4 Steps to F inanc ia l Success4 Steps to Financial Succes

2008

• Daily Journal • Cash Flow • Budget • Net Worth

"That which each of us calls our necessary expenses will always grow to equal our income unless we protest to the contrary."

George Clason's

The Richest Man in Babylon

Ù C 2008 John M. Eriksen All Rights Reserved http://www.ebook-browser.com

INTRODUCTION

Every successful business manages its money with a budget -- from the smallest one-man shop to the multimillion-dollar corporations. And like every business, shouldn’t your money be managed to produce a profit? Using this guide you can reengineer your life and begin to produce a profit!

You can begin to gain control of your moneys only by developing the habit of tracking your expenses. If you can develop the habit of tracking your expenses using the Daily Journal as shown below, you will succeed!

Managing money wisely requires a little effort, but it’s not painful if good habits are developed. The Daily Journal is the foundation to successful budgeting. The journal ensures you know exactly what is purchased, when, and the price. Only after spending habits are known and recorded can the next step, the budget, be planned & filled out with accuracy. You will need to complete a month or two of Journal entries before you can get a picture of your actual overall expenses and begin to see what expenses can be eliminated or reduced. Only then will you will be able to set a realistic goal of what can be saved each month.

The purpose of your monthly budget (shown below) is to promote self-reliance and save for future uncertainties--which are always as certain as tomorrow. The budget will allow you to see your complete financial picture-income, expenses and savings. Copy these forms for your personal use.

Here’s your number one goal: commit to not pay interest or at least reduce credit/interest purchases for all items that depreciate in value once they are purchased.

This way of' spending money will keep you permanently

indebted to others and "hooked" on payments of interest which bring you nothing in return. (Exceptions are real estate & certain other investments that are known to increase or appreciate after purchase). The following quote from George Clason's The Richest Man in Babylonsums up the challenge that faces each of us:

"That which each of us calls our necessary expenses will always grow to equal our income unless we protest to the contrary."

D A I L Y J 0 U R N A L

Month of ___________________, 200__

Date Cost Item Description

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

$ .

TIP: Get a small pocket calendar with space for each day of the year. Enter your expenses daily on the day of purchase in this book and you will have a chronological expense record that only needs to be totaled each month.

MONTHLY BUDGET

1. NET ANNUAL INCOME:

(If paid weekly, multiply net take home pay x 52 ) $______.____

(If paid biweekly, multiply net take home pay x 26)2. NET MONTHLY INCOME: (Divide #1 above by 12) $______.____ 3. FIXED MONTHLY EXPENSES

A. Rent or mortgage payment $______.____ B. 2d mortgage payment, if any $______.____ C. Life, Health or Auto Insurance $______.____ 1/12 of total annual payment

D. Transportation $______.____ (1) Monthly Auto Payment

(2) Monthly Gasoline Expense $______.____

E. Phone bill (basic service only) $______.____

F. Credit Card Payment $______.____

G. Credit Card Payment $______.____

H. Personal Debts (to friend, bank, etc) $______.____

4. VARIABLE MONTHLY EXPENSESA. General Grocery Expense $______.____

B. Food AWAY from home $______.____

C. Power & Light $______.____

D. Water/Sewer $______.____

E. School,tuition, books $______.____

F. Medical, drugs $______.____

H. Laundry/Dry Cleaning $______.____

G. Clothing $______.____

I. Child Care – Dependent expense $______.____ J. Newspapers, Mags, Books, Cds $______.____ K. Beauty/Barber Shop $______.____ L. Movies, Hobbies, Recreation $______.____ M. Alimony/Child support $______.____

N. Gifts $______.____

0. Church $______.____

P. Condo/Lawn Service $______.____

Q. Storage Fees $______.____

R. Telephone (Long Distance) $______.____

S. Home Improvement Costs/Landscaping,etc $______.____

T. Exterminator $______.____ U. $______.____ V. $______.____

5. NEEDED NON-RECURRING EXPENSES - Purchased less

than once per month or year. From an estimate of

the buying interval, show these as a monthly"

expense.

A. Tires

For example: $300 pays for 4 tires purchased $______.____every two years. $300 /24 months = $12.50 per

mo.)

B. Washer/Dryer $______.____ C. Air Conditioners $______.____

D. Lawnmowers & Lawn Tools $______.____

E. Car tag

F. Car

6. NON-ESSENTIAL EXPENSES

A. Televisions/Stereo/CDs $______.____

B. Jewelry $______.____ C. $______.____ D. $______.____

7. TOTAL PROJECTED MONTHLY EXPENSES $______.____

8. CASH SAVED (#2 minus #7)$______.____

FINANCIAL STATEMENT

Net Worth

As of:____________ $_____.____

LIABILITIES

Rent $_____.____

$_____.____Mortgage $_____.____

$_____.____

$_____.____

Home or Condo

$_____.____ Fees

Vehicle Payment

$_____.____ $_____.____Vehicle Insurance $_____.____

ASSETS

1. Total Savings

Account

2. Checking

Balance

3. Certificate of

Deposit

4. Notes

Receivable

5. Bonds-Face

Value

6. Mortgages held $_____.____ 7. Autos (Quick $_____.____

Sale Value)

8. Autos $_____.____ 9. Boats/Trailers $_____.____ 10. Real Estate $_____.____ Equity

11. Gold, Silver $_____.____ 12. Coins $_____.____ 13. Other $_____.____ Equipment

14. $_____.____ 15. $_____.____ 16. $_____.____ 17. $_____.____ 18. $_____.____

TOTAL =

$_____.____ $_____.____ $_____.____

$_____.____ $_____.____ $_____.____

$_____.____ $_____.____ $_____.____

$_____.____ $_____.____ $_____.____ $_____.____ $_____.____

TOTAL =

$_____.____

Net Worth = Total Assets minus Total Liabilities

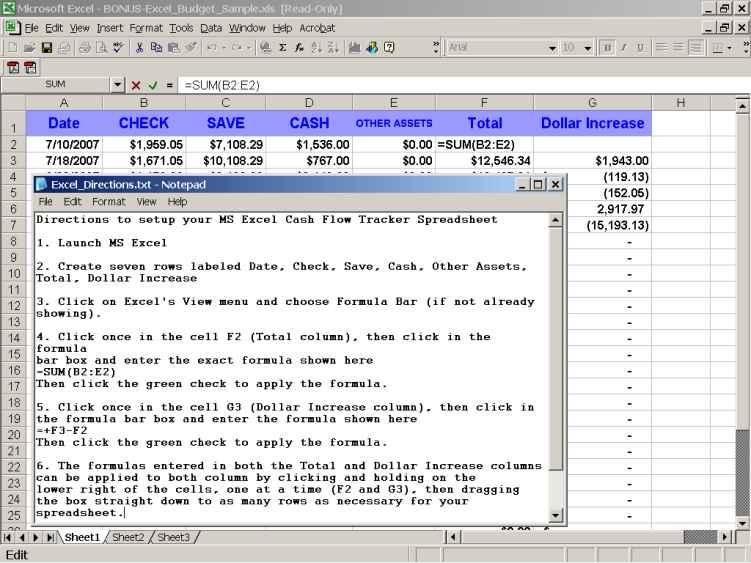

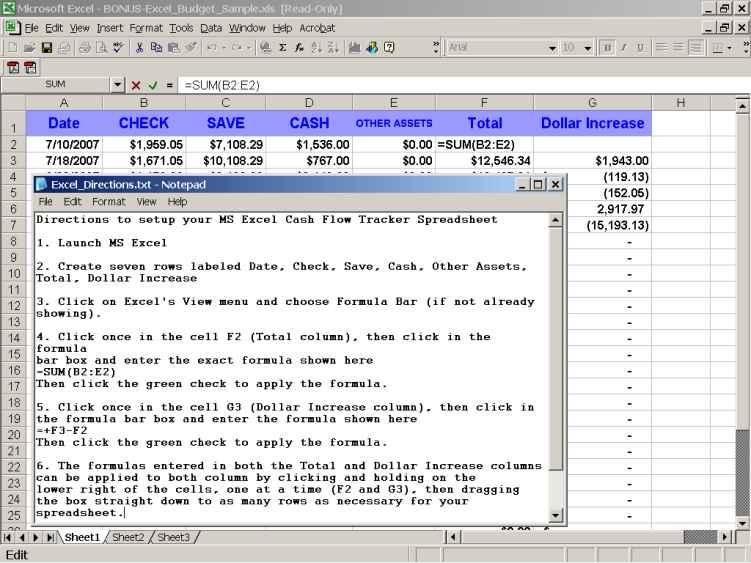

$________________ CASH FLOW TRACKER

L 0 A N G U I D E

L 0 A N G U I D E

A. PAYING INTEREST (Mortgage loans, car loans, etc.)

1. Rule #1 - Never pay interest (except, lacking cash, for necessities). Exceptions are items that appreciate in value greater than the interest paid) 2. Always ask the lender to state the interest on your loan expressed as an Annual Percentage Rate, or APR. This way you can compare your actual interest with other lenders. The reason for the APR is that lenders use many different methods of computing interest, such as the "Add On" method and "Discount" method, which are not always equal.

3.

THE RULE OF 78s This is a method of calculating interest that is sometimes called the "Sum of the Digits."

This

formula takes into consideration the fact that you pay more interest in the beginning of a loan when you have the use of more of the money, and you pay less and less interest as the debt is reduced. Because each payment is the same size, the part going to pay back the loan increases as the part representing interest decreases. When you decide to pay off a loan early, the creditor uses the Rule of 78s to determine your "rebate" or portion of the total interest charge you won't have to pay. The Rule is recognized as a practical way to calculate rebates of interest. There are other methods, but this one is widely used, and it is reflected in a number of state lending laws. Always avoid sum-ofthe-digits loans. If you decide to pay off the balance at some point you may be surprised that you owe more than you originally borrowed. A typical compound interest amortization method is preferable to a rule of 78s loan. (Check out this site for more… http://www.finance.cch.com/text/c10s10d190.asp )

4. Avoid interest-only balloon loans where the total principal is repaid in one or several lumps. Instead, ask for an amortized loan ; the total interest paid is always less than balloon loans. For example, say you have the option of borrowing $1000 with either of these two different interest methods.

Two ways to borrow $1000 for one year at 15%

a Balloon Payment method: One balloon payment is due in one year: $1150 a Amortized Payment method: Twelve monthly amortized payments of $90.26 are paid. Total = $1083

5. Always pay off any loan as soon as possible, especially if there is a high interest rate (over 10%). Making partial advance payments are not advantageous. Pay off the total balance, then pay yourself as you would the lender. This is the same as buying a mortgage; you are gaining the interest (plus the interest from your savings

account) as you make the monthly deposits to yourself. The Truth in Lending law requires that your creditor disclose whether or not you are entitled to a rebate of the finance charge if the loan is paid off early. Look for the prepayment terms before you sign a loan agreement. Ask for an explanation of anything you do not understand. Making payments before they are due does not reduce the total interest owed. Only when you pay off the entire loan early will you save interest. If you have extra money some months, put it in a savings account to accumulate until you can pay off the whole loan.

The final payoff figure on your loan depends primarily on the original time to maturity, but it may be affected by other factors, such as variances in the payment schedule or a lag between the date of calculation and the date of payment. Keep in mind that paying off a loan in, say, 15 months instead of 30 as originally planned will not produce a saving of one-half of the interest. You may, however, be entitled to a rebate of certain other charges when you prepay a loan, such as a part of a premium for credit insurance.

6. A 15 year fixed-rate mortgage is much more advantageous than one at 30 years. The interest is sometimes slightly lower and equity build-up is much faster. Example:

$50,000 loan at 10% for 30 years (Principal/Int=$438.78) AFTER 5 YEARS: Amount of loan repaid= $1712.83

$50,000 loan at 9.75% for 15 years (principal/Int= $529.68) AFTER 5 YEARS: Amount of loan repaid= $9495.27

After 5 years with the 15 yr. mortgage you've paid $5454 more than if you had the 30 yr. loan, but owe $7782.44 less -- Bottom line: you've saved $2328 ($7782 - 5454), and will save much more in future payments.

7. Sometimes auto loans are offered as having zero or very low interest. The cost of money is never zero. Look at the "total of payments" on the loan agreement. In general, this sum must represent a figure higher than the cash, book value price if the business in not going out of business soon. The interest is included in the payment schedule, but you don't know exactly what it is. For example, if the blue book value shows a certain model with a fair average resale value of approximately $5000 and the car in question is offered with Zero Interest at $6500 with 36 payments of $180.55 per month, be aware that you are paying nearly 18%.

Payment: $180.55, Months: 36, Value: $5000 = 17.92%

B. EARNING INTEREST (Savings accounts, CD.s, etc.) Always look at "effective annual yield." The interest rate alone is not necessarily an indication of the actual yield. Example: (Assume you invest in a $1,000 C.D.)

Which Certificate of Deposit has the highest yield?

- Bank A quotes you "7.82%" Annual Interest

- Bank B quotes you "8.10" Simple Annual Interest

- Bank C quotes you "7.80%" Interest Compounded Daily

The yield for Bank A can not be determined until the compounding frequency, if any, is known. Bank B has no compounding; the effective yield equals the annual rate ($81.00). Bank C is confusing. Buy & study an amortizing business calculator (e.g. the BAII Plus by Texas Instruments) or just ask the bank for the equivalent "effective annual yield" for the rate at 7.80% compounded daily comes to approximately 8.1% which is the same as bank B. So both B & C pay the highest interest. In that event, deposit your money in the bank that charges the least for early withdrawal. In summary, always ask for the annual effective yield and then compare these rates when shopping for the best return for your money.

MORTGAGE CHECKLIST

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

BANK:____________________________________________ PHONE:______________ FIXED-RATE INTEREST (30 YRS.)_______________ POINTS_________ % APPRAISAL Cost?___________ CREDIT RPT?__________ MTG APP. FEE?________ DOC STAMPS?__________ INTANGIBLE TAX?____________ TITLE SEARCH FEE?_________ PREPAYMENT PENALTY?______________ CAN POINTS BE FINANCED?__________

CONSUMER-ORIENTED AGENCIES

FEDERAL CITIZEN INFORMATION CENTER

http://www.pueblo.gsa.gov/

Consumer Information Catalog

Pueblo, Colorado 81009

U.S. OFFICE OF CONSUMER AFFAIERS

Federal Trade Commission

http://www.ftc.gov/bcp/consumer.shtm

FEDERAL TRADE COMMISSION

File Complaints About a Company, an Organization, or a Business Practice

•

Online: Use our secure complaint form: [English] [En Español]

•

Phone: Call our toll-free helpline: 1-877-FTC-HELP (1-877-382-4357); TTY: 1-866-653-4261

•

Mail: Write to:

Federal Trade Commission

Consumer Response Center

600 Pennsylvania Avenue, NW

Washington, DC 20580

The three nationwide consumer reporting companies have set up a central website, a toll-free telephone number, and a mailing address through which you can order your free annual report.

•

Equifax: (800) 685-1111, www.equifax.com;

• Experian: (888) 397-3742, www.experian.com; and

• TransUnion: (800) 916-8800, www.transunion.com.

Find unique eBooks at www.eBook-Browser.com