Six: Fighting the market’s trend.

This one goes along with the idea of selling. When the market is trending higher, it’s the right time to be looking for stocks making fresh run-ups. But when the indexes are selling off, chances are, any individual stock you own will also head south. In many cases, the best thing you can do is sell your stock in the downtrend (as we saw above). Focus your buying on times when the market itself is moving higher.

Sounds simple, right. Buy in an uptrend, be ready to sell in a downturn. But how do you know the general trend of the market? It’s actually pretty simple to determine, by watching whether or not the major indexes are moving up or down over the course of several days or weeks. You also have to check the trading volume on days when the indexes make significant moves.

Because the majority of stocks move in the same direction as the general market, it’s absolutely crucial to time your buying and selling to the way the indexes are trending.

That’s exactly how we were able to maintain the value of my stock portfolio in the 2008 and 2009 bear market. We sold all our shares before the market tanked, and didn’t lose my money. There was nothing magical or lucky about it – we simply timed our selling to go with the market’s flow.

If used properly, tracking the indexes’ selloffs and upside reversals reliably identifies market peaks and valleys. So why don’t more people use that method?

20

Seven Biggest Mistakes Investors Make

Here’s why: It’s time-consuming to learn and master. And once you’ve learned it, it requires a commitment to tracking price and volume across the major indexes – every single trading day. In addition, you have to be ready with a calculator to do the math on the percentage changes each day. Then you have to track these – maybe in an Excel spreadsheet – and keep an ongoing count of how many days of heavy-volume buying and selling have occurred.

Do you really see yourself doing this?

Didn’t think so.

Not only is it very time-consuming to track this data, but there’s a lot of conditioning that we should all be fully invested, at all times. (Remember that discussion earlier about the financial media and the fund managers?)

Fortunately, there really are simple ways of getting information about the market trend, without spending your days and nights hunched over your computer, with a calculator by your side. (Sounds fun, doesn’t it? Just cancel your golf game and time with your friends and family. You have to spend hours every day tracking the stock market! Sounds crazy – but that’s what some investing services actually expect you to do – after you’ve paid them for their materials!)

You can check our blog every day for relevant updates about the market’s trend. You can learn more here about your best buying and selling moves in any market condition.

Following the general market’s trend, not fighting against it, is one of the keys to realizing your true potential as an investor. Just remember: When you buy a stock in a market downturn, chances are, it will also go down. The math is not in your favor.

F o l l o w i n g t h e general market s trend, not fighting against it, is one of the keys to realizing your true potential as an investor.

21

Seven Biggest Mistakes Investors Make

But if you buy in a market uptrend, you’ll be much better positioned to take advantage of the rising tide.

So why fight it?

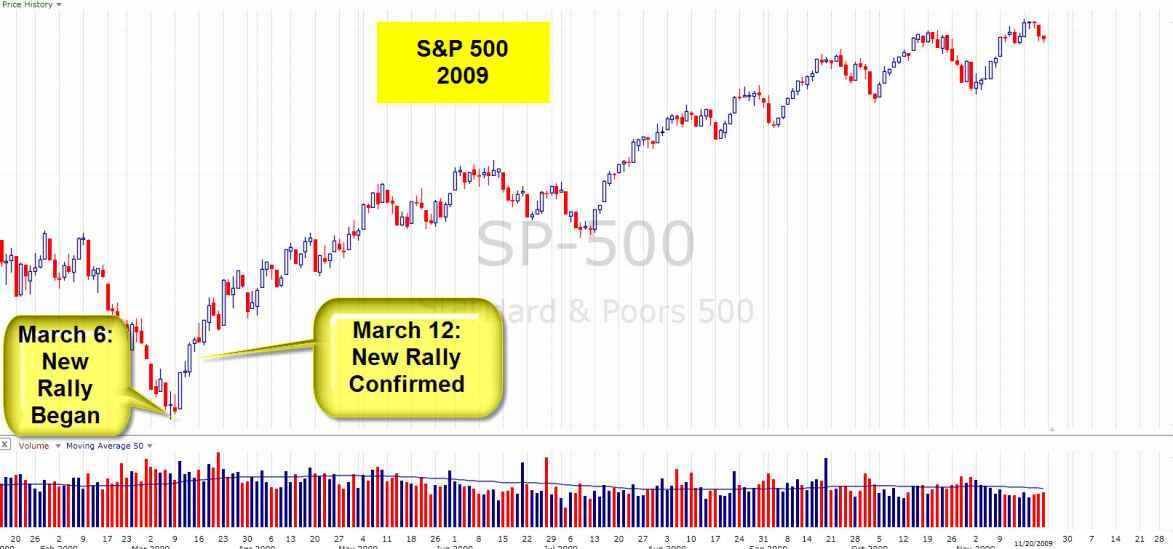

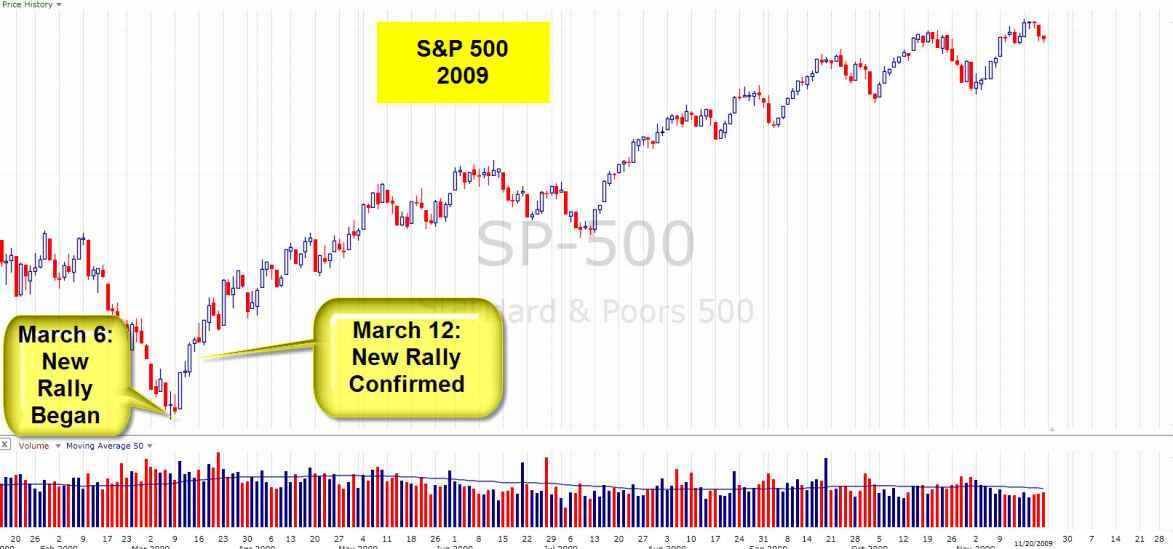

How To Determine Which Direction The Market Is Trending

In case you’re wondering exactly what goes in to determining a new market uptrend, here’s a quick explanation: When a downturn in the market has dropped to a new low, check major indexes each day. See if at least one of them (the Dow, Nasdaq, S&P 500 or NYSE Composite) beginning to rise on heavy volume. You’re looking for one index (or more, but all you need for a signal is one) to show a significant increase – around 2% or so – in heavier volume than the previous session.

This usually happens four or more days after the uptrend begins. There are various reasons given for the four-day wait, but essentially, it’s been shown that these “follow throughs” tend to be most successful if they happen a few days after the uptrend begins.

22

22

Seven Biggest Mistakes Investors Make

There’s no telling how long an uptrend will last, once you have this confirmation. It can fizzle after a few days, or last weeks or even months.

So that begs the question: How do you know if an uptrend is reversing lower, and becoming a downtrend? After a rally has been underway for awhile, notice whether there’s heavyvolume selling for several days within a short period, and whether the indexes have stopped making upward progress. That’s your sign that a rally is running out of juice, and it may be time to sell some stocks.

These methods do work. They’re simple and straightforward ways of identifying market shifts. However, they take some time to really comprehend them thoroughly, and to master their use. There are easier ways for you to get this information at key junctures. You can learn more here.

23

Seven Biggest Mistakes Investors Make