Your First Step—Making a

Financial Plan

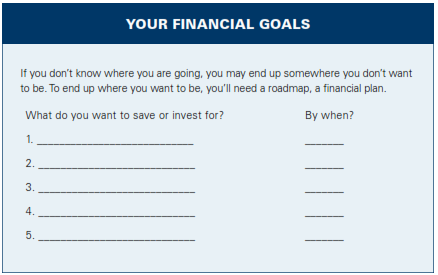

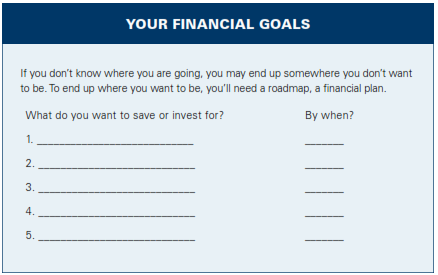

What are the things you want to save and invest for?

-

a home

-

a car

-

an education

-

a comfortable retirement • your children

-

medical or other emergencies

-

periods of unemployment

-

caring for parents

Make your own list and then think about which goals are the most important to you. List your most important goals first.

Decide how many years you have to meet each specific goal, because when you save or invest you’ll need to find a savings or investment option that fits your time frame for meeting each goal. Many tools exist to help you put your financial plan together.

You’ll find a wealth of information, including calculators and links to non-commercial resources at www.investor.gov.

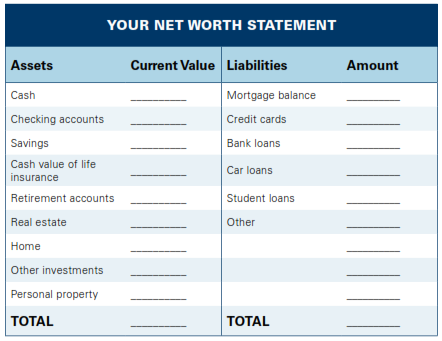

KNOW YOUR CURRENT FINANCIAL SITUATION

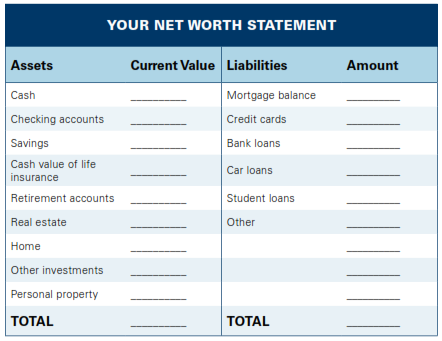

Sit down and take an honest look at your entire financial situation. You can never take a journey without knowing where you’re starting from, and a journey to financial security is no different. You’ll need to figure out on paper your current situation—what you own and what you owe. You’ll be creating a “net worth statement.” On one side of the page, list what you own. These are your “assets.” And on the other side list what you owe other people, your “liabilities” or debts.

Subtract your liabilities from your assets. If your assets are larger than your liabilities, you have a “positive” net worth. If your liabilities are greater than your assets, you have a “negative” net worth.

You’ll want to update your “net worth statement” every year to keep track of how you are doing. Don’t be discouraged if you have a negative net worth. If you follow a plan to get into a positive position, you’re doing the right thing.

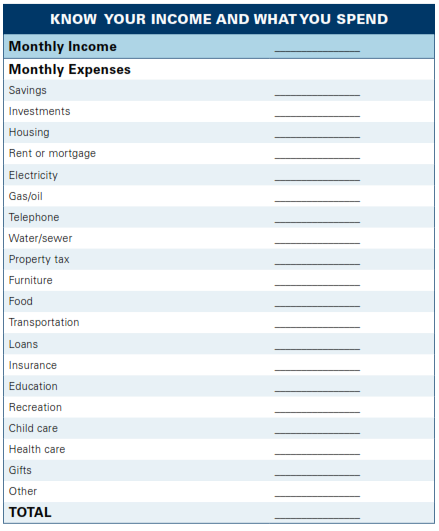

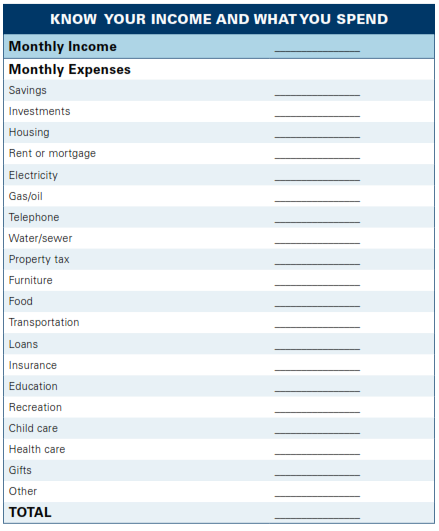

KNOW YOUR INCOME AND EXPENSES

The next step is to keep track of your income and your expenses for every month. Write down what you and others in your family earn, and then your monthly expenses.

PAY YOURSELF OR YOUR FAMILY FIRST

Include a category for savings and investing. What are you paying yourself every month? Many people get into the habit of saving and investing by following this advice: always pay yourself or your family first. Many people find it easier to pay themselves first if they allow their bank to automatically re-move money from their paycheck and deposit it into a savings or investment account.

Likely even better, for tax purposes, is to participate in an employer-sponsored retirement plan such as a 401(k), 403(b), or 457(b). These plans will typically not only automatically deduct money from your paycheck, but will immediately reduce the taxes you are paying. Additionally, in many plans the employer matches some or all of your contribution. When your employer does that, it’s offering “free money.”

Any time you have automatic deductions made from your paycheck or bank account, you’ll increase the chances of being able to stick to your plan and to realize your goals.

FINDING MONEY TO SAVE OR INVEST

If you are spending all your income, and never have money to save or invest, you’ll need to look for ways to cut back on your expenses. When you watch where you spend your money, you will be surprised how small everyday expenses that you can do without add up over a year.