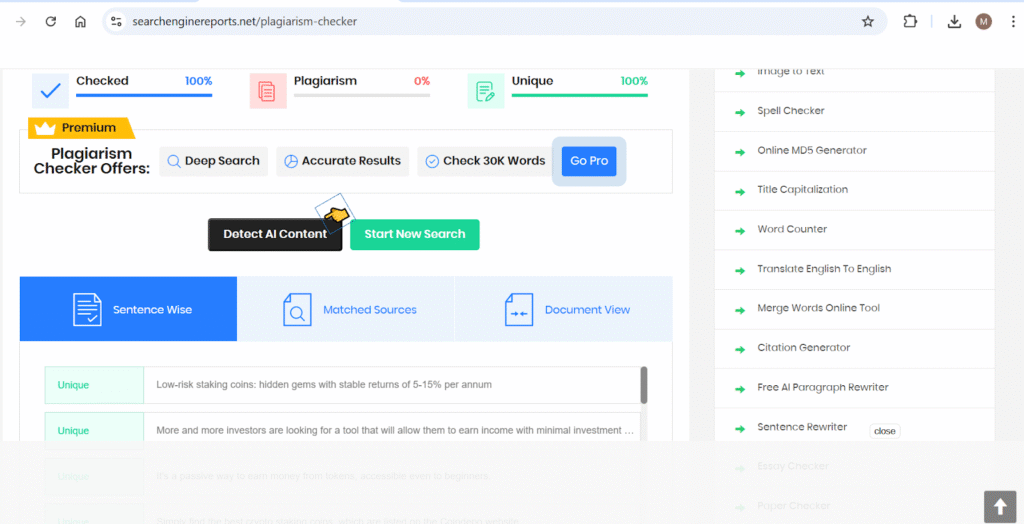

More and more investors are looking for a tool that will allow them to earn income with minimal investment of time and effort. Staking may be just the thing. It’s a passive way to earn money from tokens, accessible even to beginners. Simply find the best crypto staking coins, which are listed on the Coindepo website. Investors should remember that not all tokens provide stable returns with moderate risk. The most promising projects are those with a stable digital economy, good liquidity, and an open development team.

Low-risk ctaking coins

Low-risk staking is based on choosing coins whose blockchains have already proven their stability and security. Such assets are not susceptible to speculative fluctuations and often belong to ecosystems with a long history. The best crypto staking coins are built on infrastructure supported by large validators, reducing the likelihood of technical failures or attacks. Low-risk staking emphasizes income predictability. Projects with fixed interest rates or automatic reward recalculations allow investors to accurately estimate their annual returns. This is especially important for those planning long-term participation without the need for constant market monitoring.

Best cryptocurrencies for stable income

Popular options include coins that provide a stable return in the range of 5 to 15%. They belong to proven networks where rewards are generated through a Proof-of-Stake mechanism and the regular release of new blocks. Examples of such assets include:

- Cardano with an average return of approximately 5% per annum and high liquidity.

- Tezos offers 6-8% per annum with a stable delegation model.

- Cosmos offers 10-12% annual returns with flexible validator settings.

- Polkadot provides approximately 13% annual returns with the ability to participate in parachains.

Coindepo recommends that when choosing a coin for staking, it’s important to consider not only the stated returns but also the overall project metrics. The most reliable assets are characterized by a transparent economy, low inflation, and a clear reward distribution system.

Best cryptocurrencies and long-term sustainability

One of the main advantages of low-risk staking is the ability to maintain liquidity. The best crypto staking coins, including Ethereum and Polkadot, are implementing liquid staking mechanisms that allow investors to use locked tokens in other DeFi protocols. This increases flexibility and makes staking not just a means of income, but a full-fledged part of an investment strategy.

High liquidity also helps avoid losses when exiting staking. Coins with high trading volume and support on major exchanges allow you to sell your asset without significant losses, even during market corrections.

What risks do the best cryptocurrencies for staking pose?

Coindepo recommends remembering that even conservative staking strategies are not risk-free. The main threats remain a drop in token price, smart contract errors, and validator failures. To mitigate these risks, investors choose the best crypto staking coins, spreading their capital across multiple projects. They should also carefully evaluate offers and select only trusted pools.

Before staking, it’s also worth evaluating token locking conditions. In some networks, the minimum locking period can range from a few days to several weeks. This is important to consider when planning financial goals and portfolio liquidity.

Prospects for the development of the best cryptocurrencies for low-risk staking

In the future, we can expect a growing role for low-risk coins in the global ecosystem, according to Coindepo experts. More and more investors prefer a stable income over speculating in high-risk markets. At the same time, new blockchains are implementing solutions that ensure capital protection and better optimize rewards. The emergence of liquid tokens that combine staking and trading features makes this tool accessible even to beginners. Low-risk staking will eventually become a key form of digital savings. It’s a better alternative to deposits, but with greater transparency and control on the part of the asset owner.

The best crypto staking coins, with yields of 5-15%, offer an optimal balance between security and profit. These assets are suitable for users who prefer long-term strategies and predictable income without excessive risk. Investors have already developed many interesting investment strategies in this segment. By carefully studying the market offerings, you can create a reliable source of passive income. Staking on Coindepo is becoming more than just a tool for crypto enthusiasts, but a fully-fledged financial mechanism capable of generating stable profits and strengthening trust in digital assets. I recommend always choosing coins responsibly and studying the project’s terms to maximize your income by locking your assets in your stake.