?

If you sell a stock you don't own, you are selling short. (Yes, it's legal.) You are now short the stock. A short seller sells a stock that he believes will fall in value. A short seller does not own the stock before he sells it. Instead, he borrows it from someone who already owns it. Later, the short seller buys back the stock he shorted and returns the stock to close out the loan. If the stock has fallen in price since he sold short, he can buy the stock back for less than he received for selling it. The difference is his profit.

Short selling allows investors to profit from falling stock prices. "Buy low, sell high" is the goal of both short selling and purchasing shares ("going long"). A short sale reverses the order of a typical stock purchase: the stock is sold first and bought later.

For example, in September 1987, Bob thinks IBM is overvalued. She sells short 100 shares of IBM at $175 per share. The stock market crashes in October and IBM's shares fall to $125 per share. Bob buys back 100 shares of IBM and closes out the short sale. Bob gains the difference between the sales proceeds and the purchase costs and pockets $5,000 from the short sale, excluding transaction costs.

12.1.2 Where Does The Broker Get The Stock?

The short answer is from other customers. Oddly enough, he doesn't have to ask permission!

Short selling is a marginable (???) transaction. In plain English, that means you must open a margin account to sell short. This is the same account you would use if you want to use your stocks as collateral to borrow money from your broker.

When you open a margin account, you must sign a hypothecation / rehypothecation agreement. This hypothecation agreement says you will pledge your stocks as collateral against your loan. The re-hypothecation agreement allows your broker to loan your stocks to a bank, or to other customers!

12.1.3 How Do I Sell Short?

Unlike a stock purchase transaction, which involves two parties (the buyer and the seller), short selling involves three parties: the original owner, the short seller, and the new buyer. The short seller borrows shares from the original owner, and immediately sells them on the open market to any willing buyer. To finalize ("close out") the short sale transaction, the short seller must then go out into the stock market and buy the same amount of shares as he sold so that the broker can return them to the original owner.

To sell short you first must set up a margin account with your broker. A margin account allows you borrow from your brokerage company using the value of your portfolio as collateral. The general rule is that the value of your portfolio must equal at least 50% of the size of the short sale transaction. In other words, If you have $1,000 worth of stock in your margin account, you can borrow $2,000 of stock to sell short.

To sell a stock short, you must borrow stock. To initiate a short sale, you simply call up your broker and ask to sell short a specific number of shares of your selected stock. Your broker then checks with the Margin Department to see whether the shares are available or can be borrowed from another brokerage, usually while you wait on the phone for a minute. If they are available, the brokerage borrows the shares, sells them in the open market, and puts the proceeds into your margin account. To close out your short sale, you tell your broker that you want to buy the same number of shares that you shorted. The broker will purchase the shares for you using the money in your margin account, return the shares and close out the short sale transaction.

While your short sale is outstanding, your account will be charged interest against the value of the short position. If the stock you shorted goes up in price, or the value of the stock you are using as collateral goes down in price, so that your collateral is less than the "maintenance" requirement (usually 30% of the value of the short position) you will be required to add money to your margin account or buy back the stock that you sold short. You must also pay any dividends issued by the company whose stock you sold short.

12.1.4 Up Tick Rule

To sell your stock short, you must adhere to the up-tick rule. The transaction before your short sale must have been executed at a higher price than the transaction before it. In other words, the transaction before your short sale must be an up-tick.

In practice, you cannot short a stock that is already falling in price. Otherwise, short selling would amplify the decline.

12.1.5 Why Sell Short?

The two primary reasons for selling short are opportunism and portfolio protection. Occasionally investors see a stock that they believe has been hyped to a ridiculously high level. They believe that the stock price will fall when reality replaces the hype. A short sale provides the opportunity to profit from the overpriced stock. Short sales are also used to protect an investor's portfolio against a market downturn. By shorting stocks that the investor believes will fall sharply when the market as a whole falls, investors can help insulate the value of their portfolios against sudden market drops.

Zitel provides an example of opportunistic short selling. In 1996, Zitel was caught up in a wave of investor enthusiasm because it has a stake in a company that fixes the computer glitch that causes computers to interpret dates in the next century (2000s) as dates in this century (1900s). This problem, known as the "Year 2000" problem, suddenly became a hot topic of conversation and made it to the covers of Time and Newsweek. In September 1996, Zitel was selling for $7 per share. By December, the shares topped $70. At this point, many investors thought the stock was overpriced and saw an opportunity to make money by selling it short. If an investor had sold short in December 1996, he could have bought the stock back for $15 per share in April 1997. Selling short would have allowed the investor to take very profitable advantage of the opportunity presented by the overpriced Zitel stock. Short selling is also used to protect portfolios against erosion due to a broad market decline. Short sellers make money when stock prices fall. An investor can diversify a long portfolio by adding some short positions. The portfolio will then have positions that make money both when prices rise and when they fall. This reduces the volatility in the portfolio's returns and helps protect the value of the portfolio when prices are falling.

By shorting carefully selected stocks that are priced near their peak but that will fall sharply if the market falls, an investor can use the profits from the short sales to help offset losses in his long position to protect the value of his portfolio.

For example, Bob has most of his wealth tied up in stocks which she has bought because she expects them to appreciate in price. But she is concerned that the stock market is vulnerable to a sharp drop and wants to protect his savings while staying invested in the market. She knows that market drops are often caused by a change of investor sentiment from optimism to pessimism. She identifies businesses that are not worth much today, but whose stock price is high because people hold high hopes for their future prospects. These stocks should be especially susceptible to a negative shift in sentiment since optimism is what principally drives their stock price. She then sells these stocks short. If investors become more pessimistic and the market falls these stocks should fall more than most. Larry can use the profits from these short sales to offset losses in the rest of his portfolio. This will help to protect the value of his portfolio.

13 Appendix B– Ressources

Read On, Discover, Learn, and Prosper

For your Progress, I'm enclosing a list of recommended reading. This is trimmed down so it will conveniently start your thinking, facusing, and pursuing the questions and anwsers you need to maximize your performance and opportunities in trading and in your career for the rest of your life. Enjoy and prosper!

I highly recommend the following Books on (swing) trading written by expert traders or excellent pedagogues. I hope you will enjoy them as much as I do.

A no-nonsense, straight-shooting guide from friend/founder of Pristine.com, designed for active, self-directed traders. Provides potent trading strategies, technical skills, intuitive insights on discipline, psychology and winning methods for capturing more winning trades, more often.

great book, one of my favorites… bravo Oliver great job…

Top notch book integrates three major areas of trading; psychology, trading tactics and money management into a coherent framework for success. Unique approach combines the author's trading success with his decades of experience as physician and psychiatrist.

Tells you how to identify mispriced options and construct volatility and "delta neutral" spreads used by the pros. Using a non-technical trading approach, he leads the reader into the real world of option trading and applies his well developed pricing and volatility theories into practical, tradable strategies. Here are advanced techniques for the serious trader.

For a regularly updated list of my preferred reading, visit:

http://www.mrswing.com/en/prefered_book.html