Introduction

Welcome to Forex Trading Secrets Revealed! I hope that you are excited to discover the secrets that the successful traders are using every day to build portfolios that even the most seasoned trader would be proud to own.

After finishing this course, you wil be armed with the information that you need to build your own successful portfolio. I have laid it out in a simple to understand format that is easy to fol ow.

In the fol owing chapters you wil learn the difference between the traditional stock market and the Forex Market. You wil begin the process of understanding the market trends and statistics. I say begin to understand them because it wil be constantly changing and something that you wil be continuously learning and developing as you become more experienced in the process.

You wil discover why technical analysis is so important and how to use it to make the best trading decisions that you possibly can.

This course wil show you the best ways to determine your strategy and al ow you to manage your risks by showing you ways to manage your money.

I am also going to show you why 90% of traders lose their shirts, and how the other 10% WIN… consistently. This information alone is worth triple the price of this ebook!

I highly recommend that you grab your favorite drink, sit back and read this book thoroughly. Then read it again and take notes. You may even want to print it out for future reference… it is that good and wel worth the ink and paper.

Let’s get down to business!

http://www.GoldKaratBars.co.uk

The Stock Market vs. The Forex Market

The differences between the stock market and the forex market are significant. In this chapter, I wil discuss the general definitions of the two as wel as the pros and cons of each. A good resource to have whilst reading this ebook is

http://www.babypips.com/school

What is the Stock Market?

The definition of the stock market is simply the business of buying and sel ing stock for the financial aspect. Stock refers to a supply of money that a company has raised. Investors (or stock holders) give the company this supply of money in order to help that company grow, therefore increasing the value of their stock and in turn making a profit.

The stock market is one of the more traditional ways to create a profit from an investment… even without having much knowledge about it. A person with little or no experience can make a few bucks without much research with traditional investments, such as stocks, bonds and blue chips.

But with thousands of companies to choose from it can be quite overwhelming… and you never know when a company wil go bankrupt or fold altogether. There can be a lot of risk and uncertainty when going after large gains in short amounts of time. It can be difficult to develop a system that can provide a consistent 10 to 15% profit on a yearly basis.

The stock market is country specific, and deals only in business and currencies within that region. There are set business hours that typical y fol ow the more traditional business day, and is closed on Holidays and weekends.

Let’s check out the forex market…

The Definition of the Forex Market

The forex market, also known as the foreign exchange or the fx market, is the place where currencies are traded. It is the largest, most liquid market in the world with an average traded value of over 4 tril ion per day and includes all of the currencies in the world.

Compare that to the $25 bil ion per day that the New York Stock Exchange trades and you can easily see how enormous the forex market real y is. It actual y equates to more than 3 times the total amount of stocks and futures markets combined. Forex is awesome!

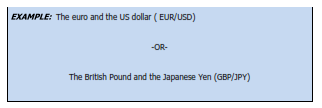

What exactly is traded on the forex market you ask? The simple answer is money. It is the simultaneous buying of one currency and the sel ing of another. Currencies are traded through a broker and are always traded in pairs.

Confused? Think of it as buying a traditional ‘share’ in a particular country. Let’s say you buy British Pound, you are essential y buying a share in the British economy as the price of the GBP is a direct reflection of what the market thinks about not only the current, but future health of the British economy.

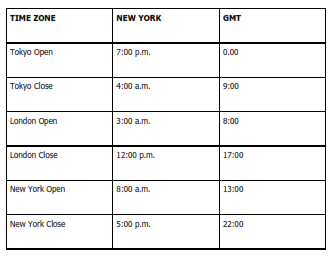

Market Hours

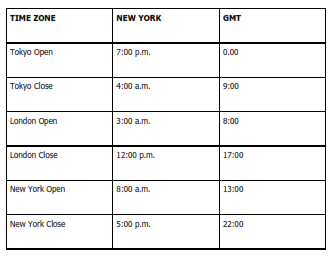

Unlike the traditional stock market, the forex market is open 24 hours a day. At any time, somewhere around the world, a financial center is open for business and is exchanging currencies every hour of the day and night.

It fol ows the sun around the world, so you can trade late at night or early in the morning.

Keep in mind that these additional hours also add additional risk for us since we aren’t able to monitor our investments 24 hours every day. There are several safety options, such as limit that we wil discuss in another chapter.

Forex Trading In Multiple Currencies

One of the most critical things that you must understand in Forex Trading is hour to correctly determine the value of multiple currencies.

Obviously not everyone wil trade in US dol ars.

But with so many variables, how can you tel a good buy or sel without complete understanding of the value of foreign currencies?

Your first step is to figure out the current exchange rate between the currencies in question. I highly recommend using this free currency converter:

http://www.oanda.com and http://www.XE.com

They are very reliable and have tons of information to help you as wel . Aside from the information that I am giving you here, I highly recommend you study the materials available on their website as wel .

Keep in mind that these currency converters wil not be consistently accurate down to the cent or fraction of a particular currency at al times throughout any day, but it wil give you a solid starting point.

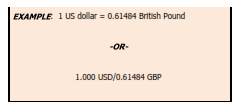

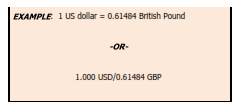

Currency conversion is usual y expressed in a ratio known as the cross rate. Normal y you wil see them listed in pairs in a xxx/yyy manner, with the xxx referred to as the ‘base’ currency (or home currency).

The base currency is usual y always listed as a whole number, while the converted currency wil be expressed with a decimal that is as close as possible to the base rate.

You’l notice that the base currency is almost always in single units (such as one dolar instead of ten). And since the whole number (often referred to as the ‘big’ figure) of the secondary currency almost never changes, it is usual y only referred to at the decimal point.

Also with the consolidation of most of the European market using the Euro, many currencies such as franc or the lira have been eliminated, making trading currencies much less complicated.

It wil take a bit of time, but once you get used to the base values of each currency, the changes wil become more obvious to you, therefore making it easier and less confusing to monitor and you’l be making profitable trading decisions right along with the pros.

Trading Terms You Must Know

Now you most likely won’t be standing amidst a few hundred other screaming stockbrokers on Wal Street, but it is important that you understand some of the terms that you would be hearing if you were. You want to be sure to understand what these terms mean in your trading.

These are some of the most common trading terms:

-

Bid/ask spread – also known as the bid/offer spread, is the quote of the price at which the parties involved are wil ing to buy or sel . The bid price is the price that a party is wil ing to purchase, while the ask or offer price is the price at which the party is wil ing to sel the same. The difference between the two prices is considered the spread.

If the spread cannot be closed, then no deal can be made. The forward price (or agreed upon price) and al details involved in the transaction are written in a contract and referred to as forward points. Most of the time it is outlined as available until a certain date and if this transaction isn’t completed by that date (transaction date), then at that time it must be renegotiated.

-

Currency Pair – since the value of one currency is only relevant when put in terms of another, forex traders wil always deal in currency pairs.

As I mentioned before, the first currency in the pair is considered the ‘base’ currency. The second currency in the pair is the ‘counter’ currency.

-

Leverage & Margin – Margin is a good faith deposit that a trader puts up as col ateral to hold a position. The amount of margin that a trader puts up determines his leverage.

In other words, when a trader opens a position larger than the amount of funds required to open it, the trader has put down margin to receive leverage. While margin refers to the amount of funds a trader has put down as col ateral, leverage refers to the amount of money he controls relative to the margin.

-

Pip – (Percentage in Point) refers to the very last digit of a currency price.

Just for il ustrative purposes let’s take the Euro/USD at 1.2635. If the sel price

was 1.2638 then we have a 3 pip increase. Should the Euro/USD sel at 1.3635

then we have a 100 pip increase.

-

Stop – Limit Order – An order to buy or sel a certain quantity of a certain security at a specified price or better, but only after a specified price has been reached. A stop limit order is essential y a combination of a stop order and a limit order.

-

Rollover/ Carry Trade – A popular trading strategy used in the forex market. It guarantees traders at least some return on their medium and longer term positions.

In the carry trade, speculators buy high interest currencies and sel currencies with low interest rates. These positions ensure that each trading day rol over- interest wil be posted to the traders account. It has the potential to significantly enhance a return.

Rol over is also sometimes referred to reinvesting any earnings in additional stock or currencies.

-

Bear Market – Refers to a strong trend of downward movement in several areas of the market.

-

Bull Market – Refers to a strong upward trend in several areas of the market.

-

Open Order – Your order remains pending until it is either executed or cancel ed.

-

Stop Order – Cancels any pending orders that are placed with the broker.

-

Market Makers/Jobbers – Stockbrokers who hold or purchase securities at low prices for the purpose of sel ing them to traders in a higher priced market so that the trader can turn around and resel them for a profit… essential y creating a separate market are cal ed market makers (also known as jobbers in Britain).

-

Whipsaw – A term for what happens when the market trends point toward a specific direction, causing a buy or sel and then the opposite effect occurs.

These wil happen occasional y and you realistical y cannot expect to win with every purchase. My best advice when it happens is to wait it out. The market wil rebound and you can stil make a profit or at least break even, if you are patient.

Those are just some of the most commonly used terms that I wanted you to be familiar with. It should help you to understand a bit about the market lingo before we get into the meat of the course, where you wil learn the details of many of the terms above.

General Concept

The forex market is by far the biggest and most popular financial market in the world. It is traded global y by individuals as wel as banks and large organizations.

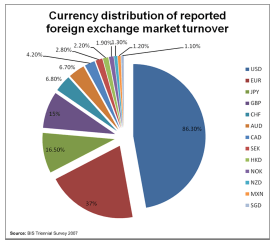

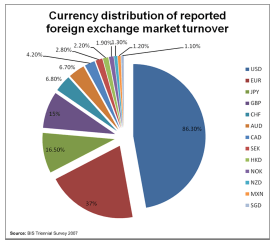

The chart below shows the global foreign exchange activity, with the United States dol ar (USD) being the most traded currency, with the Euro share at 2nd and the Japanese yen at 3rd.

The Nature of the Forex Market

The forex market is an over the counter market, which simply means that there is no central exchange or clearing house where orders are matched and transactions occur.

Large commercial banks trade with each other through what’s known as the Electronic Brokerage System (EBS). Such banks wil only make their quotes available to other banks with which they trade. This market is not accessible to individual or retail traders.

Then there is the online market makers. This is where individual traders can access the forex market through online market makers that primarily trade out of the US and the UK.

Forex: Past & Present

Until the late 1990’s the forex market was real y only available to the ‘BIG Players’. You could basical y only trade if you had a least $10 mil ion to start with!

It was original y intended to be used by bankers and large institutions- not by us ‘little’ guys.

Because of the rise of the internet, online Forex Trading firms are now able to offer trading account to normal folks like us.

Now al you need to trade in the forex market is a computer, a high speed internet connection and this guide.

Financial Markets

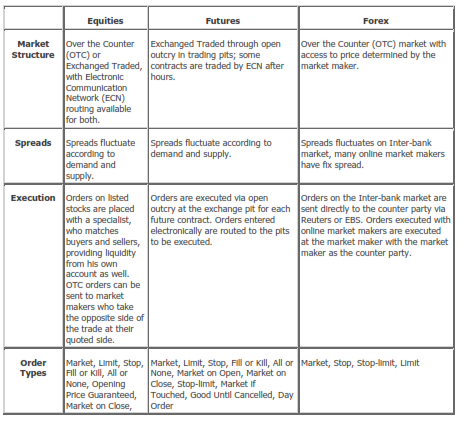

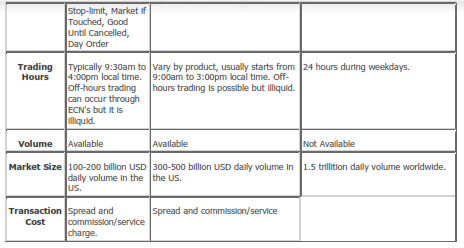

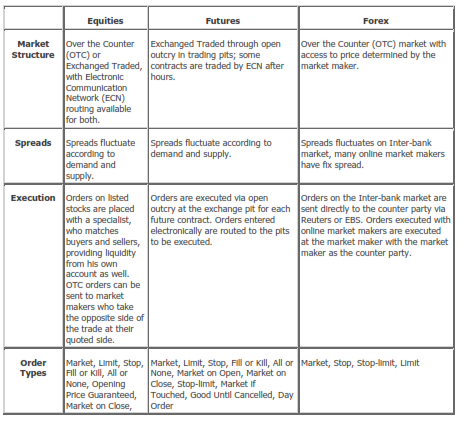

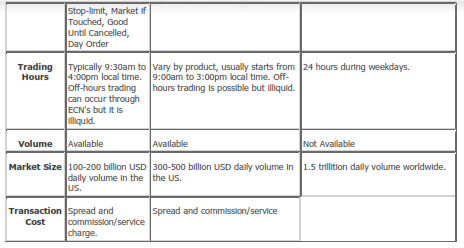

Here is a simple comparison table of various financial markets and some of their basic features:

What is a ‘Spread”?

We’ve already defined the spread to mean the difference between the bid price and the ask price, which constitutes the cost of the trade. In fact, al trades have spread… stocks, futures, commodities, etc.

Be aware that many online trading firms like to promote margin Forex Trading as virtual y cost free – commission free, no service charge, no hidden cost, etc.

The spread IS the cost of trading AND is also the main source of revenue for the trading firms.

The spread may seem to be a smal expense, but once you add up al the costs of al the trades, it can eat up your share of the profits pretty darn fast!

On the other hand, while you want to find the tightest spread possible, anything that is far lower than typical is skeptical. Since the spread is the main source of revenue for the trading firm, if the firm doesn’t earn enough from it there maybe some other hidden costs involved in the transaction.

Different Types of Orders

The fol owing are some of the different types of orders available that can help you to protect yourself in your trading ventures. This isn’t al that are available, but just some of the basic orders for you to make the most out of. Use them wisely!

-

Market Orders – a buy or sel order in which the forex firm is to execute the order at the best available current price.

-

GTC – (Good Until Cancel ed) An order wil be valid until it is cancel ed, regardless of the trading session. (General y, the entry orders, stop loss orders and take profit orders are al GTC orders in online Forex Trading).

-

Entry Orders – A request from a trader to a forex firm to buy or sel a specified amount of a particular currency pair at a specific price. The order wil be fil ed once the requested price is met.

-

Take Profit Orders – An order placed to close a position when it reaches a specified price. It is designed to limit a traders loss on a given position. This is how it works… if the position is opened with buying a currency pair, the stop loss order would be a request to sel the position when the price fel to a specified level and vice versa.

Traders are strongly recommended to use stop loss orders to limit their losses. It is also important to use stop loss orders when investors may enter a situation where they are unable to monitor their portfolios for an extended period of time.

How To Use Margins

A margin account al ows customers to open positions with a higher value than the amount of funds they have deposited in their account.

Also known as trading on a leveraged basis, most online firms offer up to 200 times leverage on a mini contract account. The forex market offers the highest leverage among other trading instruments with a margin requirement of 0.5% for open positions.

The equity in excess of the margin requirement acts as a cushion for the trader. If a trader loses on a position to the point that the cushion runs out, then a margin cal wil result.

The trader must then deposit more funds before the margin cal or the position wil be closed. The account wil be ‘margined out’, meaning that al positions wil be closed, once the equity fal s below the margin requirement.

Most trading firms offer customizable leverage; traders can choose the leverage ratio that they feel most comfortable with. Be aware of how to guard against over trading an account and managing over al risk – we wil cover that more in chapter 6.

Technical Analysis is the Name of the Game

Fundamental analysis and technical analysis are the two major approaches to analyzing and studying the currency market, the first focusing on the underlying causes of the price movements… such as economic, social and political forces that drive supply and demand.

Technical analysis focuses on the studies of the price movements themselves.

I believe that the premise of technical analysis is that al current market information is already reflected in the price movement which is why we wil focus on the latter.

In the fol owing chapter I wil explain briefly the primary tools used for technical analysis, arming you with the knowledge of the professionals. Use this to compare notes and ideas, suggestions and advice with your trading firm.

Let’s get to it.

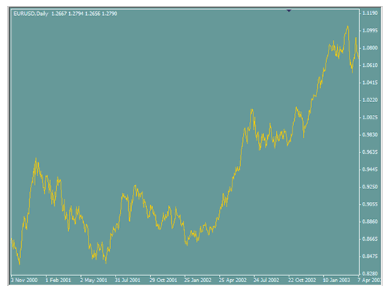

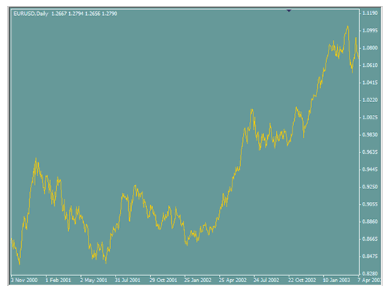

Using Charts

Charts are the most important tool in your understanding of the total sum of what is happening in the market. It is simply a visualized representation of the price movements… a reflection of the psychology of the market and a visualization of the interaction between buyers and sel ers, and shows how the market values a particular asset based on the information available.

Because of this, it is considered to be an indispensible tool in the arsenal of any trader.

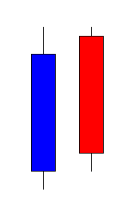

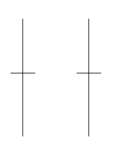

There are 3 major charts: bar charts, candlestick charts and line charts.

We wil get into a bit more detail with the Candlestick charts a bit later, since they are the most commonly used charts amongst active traders.

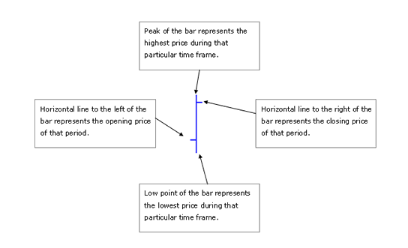

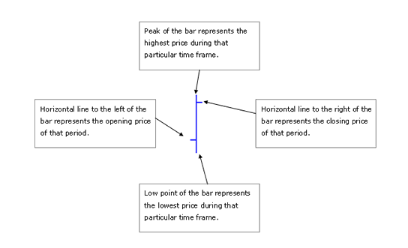

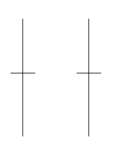

1. Bar Charts – Bar charts provide traders with 4 key pieces of information for a

given time frame:

-

The opening price during that time frame

-

The closing price

-

The high price

-

The low price

Bar charts can be applied to al time frames and therefore, a single bar can summarize price activity over the past minute or the past month.

A good rule of thumb is that the longer the time frame, the more significant it is since it wil account for more data and wil be a better reflection of the markets psychology.

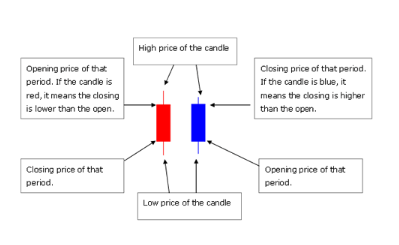

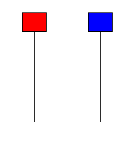

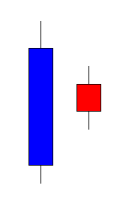

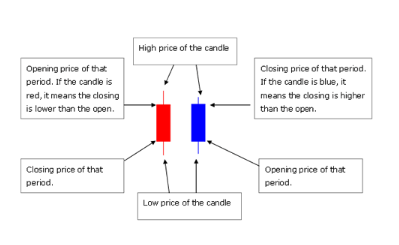

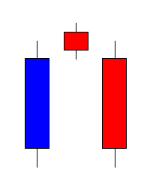

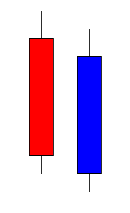

2. Candlestick Charts – Just like the bar chart, a candlestick chart contains the markets open, closing, low and high price points of a specific time frame. The main difference being that the candlesticks body wil show the range between the opening price and the closing price during that particular time frame.

Candlestick charts are more popular than the bar charts or line charts since they are more visual y appealing and helps to identify more information. (see intro to candlestick for more information).

3. Line Charts – These present much less information than the previous types of charts. They only show the closing price for a series of periods, therefore serve best to measure the overal direction of long-term trends.

Line Charts are of limited use for most traders but wil show simply and clearly the direction of the trend which can be extremely useful.

Support & Resistance

Support levels are prices where buyers have shown or are likely to show strength. Resistance levels are prices where sel ers are likely to be strong.

Support levels are basical y giving the market a ‘floor’, since this is the area in which buyers tend to be strong. If the current price is at a strong support level, then traders can expect buyers to step in and drive the price up – or at least keep it from moving any lower.

Resistance levels basical y perform the exact opposite, and are essential y a ‘ceiling’ to the market. If the price is at or rises to a strong resistance level, then sel ers in short term positions may enter the market while sel ers in long positions may cover their positions to take their profits.

Many times when a price breaks through a resistance level, it wil trigger a large number of stop orders and thereby greatly increases buying power. Be careful here though since not every breakout is valid. The same dangers of false breakouts apply to support levels as wel .

Identifying the Trends

A trend simply represents a general direction of a market.

There is a physical law stating that an object in motion tends to continue in that motion until some extreme force causes it to change direction. Price trends are no different. A strong price trend wil continue in it’s current direction unless there is a price reversal indication, that wil show up in your technical analysis – or even in fundamental analysis.

There are 3 phases of major trends that you should be aware of in your analysis; Accumulation, public participation and distribution.

The accumulation phase is the first part of the trend which represents those who are wel informed that wil buy or sel .

Meaning simply that if the wel informed or more seasoned, experienced traders recognize that a current downward trend is coming to an end, then they would buy – and vice versa.

The public participation is essential y when the masses would recognize the same and fol ow suit.

The third and final phase – the distribution phase – occurs when everyone else catches on and public participation increases even further. It is at this point that the wel informed, seasoned investors who accumulated during the accumulation phase would begin to sel , or vice versa.

Highs & Lows

As a general rule of thumb, the existence of a trend depends on a series of highs and lows. 2 consecutive highs, each above the previous relative high and 2 relative lows above the previous low would constitute a tentative uptrend. A 3rd relative high would confirm that trend.

It is very important to keep in mind that markets do not always move in trends!

They also spend a lot of time in ‘ranges’ fluctuating between already established highs and lows. A range bound market is often referred to as a ‘sideways’ market since it is neither moving in an upward trend or a downward trend.

The price during a sideways market is often simply building support for a continued move in the original direction.

Drawing Trend Lines

Trend lines are drawn on historical price levels that show the general direction of where the market is heading and also provides indications of support or resistance.

Drawing trend lines is a highly subjective matter, due to the fact that there are so many variables.

How it works is this… In an uptrend a trend line should connect the relative low points on the chart. The line connecting the lows in a longer term position wil be a support line that can provide a floor for partial retracements. The downtrend line that connects the relative highs on the chart wil similarly act as resistance to shorter moves back higher.

It is important to be flexible when drawing trend lines and redraw trend lines whenever necessary.

How to Use Price Channels

In a trending market, a price channel can often be drawn between two paral el support and resistance levels. The key to this price channel is that the lines be drawn paral el to each other and the value of the price channel depends on that.

Unlike trend lines, price channels should not be forced on a chart where they are not quickly apparent.

How it works is this… once a trend line is established, draw a duplicate line paral el on the chart. Then move it up to the relative highs above or down to the relative lows below the trend line.

If two or more fit with the line, then you may have located a valid price channel.

Otherwise the market maybe too volatile – even in the middle of a strong trend, to plot a price channel.

Intro to Candlestick

Candlestick charts contain the markets open, closing, low and highs of a specific time frame.

On a daily chart, each candle represents a 24 hour period and contains the information indicated above. On an hourly chart, each candle represents an hour… and so on.

But since the forex market never opens and closes, how can there be an open and closing price? To identify this information, the chart provider wil decide on a time, say 5 PM EST, as the daily open and closing time.

Keep in mind that different chart providers may have different opening and closing times and traders may notice that the charts may differ from different providers.

Chart Patterns & What They Mean To You

There are recurring patterns on these candlestick charts that can be observed by technical analysis. These patterns are like recurring pictures that tend to occur when a trend is starting or about to end, or even reverse it’s direction.

They provide an excel ent visualization of the price movements and can give us a good idea of what is happening in the market.

These patterns are the best gage for identifying trends in the market.

EXAMPLE: If a candlestick is very short, it implies that the range for trading that day was very tight. If this candle appears after a strong uptrend, it may suggest that sel ers are beginning to enter the market more aggressively and thus the price may be on it’s way back down.

Eventualy, with a bit of practice, these candlestick patterns can be easily used to identify potential trends in the market – especial y when used in conjunction with other indicators, al owing you to enter the market with strong references to the patters.

Here are some key patterns to watch out for:

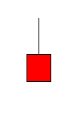

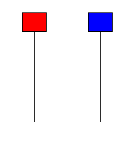

Doji/Double Doji…

This pattern indicates indecision in the marketplace as the price has a big range but isn’t going anywhere.

Hammer – Hanging Men…

This is an indication of a good reversal pattern after a severe trend. It signifies a weakening market. Pattern is considered a hammer after a downtrend and a hanging man after an uptrend.

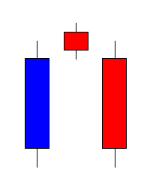

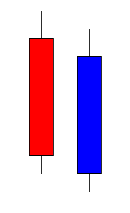

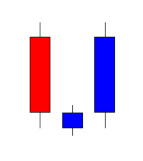

Evening Star…

Reversal pattern shows trend has changed direction after making new highs.

Morning Star…

Opposite of the evening star – reversal pattern shows trend has changed direction after making new lows.

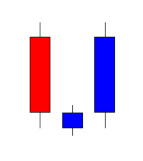

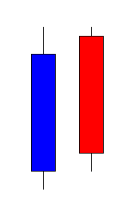

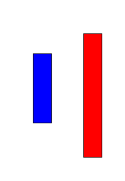

Bear Market…

Common pattern after strong uptrends. Signifies that buyers are losing control.

Bull Market

Common pattern after dramatic downtrends. Signifies that downtrend has lost momentum.

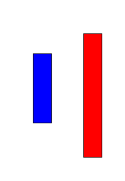

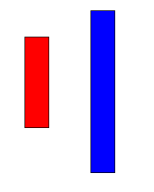

Harami…

Harami shows a trend that is losing momentum and may reverse.

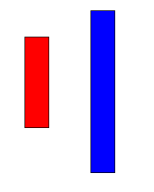

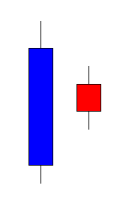

Shooting Star…

Reversal patterns that occur after gaps. Buyers may make new high but fail to sustain them.

Piercing Line…

Bul ish reversal patterns which shows sel ers are losing their dominance.

Dark Cloud Cover…