Compliance with the FCRA for Employers: Step 1

Employers Must Certify Certain Items to the Screening Company

Background checks have now become a critical part of the hiring decision making process. When making decisions like hiring, promotion, retention and reassignment, it is now customary for employers to order background checks. The common checks include employment history, education verification, criminal records, financial history and even social media usage.

In most cases, companies contract third-parties (other companies which offer background checking services) to carry out the checks on their behalf. The information gathered from the checks often plays a critical role in influencing hiring decisions.

For starters, no information that is obtained from a background check may be used to foster any form of discrimination. This includes discrimination on the basis of gender, race, color, religion, national origin, religion, disability, medical history (including genetic information) and age. Such discrimination would be a violation of laws such as Age

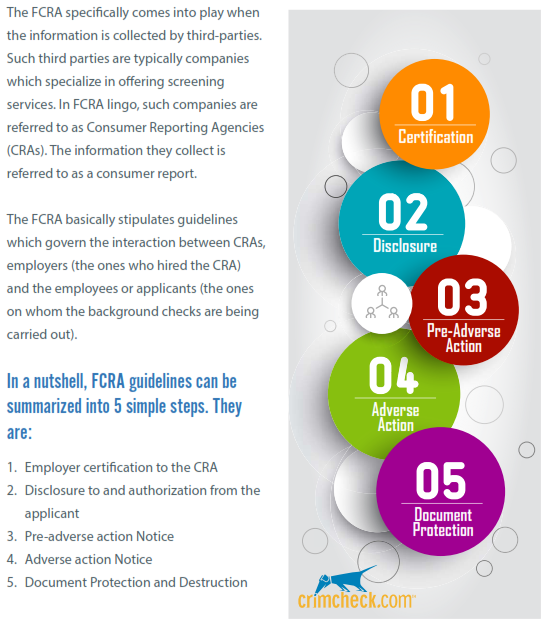

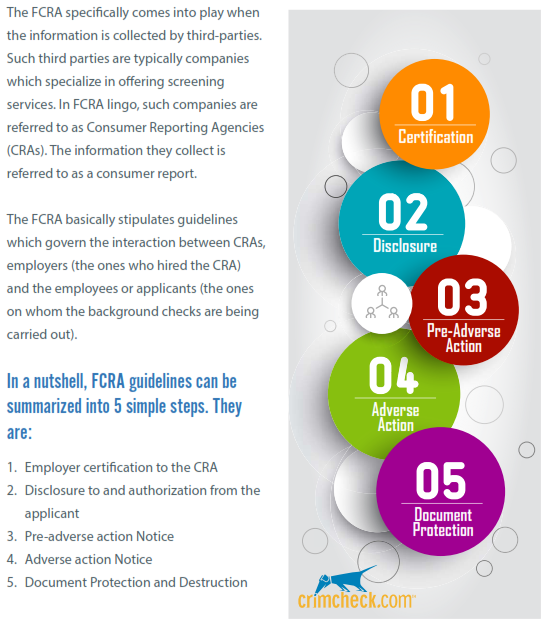

Secondly, if you intend to hire another company to carry out background checks on your behalf, then you need to know about the Fair Credit Reporting Act (FCRA). The FCRA is the law which governs background checks carried out by third parties. As such, FCRA compliance is essential if you intend your background checks to be carried out within the boundary of the law.

The first step towards compliance is understanding what the FCRA is, how it applies to background checks, and the guidelines it provides for carrying out background checks. We shall explore each of these aspects in detail later. For now, let’s begin by looking at what the FCRA is.

The FCRA is a federal law which regulates the collection, dissemination and use of consumer information. In some contexts, the FCRA governs credit information. However, in the context of hiring, it governs information contained in criminal background records, employment records and driving records, and any other information gathered to make an employment decision.

In due course, we shall look at each of these steps in depth. For now, there are two important things to note about laws regarding background checks. The first is that although FCRA is a federal law, many states have their own FCRA laws which have slight variations from the federal law. As such, to be on the safe side, you need to understand the FCRA law for your specific state or jurisdiction.

Secondly, some states have their own consumer protection laws which were in place long before the enactment of FCRA. The FCRA doesn’t invalidate these laws. As such, before starting to carry out background checks, you need to research any relevant laws in your jurisdiction.

The good news is that finding out about such laws is quite simple. Since you are reading about FCRA compliance, chances are high that you intend to hire a CRA to carry out background checks on your behalf. Any CRA worth their salt can point you in the right direction to locate any relevant laws in your jurisdiction. State, cities, and counties can all have their own legislation that covers hiring practices.

Anyway, our focus here is FCRA, so let’s stick to it. Before you can order background information from a company, the FCRA provides guidelines to follow. The first thing you need to do is to send a written certification to the CRA.

You basically need to certify that your company:

- Notified the employee or applicant that you intend to carry out a background check on them.

- Obtained written permission from the employee/applicant to carry out the background check (Some CRAs request to see the written authorization).

- Will not use the information to discriminate against the employee/applicant, or to willfully violate state or federal laws.

- Will comply with all FCRA requirements as regards the use and dissemination of the information obtained from the background check.

- That you have a permissible purpose for which the report is being obtained.

For example, FCRA stipulates a number of steps which have to be taken if the information collected will instigate an “adverse employment action.” An adverse employment action is basically a decision which will result in unfavorable consequences for the applicant or employee. Examples include not getting hired, getting fired, getting demoted or having certain benefits slashed. Among the steps recommended by FCRA is a provision for the applicant/employee to challenge any findings in the background check.

The point here is that before commissioning a background check, you have to submit a written certification for to the CRA. The CRA will review the certification, and may ask for any relevant supporting documents (e.g. a written authorization from the applicant /employee). Once they are satisfied with your request, then you can proceed to discuss the necessary terms.

In a nutshell, background checks play an essential role in guiding hiring decisions. As such, most companies hire them out to third parties – companies which specialize in carrying out background checks. As soon as they do this, they come under the scope of the Fair Credit Reporting Act (FCRA). The FCRA is a law which stipulates how background information may be collected, disseminated and used.

As such, every employer needs to understand the provisions of FCRA in order to comply with them. In case you are an employer, the above information should be a good introduction to FCRA. However, it is just the beginning. In subsequent posts, we will get deeper into other aspects of FCRA, beginning with disclosure and authorization.