Hi,.. Robert Dorfman here……First of all, thanks for your interest in this ebook and wanting to learn how to trade/invest more effectively, or for just wanting to learn more about how the market itself really works.

You may or may not know me…that‘s ok…this book will teach some key tips about what it really takes to money in the stock market…I am a 20+ year veteran trader…Wall Street trained, bred, and sometimes disgusted by,…so……I can absolutely promise one thing here…..

You are about to learn the truth about how it all w or ks… ..

so lets‘ get started…..

First a Little History….

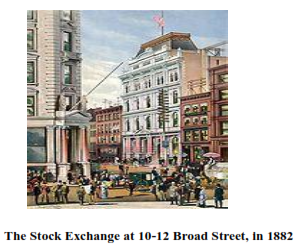

The history of the New York Stock Exchange basically begins with the signing of the Buttonwood Agreement by twenty-four New York City stockbrokers and merchants on May 17, 1792, outside at 68 Wall Street under a buttonwood tree (above). The agreement was only two sentences long, and was simply a promise to only trade with each other and abide by a .25% commission.

In the beginning there were five instruments being traded, three of which were government bonds created to finance the Revolutionary War as well as the first listed company … the Bank of New York.

The exchange began to grow and in 1817 a constitution with rules and regulations was developed and trading was moved indoors. The organization was given a formal name, the New York Stock & Exchange Board and rented office space on Wall Street. In 1863 the name was changed to the New York Stock Exchange.

By the mid-1800s, the United States itself was experiencing rapid growth due to the burgeoning Industrial Revolution and the end the Civil War and companies needed funds to assist in the expansion required to meet increasing demand of their goods and services from the wave of new immigrants coming to America’s shores and America‘s pending unification.

The great potential of the NYSE was becoming increasingly apparent to companies that realized investors would be interested in riding this incredible growth wave and began selling stock in their companies to quickly facilitate their expansion requirements.

This investing growth also benefitted the NYSE itself .

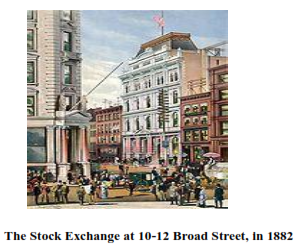

So much so that in 1865 it moved to a permanent location on Broad Street and implemented a continuous trading system of all its listed stocks on a large open trading floor with established working hours, replacing the previous method of calling the various stocks at set trading times.

This stock trading boom also created a new form of investing when investors started to realize that the additional profits could be made by re-selling their stock to other investors directly.

These transactions were the beginning of what became known as the secondary, or " speculators market" which made the market was more volatile than ever before because it was now fueled by subjective speculation about the company‘s future, rather than its present.

To meet the public‘s demand for more market information, in 1896 The Wall Street Journal began publishing The Dow Jones Industrial Average initially comprised of twelve stocks which became an overall indication of the NYSE's daily performance. The Dow with a starting value of 40.74.

Over the next few decades, the levels of share trading drastically increased, and by 1900 was hitting a whopping million shares per day so the Exchange needed to expand once again and decided to hold a contest to choose the design for its new building on 18 Broad St.

The exchange‘s board chose the now famous neoclassic design of architect George B. Post which opened on April 22, 1903 to much fanfare and festivity.

The six massive Corinthian columns across its Broad Street façade, topped by a marble sculpture by John Quincy Adams Ward, called "Integrity Protecting the Works of Man" created a feeling of substance and stability…..not just in the market, but in the United States itself.

Today, the Exchange building is considered one of Post‘s masterpieces and is a New York City and American national landmark.

The Roaring 1920’s marked another great stock market expansion period, with the Dow growing from 60 to its 1929 peak of 381.17.. and marked the beginnings of modern America as it transitioned again from a wartime to peacetime economy with increased productivity.

The decade of bath tub gin, the model T, the $5 work day, the first radio broadcast, transatlantic flight, and the movies, helped the nation became more urban and commercial. Calvin Coolidge declared that America's business was business. Good times were here!

Then the unthinkable happened…..

On October 24th, 1929 otherwise known as “Black Thursday" stock prices fell sharply on record volume of nearly13 million shares….. Five days later, "Black Tuesday" shook the world as prices fall sharply again and the stock market officially crashes with volume of over 16 million shares which is a level not to be surpassed again for 39 years. The Dow Jones Industrial Average falls more than 11 percent.

This "crash" is often blamed for precipitating the Great Depression.

Additional NYSE Notes…

The first ticker was installed in 1867.

The first telephones were put in in 1878.

In 1883, the NYSE got its first electric lights.

The electronic displays boards so often seen were first put up in 1966.

The highest price ever paid for a seat was $4 million in Dec 2006. (multiple)

Have A Seat…

A Membership on the NYSE is traditionally still referred to as a 'seat' since the early years of its existence when as mentioned earlier, members sat in assigned chairs in the hall where the Exchange‘s daily roll call of stocks was conducted. In 1817 a seat cost $25

Owning or leasing a seat on the Exchange enabled qualified and licensed professionals to buy and sell securities on the floor.

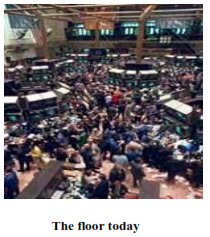

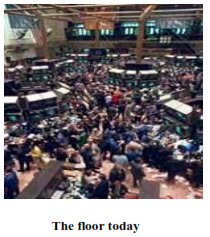

However, the term 'seat' lost its literal meaning with the advent of the current continuous trading method conducted at trading posts on a large open floor that you see today via specialists, as the actual seats that the brokers had once occupied are long gone.

The current trading floor has seventeen trading posts and each stock is assigned to one of these posts. This means that the bulk of trading in any one stock is centralized and specialists are assigned to specific posts and stocks and are required to act in a way that is deemed to maintain an 'orderly' market. (more about them later).

Brokers are employed by investment firms and trade either on behalf of their firm's clients or the firm itself. The broker moves around the floor bringing buy and sell orders to the specialists. The specialists are therefore the broker’s broker.

In 1868 the Exchange established a fixed number of memberships and revised its rules to allow members to sell their seats directly until December 30, 2005 when member seat sales officially ended in anticipation of the NYSE‘s plans to become a publicly traded company by way of merger with Archipelago Holdings Inc. (NYX)

Now instead of selling seats, the NYSE sells one year licenses.

There are now over 2700 stocks on the NYSE, including 453 from 47 different countries traded by the exchanges primary order processing system called SuperDot which stands for: Super Designated Order Turnaround System.

The system allows the NYSE to see the current status of any equity order and is believed to be able to process 7 billion shares per trading day.

NYSE and NASDAQ Markets

These two "exchanges" account for the bulk of equities traded in North America and the world. At the same time, however, the NYSE and Nasdaq are very different in the way they operate and in the types of equities that trade their.

Knowing these differences will help you better understand the function of a stock exchange and the mechanics behind the buying and selling of stocks.

Location, Location, Location

The location of an exchange refers not so much to its street address but the "place" where its transactions take place. On the NYSE, all trades occur in a physical place, on the trading floor of the NYSE. So, when you see those guys waving their hands on TV or ringing a bell before opening the exchange, you are seeing the people through whom stocks are transacted on the NYSE.

The Nasdaq, on the other hand, is located not on a physical trading floor but on a telecommunications network. People are not on a floor of the exchange matching buy and sell orders on the behalf of investors. Instead, trading takes place directly between investors and their buyers or sellers, who are the market makers through an elaborate system of companies electronically connected to one another.

Dealer vs. Auction Market

The fundamental difference between the NYSE and Nasdaq is in the way securities on the exchanges are transacted between buyers and sellers. The Nasdaq is a dealer's market, wherein market participants are not buying from and selling to one another but to and from a dealer, which, in the case of the Nasdaq, is a market maker. The NYSE is an auction market, wherein individuals are typically buying and selling between one another and there is an auction occurring; that is, the highest bidding price will be matched with the lowest asking price.

Traffic Control

Each stock market has its own traffic control police officer. Yup, that's right, just as a broken traffic light needs a person to control the flow of cars, each exchange requires people who are at the "intersection" where buyers and sellers "meet", or place their orders. The traffic controllers of both exchanges deal with specific traffic problems and, in turn, make it possible for their markets to work.

On the Nasdaq, the traffic controller is known as the market maker, who, we already mentioned, transacts with buyers and sellers to keep the flow of trading going. On the NYSE, the exchange traffic controller is known as the specialist, who is in charge of matching buyers and sellers together.

The definitions of the role of the market maker and that of the specialist are technically different as a market maker "creates a market" for a security whereas the specialist merely facilitates it. However, the duty of both the market maker and specialist is to ensure smooth and orderly markets for clients. If too many orders get backed up, the traffic controllers of the exchanges will work to match the bidders with the askers to ensure the completion of as many orders as possible.

If there is nobody willing to buy or sell, the market makers of the Nasdaq and the specialists of the NYSE will try to see if they can find buyers and sellers and even buy and sell from their own inventories.

Conclusion

Both the NYSE and the Nasdaq markets accommodate the major portion of all equitiestrading in North America, but these exchanges are by no means the same. Although their differences may not affect your stock picks, your understanding of how these exchanges work will give you some insight into how trades are executed and how a market works

Thanks to Investopedia.com

Now that you have learned the basics….

How It All Works Now

Ok…so many of you may still be asking how this whole trading/investing market thing works for you…sure……. but BE AWARE ….. the market is still an evolving monster…..devouring most of its own clients just for pure enjoyment of it……. not even leaving the bones behind for the rest of us to pick at and learn from especially as technology plays an ever increasing role…

The truth is, many full time traders don‘t even know how it all works….. but I will try to make some sense of it all.

So….with some time, patience, and this ebook, you will learn more about the secrets to investing/trading and what goes on behind the scenes so that you will become a smarter investor/trader…. keeping the monster at bay….. because it truly is out to eat you alive …. just like the Dilophosaurus theropod dinosaur, which in spite of its supposed friendly appearance, eventually spews deadly venom to blind and paralyze its targets before eating them, just like how you saw Newman from Seinfeld die in the Jurassic Park movie.

Appearances can be deceiving…even in the stock market… or maybe especially so…

So before you get started trading, two things to keep in mind….

First….Don't get overwhelmed by the amount of information you find concerning the stock market or trading.

Yes it's certainly a vast subject, and studying all its facets could take the rest of your life. But if you decide to play the trading/investing game, know that you will always need to be a student of human psychology and the latest trading methodologies and technologies to keep a handle on it. (remember the underlined part for later)

Second….Wall Street is not a casino…even though you may already have that perception like many other traders who have lost money or even non-investors who believe that playing the stock market is gambling….that is a mis-perception.

Well actually, the truth is, to the under-educated investor it probably is a casino..

Because, just like those gamblers who go to a casino with no game plan and are expecting to get lucky and break the bank so to speak, ….which is ok if they can afford the risk, but that is exactly how Vegas casino owners can build those wonderful palaces of decadence….

…..thanks to people’s innocent expectations of good luck ….or….. thinking they are smarter than the house which already has a built in edge in every game.

The same can be said of many stock market players….

But for those of us who know exactly what, why, and how markets and prices move, …….and have a regimented money management plan, going to the “Wall Street casino” indeed can be both fun and highly profitable ……. as you will soon learn

It is simply one of the most exciting businesses/hobbies the world has ever seen.

Ok….You may be thinking… “Trading isn’t that complicated… I am a smart businessman, I‘ve made a lot of money in my career, …I have an online brokerage account with some of my hard earned money in it, ….I do my research into a companies‘ fundamentals, ……I can even read a chart to predict a price move ………and when I hit the buy button, my broker is going to make sure that I get the best fill and that I make money.

In Fact, I think I’m smarter than most of those talking heads on TV ……what’s so complicated about it?”

Well you may be partly right.

You indeed may be smarter than some of the guys you see on TV blabbing about the market…I don‘t know,.. but that certainly does not mean you will actually make money trading……

Yes you may have done your research into a company which might serve some useful purpose in some aspect of the business world, but don‘t believe for a minute that information will be useful in trading its stock.

There are forces in the market working against you that you don’t even know about ….

….which basically means that you are competing to make and take money from the people who have the inherent ability to create everything you see and hear about a stock or a market…. Even creating that "herd" like enthusiasm or unnecessary fear to get ordinary, un-knowing investors (you) to do what they want you to do with your shares …..and you don‘t even know it …..or maybe even believe it……but I assure its true as you will soon learn.

And don‘t believe for a minute that your broker cares about you and wants to see you make money.

The reality is those guys could care less if you do…They just got paid on your order regardless of whether you make money or not.

But without getting into the ulterior motives of most brokers, ….what you need to know is this………..

When you place a trade, whether online or over the phone, your broker looks at the order and has to decide which the best way to get your order executed, …………for HIM to make the most money …….. by choosing one of the following options.

Order to the Floor - For stocks trading on exchanges such as the New York Stock Exchange (NYSE), the broker can direct your order to the floor of the stock exchange, or to a regional exchange. In some instances regional exchanges will pay a fee for the privilege to execute a broker's order, known as payment for order flow. Because your order is going through human hands, it can take some time for the floor broker to get to your order and fill it.

Order to Third Market Maker - For stocks trading on an exchange like the NYSE, your brokerage can direct your order to what is called a third market maker. A third market maker is likely to receive the order if: A) they entice the broker with an incentive to direct the order to them or B) the broker is not a member firm of the exchange in which the order would otherwise be directed.

Internalization - Internalization occurs when the broker decides to fill your order from the inventory of stocks your brokerage firm owns. This can make for quick execution. This type of execution is accompanied by your broker's firm making additional money on the spread.

Electronic Communications Network (ECN) - ECNs automatically match buy and sell orders. These systems are used particularly for limit orders because the ECN can match by price very quickly.

Order to Market Maker - For over-the-counter markets such as the Nasdaq, your broker can direct your trade to the market maker in charge of the stock you wish to purchase or sell. This is usually timely, and some brokers make additional money by sending orders to certain market makers (payment for order flow). This means your broker may not always be sending your order to the best possible market maker.

As you can now see, your broker has different motives for directing orders to specific places.…..basically whoever is offering the best deal….. Commissions talk!!!

The choice the broker makes can affect your bottom line.

Now learn more about these key players who have caused your past losses.

The Specialists

Here is the term you heard earlier, …..but who are they and what exactly do they Do?

Specialists are people on the trading floor of the NYSE, who hold inventories of particular stocks and whose job it is to match buyers and sellers and to keep an inventory for him or herself that can be used to fill orders during a period of illiquidity.

Every specialist can accomplish this by filling one of the four vital roles of (1)auctioneer, (2) catalyst, (3) agent and (4) principal.

Let's take a closer look at what a specialist does in fulfilling each of these roles:

1. Auctioneer – Shows best bids and offers, becoming a 'market maker'.

2. Catalyst – Keeps track of the interests of different buyers and sellers and continually updates them.

3. Agent – Places electronically routed orders on behalf of clients. Floor brokers can leave an order with a specialist, freeing themselves up to take on other orders. Specialists then take on the responsibilities of a broker.

4. Principal – Acts as the major party to a transaction. Since specialists are responsible for keeping the market in equilibrium, they are required to execute all customer orders ahead of their own.

The specialists at the NYSE are employed by only a few powerful firms.. Companies becoming listed will interview employees of the specialist firms seeking the most suitable people to represent them (by holding inventories of their stock).

There are about 500 individual specialists on the floor working mostly for these current NYSE specialist firms:

Bank of America Specialists, Barclays Capital, Kellogg Specialist Group, LaBranche and Co. LLC, and Spear, Leeds & Kellogg Specialists

Now here‘s a great stat for you…….Specialist firms earn between 80 to 190% a year even during crashes How is that even possible?

NOTE… At the time of this writing, In a move to be more competitive against faster moving markets, dark pools and alternative trading systems that have eroded its market share, the New York Stock Exchange is proposing new rules that will phase out specialists and redefine the role to be called designated market makers or DMMs.

Perhaps the most important change is that the new specialists will no longer have an information advantage over other market participants. Under the new rules, DMM will not have a first look at electronic orders before they are displayed in the order book……..

Now you might be thinking everything seems pretty harmless so far for a book carrying such a bold title Right? …..

Well get ready to feel aggravated, disgusted, cheated, robbed, annoyed ….

and quite possibly RICH!!!!

Here’s How the Market Really Works

“Once upon a time a man appeared in a village and announced to the villagers that he would buy monkeys for $10 each.

The villagers, seeing that there were many monkeys around, went out to the forest, and started catching them. The man bought thousands at $10 and as supply started to diminish, the villagers stopped their effort. He further announced that he would now buy at $20. This renewed the efforts of the villagers and they started catching monkeys again.

Soon the supply diminished even further and people started going back to their farms. The offer increased to $25 each and the supply of monkeys became so little that it was an effort to even see a monkey, let alone catch it!

The man now announced that he would buy monkeys at $50! However, since he had to go to the city on some business, his assistant would now buy on behalf of him.

In the absence of the man, the assistant told the villagers. “Look at all these monkeys in the big cage that the man has collected. I will sell them to you at $35 and when the man returns from the city, you can sell them to him for $50 each.”

The villagers rounded up with all their savings and bought all the monkeys. Then they never saw the man nor his assistant, only monkeys everywhere!

Well that kind of sums up it up….. Make sense to you? Ok Let me explain further.